As computational photography gains ground, integration into smartphones and medical devices is becoming more common. Additionally, ongoing investments in R&D by startups and tech leaders are pushing the boundaries of plenoptic imaging systems, further driving momentum. The tariff conflict initiated during the Trump administration has created pricing challenges for manufacturers relying on imported components. As the cost of essential parts rises, manufacturers in the U.S. either face reduced margins or must pass price increases to customers. Without viable domestic alternatives, these companies are under pressure to optimize production costs or shift sourcing strategies to remain competitive.

The standard plenoptic cameras segment was valued at USD 800 million in 2024. These cameras feature a microlens array placed between the main lens and the sensor to record both spatial and angular light data. This configuration produces 4D plenoptic data, enabling users to adjust focus or perspective after capture. These capabilities make standard plenoptic cameras ideal for research, creative media, and photography, where image depth and post-processing flexibility matter. However, the need to balance angular and spatial resolution continues to influence image clarity.

The microlens array (MLA)-based camera segment is poised to reach USD 4.8 billion by 2034. These systems use a microlens array placed between the primary lens and sensor to trap light from multiple directions, transforming flat 2D captures into detailed plenoptic images. This imaging method supports functions like post-capture refocusing and depth mapping, which are essential in fields such as film production, scientific research, and virtual visualization. The ability to replicate light ray pathways through MLA offers users a rich, immersive viewing experience with enhanced depth and precision.

United States Plenoptic Camera Market is expected to reach USD 2.3 billion by 2034. The country remains a vital contributor to global demand thanks to its robust technological landscape and innovation-driven ecosystem. Strong interest in AR and VR technologies continues to elevate the demand for cameras capable of creating immersive and responsive visual environments. With advanced research centers and the rapid adoption of futuristic imaging tools, the U.S. is expected to maintain its dominance in this space.

Key players influencing the market include Canon Inc., Adobe Inc., Apple Inc., Raytrix GmbH, and Google LLC, who collectively drive innovation and technological leadership. Leading companies in the plenoptic camera market are strengthening their foothold by prioritizing innovation and expanding their application scope. They are increasing R&D investments to develop next-generation imaging solutions that offer enhanced depth mapping, real-time 3D rendering, and post-capture editing capabilities. Strategic partnerships with firms in the AR/VR, healthcare, and autonomous systems sectors are also gaining traction. These collaborations allow companies to tailor their plenoptic technologies for specific use cases. Additionally, firms are focusing on software integration and edge computing compatibility to boost real-time performance.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Plenoptic Camera market report include:- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Micron Technology, Inc.

- Kingston Technology Corporation

- Corsair Components, Inc.

- ADATA Technology Co., Ltd.

- G.SKILL International Enterprise Co., Ltd.

- Patriot Memory LLC

- TeamGroup Inc.

- Mushkin Enhanced MFG

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- Lenovo Group Limited

- Cisco Systems, Inc.

- IBM Corporation

- SMART Modular Technologies, Inc.

- Viking Technology (Sanmina Corporation)

- Innodisk Corporation

- Transcend Information, Inc.

- Apacer Technology Inc.

- Netlist, Inc.

- Panram International Corp.

- Silicon Power Computer & Communications Inc.

- Exceleram

- PNY Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

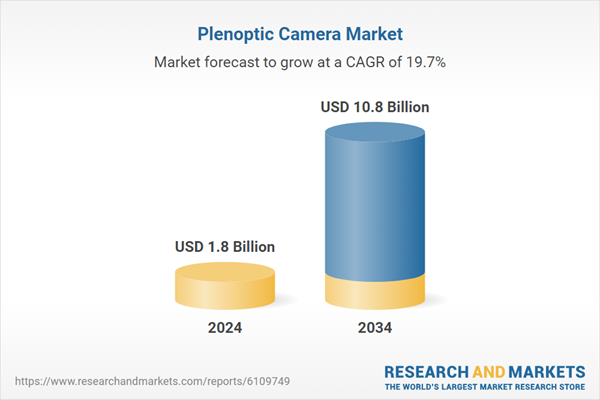

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 10.8 Billion |

| Compound Annual Growth Rate | 19.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |