Additionally, the shift toward using lighter and stronger materials, including composites and high strength alloys, necessitates more advanced cutting tools that can handle these tough materials. Another key driver is the ongoing infrastructure boom, especially in rapidly developing economies, which raises the need for tools suitable for large machines and site equipment. Along with this, the focus on optimizing raw material use and minimizing waste continues to push manufacturers toward more durable, cost-effective cutting tools.

Furthermore, the drive for greener production methods is accelerating within the cutting tools industry, as companies increasingly prioritize sustainability alongside performance. Manufacturers are adopting eco-friendly practices at every stage, from sourcing raw materials to improving energy efficiency during the manufacturing process. Advances in cutting tool coatings and materials are enabling longer tool lifespans and reduced waste, while also enhancing cutting efficiency. Additionally, there is a growing emphasis on recycling and reusing cutting tools, reducing the overall environmental footprint. Many companies are also focusing on reducing hazardous emissions and minimizing the use of harmful chemicals during the production process.

In 2024, the indexable tools segment generated USD 5.6 billion. This segment is growing in popularity due to its cost-effectiveness and versatility. Indexable tools allow users to replace worn-out inserts instead of discarding the entire tool, which helps lower operational costs, making them highly attractive in precision-driven industries like automotive and aerospace. These tools also support high-speed machining, enhancing efficiency and durability, which are crucial for manufacturers. The shift toward sustainability further adds to their appeal, as using replaceable inserts generates less scrap metal and reduces waste, aligning with the growing demand for greener manufacturing processes.

The milling tools segment accounted for a 33.1% share in 2024. The rapid expansion of this segment can be attributed to the wide range of tasks milling tools are capable of handling in multiple industries. These tools are essential for producing complex profiles with high precision, and they are commonly used in automotive, aerospace, and electronics. As product designs demand lighter yet more durable parts, milling tools are gaining popularity due to their ability to cut through advanced materials. Innovations, such as multi-purpose designs and improved coatings, have also contributed to the segment's growth by extending tool life and reducing operational costs.

United States Cutting Tools Market was valued at USD 2.6 billion in 2024, leading the global market. The U.S. manufacturing sector, which spans a wide range of industries, is a key factor driving this dominance. The automotive and aerospace sectors fuel the demand for highly accurate tools that meet stringent quality standards. Additionally, the integration of robotics, sensors, and cloud analytics in manufacturing further boosts market growth by enhancing operational efficiency.

Key companies in the Cutting Tools Industry include Ceratizit S.A., Cougar Cutting Tools, Emuge Corporation, Greenleaf Corporation, Ingersoll Cutting Tools, Iscar Ltd., Kennametal Inc., Mapal Inc., Mitsubishi Materials Corporation, Mohawk Special Cutting Tools, OSG Corporation, Sandvik Coromant, Seco Tools AB, Tungaloy Corporation, and Walter Technologies. In response to the increasing demand for cutting-edge products, companies in the cutting tools market are focusing on technological advancements to enhance their market position.

Leading players are investing heavily in research and development to improve the performance of their tools and increase their lifespan. They are also actively exploring sustainable manufacturing techniques to meet environmental regulations and consumer demands for greener products. Additionally, strategic partnerships, mergers, and acquisitions are being utilized to expand product offerings and strengthen supply chains. Companies are also incorporating digital tools, such as smart sensors and IoT-enabled devices, to enhance precision and operational efficiency in manufacturing.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Ceratizit S.A.

- Cougar Cutting Tools

- Emuge Corporation

- Greenleaf Corporation

- Ingersoll Cutting Tools

- Iscar Ltd.

- Kennametal Inc.

- Mapal Inc.

- Mitsubishi Materials Corporation

- Mohawk Special Cutting Tools

- OSG Corporation

- Sandvik Coromant

- Seco Tools AB

- Tungaloy Corporation

- Walter Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2025 |

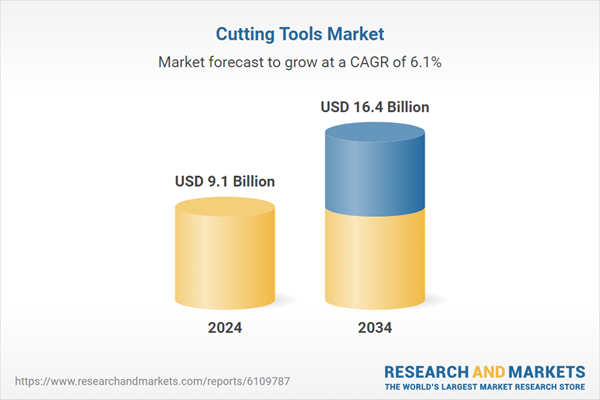

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 16.4 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |