Government-enforced packaging regulations, particularly in the pharmaceutical and food industries, are accelerating the adoption of secure and traceable packaging technologies. Cartoning machines are being enhanced with Industry 4.0 capabilities, including IoT sensors and AI-based monitoring systems. These features enable predictive maintenance and real-time data tracking, improving operational efficiency. About 40% of packaging firms now use smart automation to streamline their production cycles. Additionally, the market is seeing a growing shift toward eco-conscious operations. More than 75% of consumers now prefer sustainable options, prompting manufacturers to incorporate recyclable paperboard and energy-efficient solutions into cartoning lines.

Horizontal cartoning machines segment generated USD 3 billion in 2024 and is forecasted to grow at a CAGR of 5.2% through 2034. Their popularity lies in their versatility and speed, making them ideal for processing different product forms. These machines are widely used in personal care and food packaging and can handle both automatic and manual loading, thanks to enhanced features like servo-driven systems that increase precision and throughput.

The fully automatic cartoning machines segment held a dominant share of 72.8% in 2024 and is projected to hit USD 6.1 billion by 2034. These systems are preferred for their minimal dependency on human labor and their ability to ensure consistent output in high-volume sectors such as pharmaceuticals and food production. Innovations such as AI-enabled tracking and solvent-free gluing have also contributed to their growing usage, particularly in regions focused on reducing environmental impact.

U.S. Cartoning Machinery Market generated USD 980 million in 2024 and is on track to grow at a 5.5% CAGR through 2034. The country leads with widespread demand for smart cartoning machinery across industries including healthcare, food, and online retail. Strong technological infrastructure and an experienced workforce make it a favorable environment for automation. U.S. packaging firms are also influenced by sustainability regulations, which continue to push the market toward greener operations.

Key players in the Cartoning Machinery Market include Omori Machinery, Marchesini Group, Mpac Group, ShineBen Machinery, IMA Group, Jacob White Packaging, SaintyCo, Econocorp, BW Integrated Systems, Serpa Packaging Solution, Infinity Automated Solutions, Nichrome, ADCO Packaging Solutions, Mespack, and Elite Packaging Machinery. Leading companies in the cartoning machinery market are focusing on technological innovation, product customization, and sustainability to expand their market reach. Many are integrating AI and IoT into their systems to offer smart, connected solutions that provide real-time diagnostics and predictive maintenance. Partnerships with packaging companies help them tailor equipment for specific operational needs, especially in the food, pharma, and personal care sectors. Expanding product lines with energy-efficient systems and eco-friendly features is another priority, aligning with global sustainability goals.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- ADCO Packaging Solutions

- BW Integrated Systems

- Econocorp

- Elite Packaging Machinery

- IMA Group

- Infinity Automated Solutions

- Jacob White Packaging

- Marchesini Group

- Mespack

- Mpac Group

- Nichrome

- Omori Machinery

- SaintyCo

- Serpa Packaging Solution

- ShineBen Machinery

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

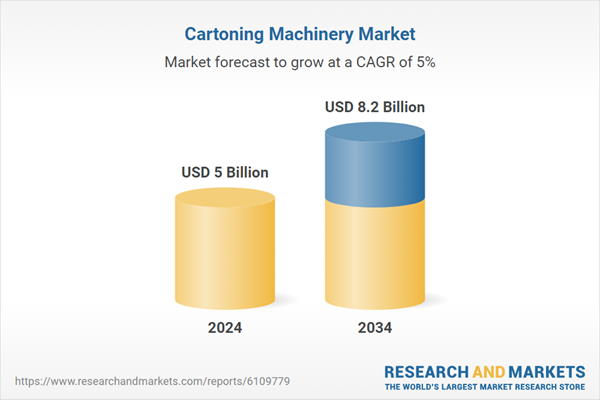

| Estimated Market Value ( USD | $ 5 Billion |

| Forecasted Market Value ( USD | $ 8.2 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |