They also play a pivotal role in maintaining strict hygiene protocols, particularly in sectors such as pharmaceuticals and food processing, where even minimal contamination risks can compromise product safety. By reducing manual handling and automating the packaging process, these systems not only improve operational cleanliness but also support facilities in consistently adhering to stringent global health regulations. Their ability to limit exposure to contaminants and maintain controlled environments ensures that producers meet both safety and quality benchmarks set by governing bodies. Moreover, automated systems enable manufacturers to standardize procedures and documentation, which simplifies audits and inspections-an increasingly vital factor for global trade and certification requirements.

The automatic bagging systems segment led the market in 2024, generating USD 2.2 billion, and is poised to grow at a CAGR of 6.1% through 2034. While smaller businesses in developing regions favor manual or semi-automatic systems due to lower costs and simplified technology, automatic versions gain traction thanks to their compatibility with smart factory environments. These systems often incorporate IoT and AI capabilities, ensuring precise bag filling and greater batch consistency.

The direct sales channels segment represented a 72% share in 2024 and is expected to grow at a CAGR of 5.9% through 2034. Purchasing directly from machine manufacturers allows large-scale users to access tailored configurations, priority technical support, and extended service agreements. This method also gives OEMs greater control over shipping and customer service, fostering stronger client partnerships.

North America Bagging Systems Market held a 76% share and generated USD 1.2 billion in 2024. The nation’s advancement is fueled by the thriving agricultural and chemical industries, which demand high-throughput packaging solutions. The shift toward automation under Industry 4.0 has accelerated the adoption of intelligent bagging equipment, which can be seamlessly integrated into existing production lines.

Major players in the Global Bagging Systems Market include Harper International, BW Flexible Systems, Fuji Machinery, Premier Tech, Pakona Engineers, Syntegon Technology, Torrey Hills Technologies, ProMach, Vanguard Masek, ALL-FILL, Concetti, LoeschPack, Fitzpatrick Packaging, Wenger Manufacturing, and Paxiom Group. Leading firms are focusing on innovation, customization, and service excellence to reinforce their market positions. They are investing in R&D to embed smart technologies-including IoT sensors, AI-driven diagnostics, and predictive maintenance-into new bagging solutions. Partnerships with system integrators and major manufacturers are helping deliver turnkey automated packaging lines. Companies are also expanding their global footprints through localized production and service hubs, reducing lead times and ensuring on-site support.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- ALL-FILL

- BW Flexible Systems

- Concetti

- Fitzpatrick Packaging

- FUJI Machinery

- Harper International

- LoeschPack

- Pakona Engineers

- Paxiom Group

- Premier Tech

- ProMach

- Syntegon Technology

- Torrey Hills Technologies

- Viking Masek

- Wenger Manufacturing

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | June 2025 |

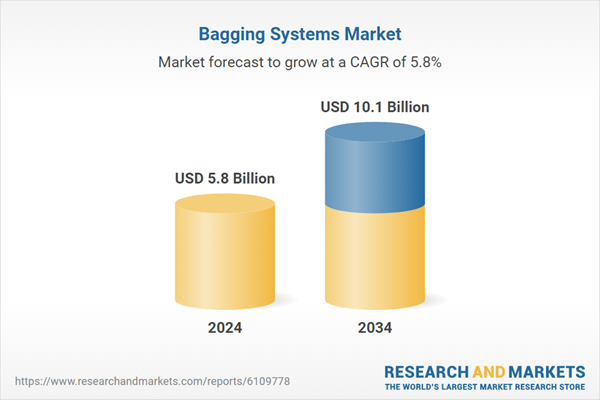

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 5.8 Billion |

| Forecasted Market Value ( USD | $ 10.1 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |