Increase in Livestock Production Fuels North America Feed Anticoccidials Market

Industrial livestock production has undergone a significant transformation owing to increasing demand for meat-based products and dairy products. Animal protein accounts for 16% of energy and 34% of the protein in human diets. Livestock production also accounts for ~19% of the value of food production and 30% of the global value of agriculture. The demand for livestock products is driven by changing lifestyles and food preferences, increasing urbanization, growing income, and the rapidly rising world population. With burgeoning livestock demand, the consumption of protein-rich meat products is upsurging. According to the Food and Agriculture Organization (FAO), worldwide meat protein consumption is predicted to increase by 14% by 2030.World milk production is expected to rise by 1.6% annually between 2020 and 2029 and reach 997 million metric tons by 2029, according to a report by the Organization for Economic Co-operation and Development (OECD) and FAO. Thus, with the increasing consumption of livestock products such as meat and milk, the production of healthy livestock is increasing across the globe. The rising production has encouraged manufacturers to focus on the feed given to the livestock.

As shown in the following figure, according to the FAO, the total meat production globally was 235.06 million metric tons in 2001, significantly increasing to 354.82 million metric tons in 2021. Poultry production accounted for a notable growth of 93% from 2001 to 2021.

Source: Food and Agriculture Organization (FAO) of the United Nations

The growth in livestock production is likely to create a demand for feed anticoccidials to fight against diseases such as coccidiosis. Livestock farmers are also concerned about the health of livestock. Thus, they are adopting various strategies to fight against diseases and investing in feed antibiotics such as anticoccidials. These feed anticoccidials are significantly used as a poultry feed additive. They are also used in the feed of swine, ruminants, and aquaculture. Thus, the upsurging livestock production drives the feed anticoccidial market growth.North America Feed Anticoccidials Market Overview

The US feed anticoccidials market is growing due to significant demand in the poultry sector. Anticoccidials are crucial in preventing and treating coccidiosis, a disease caused by coccidia parasites that affect animal intestines. The increasing consumption of poultry meat and eggs and growing awareness about animal health drive the feed anticoccidials market. According to the United States Department of Agriculture (USDA) Foreign Agricultural Service report from January 2022, the US leads as the world's largest producer of poultry meat and eggs.Technological advancements and strict animal feed safety regulations have led to the development of innovative products with fewer side effects, significantly expanding the market. Major US companies are investing in research and development to develop more effective and sustainable anticoccidial compounds. Companies in the US are introducing technologies to enhance the health of their livestock population to meet the increasing demand for meat products. For instance, in April 2024, Amlan International introduced Phylox, a natural anticoccidial product for the animal health market. This proprietary blend of phytochemicals is a unique solution for coccidiosis, demonstrating Amlan's commitment to enhancing gut health and feed efficiency for producers in the animal health market.

North America Feed Anticoccidials Market Segmentation

The North America feed anticoccidials market is segmented based on type, form, livestock, and country. Based on type, the North America feed anticoccidials market is segmented into ionophore, chemical anticoccidials, and chemical-ionophores. The chemical anticoccidials segment held the largest market share in 2023.In terms of form, the North America feed anticoccidials market is bifurcated into dry and liquid. The dry segment held a larger market share in 2023.

Based on livestock, the North America feed anticoccidials market is segmented into poultry, ruminants, swine, and others. The poultry segment held the largest market share in 2023.

Based on country, the North America feed anticoccidials market is segmented into the US, Canada, and Mexico. The US dominated the North America feed anticoccidials market share in 2023.

Phibro Animal Health Corp, Zoetis Inc, Kemin Industries Inc, Elanco Animal Health Inc, Huvepharma EOOD, Impextraco NV, and Virbac SA. are some of the leading players operating in the North America feed anticoccidials market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America Feed Anticoccidials Market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America Feed Anticoccidials Market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America Feed Anticoccidials Market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Feed Anticoccidials Market include:- Phibro Animal Health Corp

- Zoetis Inc

- Kemin Industries Inc

- Elanco Animal Health Inc

- Huvepharma EOOD

- Impextraco NV

- Virbac SA.

Table Information

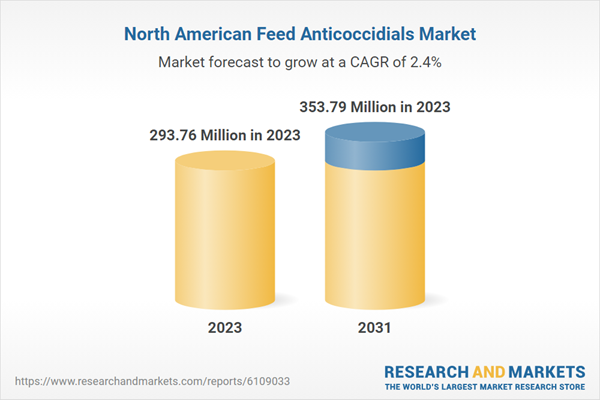

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | April 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 293.76 Million in 2023 |

| Forecasted Market Value by 2031 | 353.79 Million by 2031 |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |