Countries across the globe are ramping up their defense spending to enhance aerial survivability and strategic readiness, making decoy flares a cornerstone of modern warfare technology. These countermeasures are increasingly seen as essential tools to outmaneuver sophisticated missile threats, particularly in regions where tensions are escalating and airspace integrity is a priority.

Armed forces are embedding decoy flare systems into both legacy and next-generation aircraft platforms to ensure comprehensive protection against heat-seeking threats. This trend is especially pronounced in military modernization programs aimed at strengthening national security through cost-effective yet capable defense technologies. The inclusion of multi-spectral flare systems and next-gen flare deployment mechanisms further underlines how critical these tools have become in advanced threat environments.

The traditional pyrotechnic flares segment led the market in 2024 and was valued at USD 870 million. Their cost-effectiveness and ease of integration make them indispensable in routine testing, training, and low-budget procurement programs. They support high-volume inventory needs in tense regions, helping militaries sustain readiness without escalating costs.

Magnesium-based flares segment held a market share worth USD 721 million in 2024. Magnesium remains favored due to its intense heat output and lightweight profile, closely mimicking aircraft engine signatures to distract IR-guided missiles. Its affordability and ease of lightweight mass production make it ideal for both operational deployment and training exercises.

U.S. Decoy Flares Market generated USD 602 million in 2024, driven by sustained military modernization and expanding aerial defense investments. With consistent defense funding and global security challenges, demand for sophisticated countermeasures remains strong. Major national defense contractors are refining flare compositions and deployment systems to achieve quicker ignition and higher thermal output, further enhancing aircraft evasion capabilities.

Leading companies in the Global Decoy Flares Market include Rheinmetall AG, Chemring Group PLC, Elbit Systems Ltd., and L3Harris Technologies, Inc. Top firms in the decoy flares sector are focusing on product innovation, strategic partnerships, and expanding global footprints to enhance their market positions. Technology development is centered on improving pyrophoric flare performance, including faster ignition, extended burn time, and enhanced spectral coverage.

Collaborations between defense contractors and military agencies support field testing and certification, accelerating adoption. Companies are also optimizing production facilities to handle larger volumes and reduce unit costs, responding to high inventory demands across regions. By expanding into emerging markets and leveraging offset agreements, manufacturers are strengthening relationships with new defense clients.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Alkan SAS

- Aselsan A.S.

- Bharat Dynamics Limited (BDL)

- Chemring Group PLC

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- MBDA

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Terma A/S

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2025 |

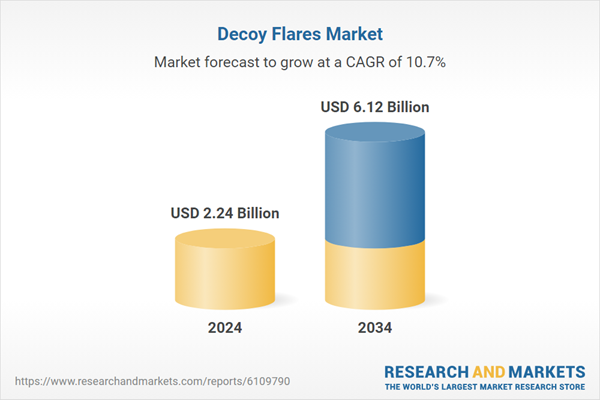

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.24 Billion |

| Forecasted Market Value ( USD | $ 6.12 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |