As traditional scheduling methods prove inadequate for handling today’s operational complexities, airlines are increasingly turning toward automated crew management systems. These platforms enable real-time updates, efficient resource allocation, reduced administrative errors, and quicker adaptation to last-minute crew changes. Additionally, the growing emphasis on flight safety, operational compliance, and crew well-being is further accelerating adoption.

Changing global trade policies have influenced the pricing and availability of imported aviation technologies. New tariffs on IT infrastructure and imported software have raised the costs associated with deploying and maintaining crew management platforms. In response, aviation firms are pivoting toward regional and locally developed solutions to ensure resilience and regulatory compliance.

By investing in domestic or regional software, companies are mitigating risks related to international trade shifts and cybersecurity exposure while maintaining uninterrupted operations and long-term cost efficiency. This shift is aligning with strategic digital transformation goals while keeping software ecosystems more localized. Growing concerns around crew fatigue have also driven more airlines to integrate fatigue monitoring capabilities within their systems. Aviation safety regulators are placing greater importance on Fatigue Risk Management Systems (FRMS), which help forecast and avoid high-risk schedules.

In 2024, the software segment accounted for the largest share of the market, valued at USD 2.5 billion. Airlines are rapidly investing in artificial intelligence-enhanced software that offers real-time scheduling, proactive fatigue tracking, and enhanced crew communication. As aviation operations become more global and complex, these intelligent platforms are enabling better operational decision-making, more efficient workforce management, and greater regulatory adherence. By reducing human error and increasing automation, these software solutions are becoming indispensable in modern airline operations.

The crew planning segment is set to generate USD 3.2 billion by 2034, propelled by rising demand for optimized scheduling and duty time management. As airlines scale their operations, there’s increasing emphasis on AI-driven planning systems that can handle resource distribution intelligently while adhering to labor standards. Crew planning modules are being used to prevent scheduling conflicts and reduce downtime, helping airlines maintain punctuality and boost crew performance. These predictive tools are becoming essential in minimizing delays and improving operational flow across fleets.

United States Aviation Crew Management System Market is expected to reach USD 2 billion by 2034. Growth in this region is driven by safety-focused regulations and infrastructure improvements. With regulatory authorities calling for safety management frameworks across aviation sectors, the demand for advanced crew management platforms is growing. Increased investment in air traffic infrastructure and staffing has further amplified the need for seamless crew coordination. Integration of smart technologies such as IoT and artificial intelligence is improving system responsiveness, making aviation operations safer and more efficient, and reinforcing the push toward digital transformation in the U.S. aviation sector.

Key players shaping the competitive landscape include Lufthansa Systems, CAE Inc., IBS Software, PDC, and Jeppesen. Leading aviation crew management system providers are strengthening their market positioning through a mix of AI integration, strategic collaborations, and regional expansion. They are investing in intelligent scheduling systems and fatigue prediction tools to improve operational visibility and reduce compliance risks.

These companies are also building modular platforms that integrate seamlessly with existing airline infrastructure, ensuring ease of adoption. Strategic partnerships with local aviation companies help expand their geographical reach and enable tailored offerings for regional markets. By incorporating cloud-based deployments and offering scalable solutions, vendors are enhancing accessibility for both large carriers and regional operators.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- AIMS INTL DWC LLC

- APD

- Awery Aviation Software

- Blue One Management S.A. / N.V.

- BytzSoft Technologies Pvt.

- CAE Inc.

- FL3XX GmbH

- HITIT

- IBS Software

- Jeppesen

- Laminaar Aviation Infotech Pte Ltd.

- Leon Software

- Lufthansa Systems

- Maureva Ltd.

- NAVBLUE

- PDC

- Ramco Systems

- Takeflite

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

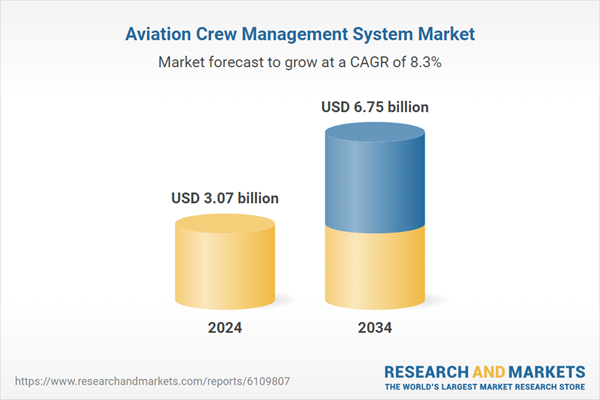

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 3.07 billion |

| Forecasted Market Value ( USD | $ 6.75 billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |