An important growth driver within this market is the increasing deployment of motion sensors in modern vehicles. Automotive safety is undergoing a rapid transformation with more cars incorporating advanced systems designed to prevent accidents. These safety applications, including lane guidance, collision alerts, and blind-spot monitoring, rely heavily on high-precision sensors to operate effectively. Real-time data provided by motion sensing units allows these intelligent vehicle systems to function autonomously with greater control and accuracy, especially as semi-autonomous features continue to evolve. The integration of such motion technology into vehicle frameworks reflects a deeper trend toward automation and driver assistance.

The microwave sensor segment is expected to grow at a CAGR of 8.8% through 2034, driven by its effectiveness in demanding and variable environments. These sensors outperform conventional technologies by offering stable motion detection in poor visibility conditions and through physical barriers. Because they can deliver accurate and reliable performance regardless of lighting or weather, microwave motion sensors are gaining ground in security, industrial, and transport infrastructure. Their capacity for long-range detection and compatibility with complex systems has made them highly sought-after for next-generation safety applications and intelligent sensing installations.

Discrete motion sensors segment accounted for a 62.9% share in 2024, supported by widespread use in everyday automation systems such as lighting, security, and industrial controls. Their straightforward architecture and flexible design make them ideal for cost-sensitive projects and retrofitting older infrastructure. These sensors are also preferred for their ease of maintenance and cross-compatibility with existing hardware platforms. While integrated systems are advancing rapidly, discrete sensors continue to dominate where simplicity and cost-effectiveness are paramount, especially in developing or transitional markets.

United States Motion Sensor Market is expected to generate USD 1.18 billion by 2034. In the U.S., expanding interest in home automation, infrastructure upgrades, and connected vehicles is driving significant demand. Motion sensing technology is being deployed not just in consumer gadgets, but also across critical infrastructure networks where reliability and performance are essential. As digital modernization accelerates, these devices are proving vital in enabling automated responses across utilities, transportation systems, and smart energy management. Government efforts to upgrade outdated infrastructure further underscore the importance of motion sensors in monitoring, tracking, and securing physical assets.

Leading companies in the Global Motion Sensor Market include Texas Instruments Incorporated, Honeywell International Inc., Bosch Sensortec GmbH, and STMicroelectronics. To enhance their market position, motion sensor manufacturers are implementing a variety of strategic initiatives. Key players are investing in the development of miniaturized, power-efficient sensors optimized for wearable tech, automotive applications, and IoT-enabled systems. Strengthening global distribution networks and entering emerging markets are also high on the agenda to capitalize on growing urbanization. Strategic alliances with system integrators and OEMs help foster faster adoption of sensor technology into smart devices. Additionally, companies are prioritizing research on hybrid sensor designs that combine multiple detection methods - such as microwave, infrared, and vibration - into compact, multifunctional units.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Allegro MicroSystems, Inc.

- Analog Devices, Inc.

- Bosch Sensortec GmbH

- Elmos Semiconductor SE

- Honeywell International Inc.

- InvenSense

- KEMET Corporation

- Littelfuse, Inc.

- NXP Semiconductors

- Panasonic Holdings Corporation

- Schneider Electric

- Siemens AG

- STMicroelectronics

- TE Connectivity

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2025 |

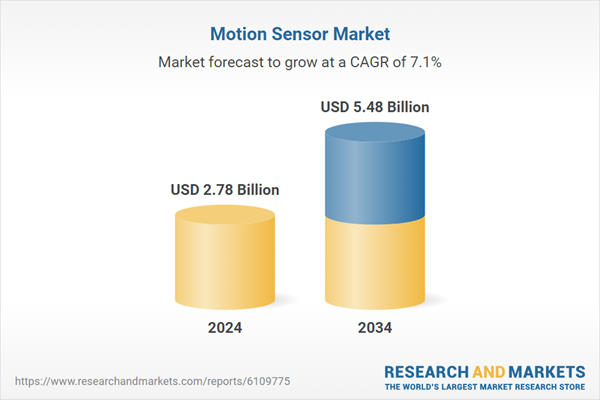

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.78 Billion |

| Forecasted Market Value ( USD | $ 5.48 billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |