Rise in Mobile Lithotripsy Services Boosts South & Central America Lithotripsy Market

Mobile lithotripsy medical units, commercial tractor-trailers, and coaches are significantly beneficial to patients. These units offer patients a new healthcare service without any requirement to set up a specialized lithotripsy center or additional investment. Patients' experience with mobile lithotripsy services is significantly improving with technological advancements. For example, in June 2021, Mobile Medical announced launching its new state-of-the-art mobile lithotripsy unit. The lithotripter device was successfully removed from the existing lithotripsy center and installed in a cab/mobile truck. Similarly, The Oklahoma Mobile Lithotripsy Associates (OMLA), a subsidiary of Oklahoma Lithotripter Associates, has continued to provide extracorporeal shockwave lithotripsy (ESWL) services to area hospitals through a lithotripsy bus/trailer since 1995. The service began with a single Dornier unit. However, with a rise in technological advancements, the units are now transported to each location in small vans, making accessibility and scheduling noninvasive lithotripsy procedures much more accessible. Currently, mobile lithotripsy service is only available in developed countries, particularly in the US, and is anticipated to grow in other countries in the future if awareness about mobile lithotripsy service is increased worldwide. Thus, the rise in mobile lithotripsy services is anticipated to create lucrative opportunities for the lithotripsy service providers in the market in the coming years.South & Central America Lithotripsy Market Overview

The prevalence of nephrolithiasis in Brazil is approximately 5%, with a recurrence rate of 80-90%, as per the Springer 2024 report. According to the National Institute of Health (NIH) report, in Brazil, the prevalence of nephrolithiasis has increased in the past decade, which has had a massive impact on the healthcare system with limited lithotripsy procedures. For example, the frequency of performing percutaneous nephrolithotomy (PCNL) by urologists in Brazil is less compared to other ureteroscopies as the procedure can lead to various complications such as sepsis, injury to adjacent organs, and hemorrhage and death. ESWL is a noninvasive technique having minimal complications therefore, with increase in adoption of ESWL in the Brazilian hospitals in the coming years, it will surpass the traditional PCNL techniques.South & Central America Lithotripsy Market Segmentation

The South & Central America lithotripsy market is categorized into product type, application, end user, and country.By product type, the South & Central America lithotripsy market is segmented into extracorporeal shock wave lithotripsy devices, intracorporeal lithotripsy devices, and ureteroscopic. The extracorporeal shock wave lithotripsy devices segment held the largest share of the South & Central America lithotripsy market share in 2023.

In term of application, the South & Central America lithotripsy market is segmented into kidney stones, ureteral stones, pancreatic stones, bile duct stones, and bladder stones. The kidney stones segment held the largest share of the South & Central America lithotripsy market share in 2023.

Based on end-user, the South & Central America lithotripsy market is segmented into hospitals, specialty clinics, and others. The hospitals segment held the largest share of the South & Central America lithotripsy market share in 2023.

Based on country, the South & Central America lithotripsy market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil segment held the largest share of South & Central America lithotripsy market in 2023.

Becton Dickinson and Co, Boston Scientific Corp, DirexGroup, Edap Tms SA, ELMED Medical Systems, EMS Electro Medical Systems SA (EMS+), Karl Storz SE & Co KG, NOVAmedtk, Olympus Corp, and Potent Medical are some of the leading companies operating in the South & Central America lithotripsy market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South & Central America lithotripsy market.

- Highlights key business priorities to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the South & Central America lithotripsy market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth South & Central America market trends and outlook coupled with the factors driving the South & Central America lithotripsy market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the South & Central America Lithotripsy Market include:- Becton Dickinson and Co

- Boston Scientific Corp

- DirexGroup

- Edap Tms SA

- ELMED Medical Systems

- EMS Electro Medical Systems SA (EMS+)

- Karl Storz SE & Co KG

- NOVAmedtk

- Olympus Corp

- Potent Medical

Table Information

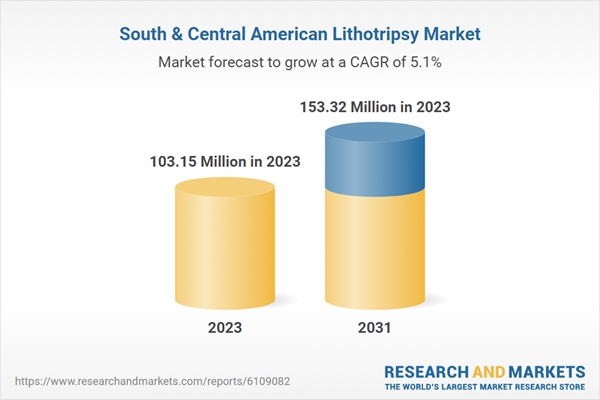

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | April 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 103.15 Million in 2023 |

| Forecasted Market Value by 2031 | 153.32 Million by 2031 |

| Compound Annual Growth Rate | 5.1% |

| No. of Companies Mentioned | 11 |