Training in immunology continues to improve among healthcare providers, allowing earlier identification and intervention for patients with suspected immunodeficiency disorders. Patient advocacy organizations and community support groups are playing a crucial role in connecting individuals to care networks and pushing for systemic changes in healthcare policy. This broader engagement is helping increase access to advanced diagnostic tools, such as genetic sequencing and flow cytometry, which are being adopted globally to aid in detecting and classifying PIDs.

The rise of urbanization and access to better healthcare services, along with increasing disposable incomes in developing regions such as South Africa, Brazil, India, and China, is encouraging people to seek medical evaluations and pursue proper treatment. Primary immunodeficiency disorders are inherited immune system conditions that lead to higher vulnerability to infections, chronic illnesses, and overall weakened immune function. Treatment innovations are focused on improving immunity, alleviating symptoms, and minimizing disease recurrence.

The antibody deficiencies segment represented the largest market segment in 2024, with a valuation of USD 4.1 billion. This dominance stems from the high prevalence of immune disorders linked to impaired antibody production. Among the most common are immunodeficiencies that result in frequent, severe infections requiring lifelong therapy. Patients with these conditions typically need regular immunoglobulin therapy administered through intravenous or subcutaneous methods, which contributes to sustained product demand. Ongoing medical advancements are ensuring more efficient and patient-friendly delivery systems, expanding this segment’s growth potential.

In terms of treatment, the immunoglobulin replacement therapy (IRT) segment held a 68.3% share in 2024. The continued reliance on IRT as a standard care protocol for most antibody-related immunodeficiencies reinforces its strong market presence. These therapies offer long-term protection from infections, which is essential in managing these lifelong conditions. Recent improvements in treatment formulations, including options with extended half-lives and recombinant technology, are further increasing therapy effectiveness and patient comfort. Additionally, greater awareness and advocacy support early treatment initiation and improved adherence, which directly supports this market’s expansion. Healthcare providers now recognize IRT as a cornerstone therapy in PID treatment, prompting its broader acceptance and usage.

U.S. Primary Immunodeficiency Disorders Market was valued at USD 2.9 billion in 2024. The country leads the global market with a robust healthcare infrastructure, widespread adoption of advanced diagnostics, and strong public and clinical awareness of immunodeficiency disorders. Diagnostic tools, including immune profiling, flow cytometry, and advanced genetic testing, are widely used to confirm and classify PID cases, especially among children. The availability of cutting-edge therapies such as gene editing technologies and stem cell-based interventions is giving U.S. patients access to some of the most innovative treatments globally. Specialized clinics, immunology-focused hospitals, and home-based care delivery models have all contributed to market maturity. Strong research investments in targeted biologics, next-generation immunoglobulins, and novel therapies for rare diseases continue to shape the market’s evolution.

Leading companies in the Primary Immunodeficiency Disorders Market include Orchard Therapeutics, Miltenyi Biotec, CSL Behring, Baxter International, Medac, Octapharma, ADMA Biologics, Takeda Pharmaceutical, F. Hoffmann La Roche, Bluebird Bio, Biotest (Grifol Group), Avanos, and Leadiant Biosciences. Companies operating in the primary immunodeficiency disorders market are pursuing several strategies to enhance their market presence.

One major focus is investing in advanced R&D pipelines for targeted biologics, gene therapies, and next-gen immunoglobulin therapies with enhanced bioavailability and reduced administration frequency. Firms are also expanding manufacturing capabilities to meet the growing demand for lifelong immunoglobulin replacement therapies. Strategic collaborations with academic institutions and research centers allow access to emerging technologies and new indications. Companies are increasing market penetration through geographic expansion, especially in developing regions with rising diagnostic awareness.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- ADMA Biologics

- Baxter International

- Biotest (Grifol Group)

- Bluebird Bio

- CSL Behring

- F. Hoffmann La Roche

- Leadiant Biosciences

- Medac

- Miltenyi Biotec

- Takeda Pharmaceutical

- Octapharma

- Orchard Therapeutics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | June 2025 |

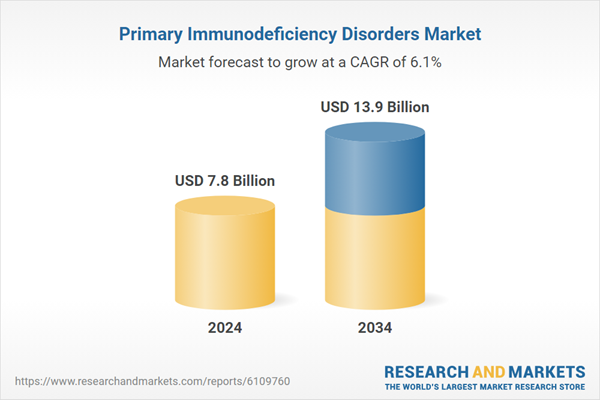

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.8 Billion |

| Forecasted Market Value ( USD | $ 13.9 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |