Countries across Asia and Europe are significantly funding transit tunnels, underground utilities, and infrastructure corridors. As a result, demand is rapidly shifting toward robotic shotcrete sprayers that deliver fast application, superior surface adhesion, and access to confined zones. These automated solutions offer consistent spraying accuracy while minimizing manual labor requirements and improving safety standards. Labor shortages and stricter safety regulations in regions like North America and Europe are further driving the adoption of robotic systems. The rise of automated and remote-controlled shotcrete equipment is transforming worksite operations by boosting speed, precision, and overall job site efficiency.

The wet-mix process segment generated USD 846.3 million in 2024 and is expected to reach USD 1.31 billion by 2034. Wet-mix shotcrete has rapidly become the preferred application method across large-scale projects due to its uniform consistency and enhanced compressive strength, which typically ranges between 4,000 to 7,000 psi. Since all materials are pre-mixed before spraying, this process ensures a smooth and even application with minimal material loss. Rebound rates stay well below 10%, resulting in cleaner job sites, better quality output, and reduced waste, which together contribute to project cost savings and safer environments.

The robotic spray machines segment held a 68.4% share in 2024 and is projected to grow at a CAGR of 4.7% from 2025 through 2034. These advanced systems are setting new benchmarks in the industry by delivering highly uniform layers and reducing operator exposure to hazardous overhead zones. Many systems offer positioning precision within ±5 mm, ensuring consistent quality. Capable of spraying up to 20 cubic meters per hour, robotic sprayers can shorten project timelines by nearly a quarter while lowering labor costs. Suppliers like Normet and Aliva are integrating smart features that automate nozzle movement and provide live data feedback to optimize performance and surface finish.

U.S. Shotcrete Spray Machines Market was valued at USD 259.9 million in 2024 and is forecast to grow at a CAGR of 4.4% through 2034. Aging infrastructure and a focus on repair and rehabilitation continue to drive demand across transportation and public works sectors. In parallel, steady activity in housing and commercial development has supported additional demand for efficient spraying systems. The market shows a clear preference for robotic wet-mix equipment in large-scale construction projects, underpinned by an increasing focus on productivity and workplace safety. Within North America, Canada is also gaining traction due to growing investments in underground urban development and resource mining projects.

Prominent companies shaping the Shotcrete Spray Machines Industry include YG Machinery, Normet, Filamos, Sika, Reed, JUHE Group, Putzmeister, Gunite Supply & Equipment, CIFA, Epiroc Deutschland, Tünelmak, Gengli, Leadcrete, Blastcrete, and MacLean Engineering. Leading manufacturers in the shotcrete spray machines market are focusing on expanding their product portfolios with automation-driven models that enhance safety and efficiency. Strategic collaborations with infrastructure contractors allow them to deliver application-specific solutions that meet evolving regulatory standards. Companies are also investing in R&D to integrate AI-based control systems, improve precision spraying, and reduce operator dependency. Global players are strengthening their supply chains in high-growth regions through distributor partnerships and service networks to ensure quicker delivery and post-sale support. Some firms are offering modular equipment designs and remote diagnostics to optimize maintenance and lifespan.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Blastcrete

- CIFA

- Epiroc Deutschland

- Filamos

- Gengli

- Gunite Supply & Equipment

- JUHE Group

- Leadcrete

- MacLean Engineering

- Normet

- Putzmeister

- Reed

- Sika

- Tünelmak

- YG Machinery

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

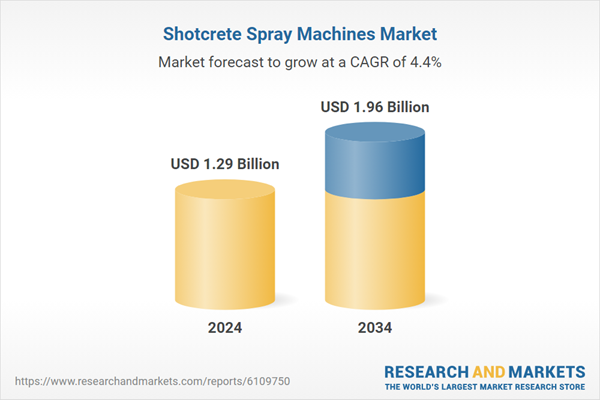

| Estimated Market Value ( USD | $ 1.29 Billion |

| Forecasted Market Value ( USD | $ 1.96 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |