Growth is further supported by the complexity of global logistics and the expansion of e-commerce, both of which require highly efficient handling of diverse products in warehouses and distribution centers for rapid order processing. Innovations such as advanced robotic arms and the introduction of collaborative robots have made robotic palletizers more versatile and accessible to small and medium-sized businesses alike. Despite their advantages, the market faces challenges due to high upfront costs, integration complexities with existing systems, ongoing maintenance and programming expenses, and the need for skilled personnel. Nevertheless, ongoing technological innovations and economic benefits are driving the adoption of robotic palletizers within automated manufacturing and supply chain environments.

The handling products up to 500 kg segment generated USD 491.4 million in 2024. Robots in this category are designed for light to medium-weight packages and are experiencing rapid growth, particularly due to increasing automation in e-commerce and consumer product handling. These robotic palletizers are favored across industries such as pharmaceuticals, food and beverages, consumer goods, and other manufacturing sectors. Their ability to manage varying box sizes, bags, and cases makes them versatile and highly demanded for diverse palletizing applications.

The food & beverages segment held the largest market share in 2024, accounting for 36.2%. Robotic palletizers have become indispensable in this industry where efficiency, hygiene, and consistency are critical. High-volume production and swift distribution demands, combined with persistent labor shortages and rising costs for repetitive tasks like palletizing, push companies to automate processes. Robotic systems not only improve operational efficiency but also reduce human contact with food products, minimizing contamination risks. Additionally, specialized food-grade robots are developed to comply with strict hygiene standards, further driving adoption in this sector.

United States Robotic Palletizers Market held a 68% share in 2024. Factors fueling this growth include increasing supply chain complexity and high labor costs, which make robotic palletizers a practical investment to maintain operational continuity. The U.S. also benefits from advancements in manufacturing technology and Industry 4.0 initiatives, boosting the demand for robotic palletizing solutions. As one of the leaders in robotics adoption, the country exhibits growing robot density across multiple manufacturing processes, enhancing market momentum.

Leading companies competing in the Global Robotic Palletizers Industry include FANUC Corporation, KUKA AG, ABB, Honeywell International Inc, Schneider Packaging Equipment Company, Bastian Solutions, Fuji Robotics, Okura LLC, Pasco Systems, Premier Tech, Robotiq, Kawasaki Heavy Industries Ltd, KION Group AG, Sidel, and Yaskawa Electric Corporation. To strengthen their market presence, companies in the robotic palletizers sector focus on innovation by developing highly adaptable robotic systems capable of handling a wide range of product sizes and weights with precision. They invest in research and development to improve automation efficiency, ease of integration, and user-friendly interfaces. Strategic collaborations with packaging and logistics solution providers allow them to deliver end-to-end automation solutions that fit seamlessly into existing supply chains. Firms also expand their global footprint through localized production, enhanced customer service networks, and tailored after-sales support, ensuring robust client relationships.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- ABB

- Bastian Solutions

- FANUC Corporation

- Fuji Robotics

- Honeywell International Inc

- Kawasaki Heavy Industries Ltd

- KION Group AG

- KUKA AG

- Okura LLC

- Pasco Systems

- Premier Tech

- Robotiq

- Schneider Packaging Equipment Company

- Sidel

- Yaskawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

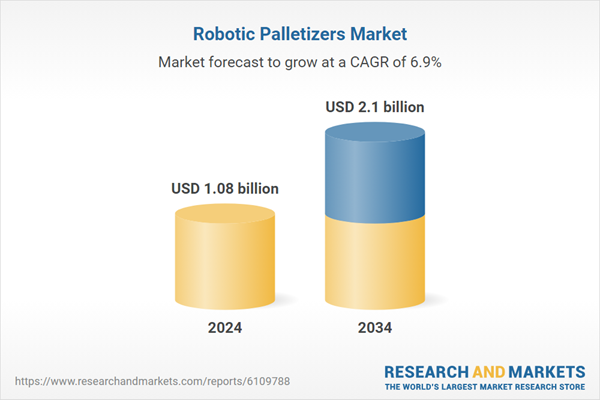

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.08 billion |

| Forecasted Market Value ( USD | $ 2.1 billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |