Advancements in synthetic absorbable materials are also transforming wound management practices. Hospitals and surgical centers are expanding their infrastructure to support rising procedure volumes, further boosting procurement. Healthcare professionals are increasingly adopting coated sutures that reduce infection risks, reflecting a broader shift toward infection control and faster healing. Both traditional and modern suture types are experiencing elevated demand across surgical specialties, positioning the market for sustained long-term expansion.

The absorbable sutures segment generated USD 3 billion in 2024. Their popularity lies in their ability to naturally degrade within body tissues, removing the need for physical extraction. This feature enhances patient comfort and shortens post-operative care, especially in internal procedures where suture removal is impractical. Surgeons increasingly prefer absorbable sutures in soft tissue operations and pediatric surgeries due to reduced infection risks and better biocompatibility. The segment's momentum is also supported by growing awareness around minimally invasive treatments and the rising burden of chronic diseases that require surgical resolution. These factors collectively support a shift in hospital procurement strategies toward absorbable, biodegradable options.

The multifilament sutures segment held a 63.8% share in 2024. These sutures are composed of braided or twisted strands, delivering superior tensile strength, knot security, and flexibility - key attributes that make them ideal for surgeries that demand reliable closure. Their structure allows for more precise control and easy handling during intricate operations, which is essential for procedures involving muscle, gastrointestinal tissue, or reproductive organs. Multifilament sutures are used extensively in general, orthopedic, gynecological, and gastrointestinal surgeries due to their ability to secure wounds effectively and resist breakage under pressure.

U.S. Surgical Sutures Market generated USD 1.9 billion in 2024. This growth is supported by the country’s advanced healthcare infrastructure, an aging population, and high surgical volumes. The market presence of global leaders such as Medtronic, Ethicon (Johnson & Johnson), and Teleflex ensures that hospitals and surgical centers have prompt access to innovative suturing solutions. These players operate through well-established distribution networks, enabling rapid adoption of new technologies across public and private health systems. In the U.S., emphasis on post-operative outcomes, patient safety, and reduced infection rates is pushing demand for advanced coated and absorbable sutures across both inpatient and outpatient surgical settings.

Notable companies influencing the Surgical Sutures Market include Dolphin Sutures, Boston Scientific, Corza Medical, Smith and Nephew, B. Braun Melsungen, Kono Seisakusho, Integra Lifesciences, Advanced Medical Solutions, Teleflex, Zimmer Biomet, Healthium Medtech, Peters Surgical, Ethicon (Johnson & Johnson), CONMED, Medtronic, Stryker, and GPC Medical. These manufacturers are deeply embedded in the value chain and continue to expand their reach through innovation and global partnerships.

Major players in the surgical sutures market are focusing on continuous R&D to improve suture material properties - enhancing strength, biodegradability, and antimicrobial performance. Companies are actively expanding their portfolios to include coated, barbed, and drug-embedded sutures that support infection control and accelerate healing. Strategic acquisitions and partnerships help leading firms enter new regional markets and strengthen distribution. Localization of manufacturing and supply chains is being adopted to reduce costs and ensure product availability in high-demand areas.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Advanced Medical Solutions

- B. Braun Melsungen

- Boston Scientific

- CONMED

- Corza Medical

- Dolphin Sutures

- Ethicon (Johnson & Johnson)

- GPC Medical

- Healthium Medtech

- Integra Lifesciences

- Kono Seisakusho

- Medtronic

- Peters Surgical

- Smith and Nephew

- Stryker

- Teleflex

- Zimmer Biomet

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | June 2025 |

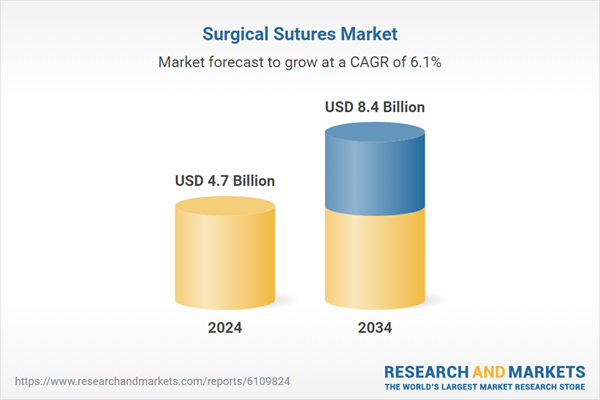

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 8.4 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |