Rising chronic illness cases, the need for continuous medication delivery, and the growth in home infusion therapy have all contributed to the increasing demand for these pumps. Their portability and ease of use, coupled with growing patient preferences for home care options and fewer clinic visits, have established elastomeric infusion pumps as an asset in modern treatment protocols. The continued emphasis on value-based care and patient independence post-pandemic is driving long-term demand, especially for conditions requiring frequent infusions like cancer, autoimmune disorders, and thalassemia.

As homecare treatment becomes more prevalent, healthcare providers are increasingly using elastomeric pumps to deliver medication for chemotherapy, immunotherapy, and iron chelation therapy. The ability to maintain steady medication levels without complicated machinery makes these pumps well-suited for home-based therapies, particularly in cases where patient monitoring is limited. Home infusion solutions are now part of standard protocols for managing long-term diseases, especially as patients seek more autonomy and comfort. These pumps are also proving beneficial for outpatient treatments, enabling healthcare professionals to support continuity of care while minimizing hospital resources. Their disposable nature also aligns with infection control practices and makes them a convenient choice for patients and clinicians alike.

In 2024, the continuous rate elastomeric pumps segment held a 69.2% share. These pumps offer reliable, uninterrupted drug infusion, vital for maintaining stable therapeutic levels in chronic care management. Whether managing infections, cancer symptoms, or pain, a constant flow rate reduces dosing errors and helps patients remain compliant with prescribed regimens. The ability to function without electricity or programming makes these pumps accessible to a broad patient population, especially those receiving treatment at home. Their simplicity encourages adherence, fosters patient independence, and lowers the workload on caregivers and clinicians. The preference for these pumps is also reinforced by the growing demand for predictable dosing schedules in long-term therapies.

The pain management segment accounted for USD 249.8 million in 2024. The widespread adoption of minimally invasive surgeries and enhanced recovery protocols has intensified the focus on efficient post-operative pain control. Elastomeric infusion devices are frequently used to administer continuous doses of local anesthetics or opioid-based analgesics, ensuring consistent pain relief without reliance on electronic devices. Their portability enables deployment in ambulatory care centers and outpatient surgery settings, supporting rapid discharges and faster recovery timelines. The simplicity and effectiveness of elastomeric pumps continue to drive their use as part of enhanced post-surgical care strategies globally.

United States Elastomeric Infusion Pumps Market is projected to reach USD 504.7 million by 2034, supported by the nation’s growing preference for outpatient treatment models and efficient post-discharge care. Procedures once confined to inpatient settings are now increasingly managed through ambulatory centers and home health services. Elastomeric infusion pumps are playing a key role in this transition by offering portability, safety, and ease of use. They are regularly utilized for pain relief, chemotherapy, and antibiotic administration. U.S. reimbursement frameworks, including Medicare’s coverage for durable medical equipment, have strengthened the business case for providers to adopt these devices across home infusion programs. With a strong policy push toward reducing hospitalization durations and increasing care efficiency, these pumps are well-positioned to support healthcare institutions as they align with value-based models.

Leading players in the Global Elastomeric Infusion Pumps Market include ICU Medical, Ambu, Terumo, Baxter, B. Braun, Woo Young Medical, Nipro, Avanos, Smiths Medical, ACE Medical, Halyard, JMS, Leventon, KB Medical, and Fresenius Kabi. Key players in the elastomeric infusion pumps market are investing heavily in product innovation to enhance pump accuracy, comfort, and safety for patients in home and outpatient settings.

Companies are focusing on expanding their home infusion product lines with versatile flow-rate options, tamper-evident designs, and better ergonomic features. Strategic collaborations with healthcare providers and home health agencies are helping firms strengthen their distribution networks and broaden patient access. Many players are also optimizing manufacturing processes to maintain product affordability and scalability. Alongside this, companies are obtaining international regulatory approvals to enter untapped regions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- ACE Medical

- Ambu

- Avanos

- B. Braun

- Baxter

- Fresenius Kabi

- Halyard

- ICU Medical

- JMS

- KB Medical

- Leventon

- Nipro

- Smiths Medical

- Terumo

- Woo Young Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | June 2025 |

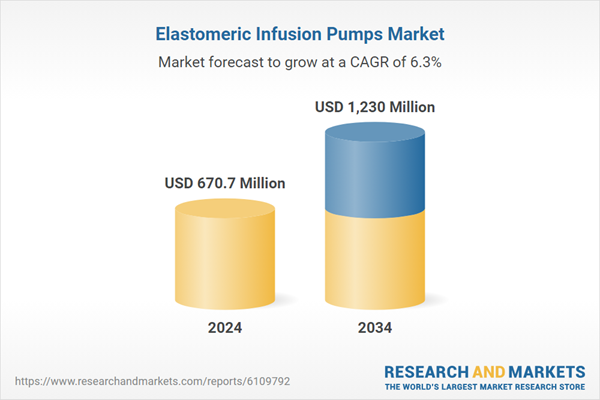

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 670.7 Million |

| Forecasted Market Value ( USD | $ 1230 Million |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |