Automotive manufacturers are transitioning from steel to lighter alternatives like composites, thermoplastics, and aluminum to reduce overall vehicle weight. This shift plays a critical role in supporting fuel efficiency, which is especially vital in the electric vehicle space, where lighter structures can boost driving range. The trend toward aerodynamic paneling is also shaping product development, as smooth fender contours and integrated wheel arches improve airflow and reduce energy consumption.

These enhancements are particularly beneficial for electric and high-performance models, where noise reduction and efficiency are selling points. As manufacturers continue adapting to international energy standards, modular assembly techniques are also gaining ground, allowing multiple components to be integrated into single units for quicker manufacturing and easier installation.

The passenger vehicles segment generated USD 9.1 billion in 2024. This segment continues to thrive, particularly in regions like Latin America and the Asia Pacific, where personal mobility is on the rise. Passenger vehicle types such as sedans, SUVs, and hatchbacks increasingly rely on sleek designs, aerodynamic styling, and lighter materials, driving up demand for enhanced fender systems. The rise of electric and hybrid passenger models is also reshaping Fender design requirements, as newer vehicles require lighter and structurally unique panel configurations. Additionally, the need to meet strict noise standards and provide better protection from road debris is encouraging manufacturers to develop multilayered fender panels that serve both functional and safety roles.

In 2024, the aftermarket segment held a 60% share. This sector continues to grow due to the consistent demand for replacement parts following minor accidents, aging vehicles, or wear and tear. Exterior body parts like wheel house panels and fenders are among the most replaced, especially in areas prone to harsh weather or heavy traffic. Consumers are drawn to the wide selection of cost-effective aftermarket options offered through online channels, independent shops, and local suppliers. The aftermarket also enables consumers to customize or repair their vehicles affordably, particularly in areas with high car ownership but limited warranties.

China Automotive Fender Wheel House Panel Parts Market generated USD 2.4 billion in 2024. The country remains a powerhouse in vehicle manufacturing, particularly in the passenger and EV categories, fueled by growing consumer demand and continued investment in automotive production. China's push toward electric mobility, backed by strong government support and national energy goals, is encouraging the use of advanced materials and aerodynamic designs in vehicle parts. The country’s robust supply chain and cost-effective production capabilities are key advantages, making it a leading exporter of both metal and composite fender parts.

Notable market participants in the Global Automotive Fender Wheel House Panel Parts Market include Kostal Group, Valeo S.A., Yazaki Corporation, Flex-N-Gate Corporation, Lear Corporation, Magna International Inc., Aisin Seiki Co., Ltd., among others. Leading companies in the automotive fender wheel house panel parts market are focusing on innovative material development and advanced manufacturing techniques to stay competitive. Many are investing in lightweight composite technologies and modular panel systems that improve assembly time and vehicle aerodynamics. Partnerships with EV manufacturers allow suppliers to tailor parts to electric drivetrains and structural layouts. Firms are also expanding production in emerging markets to meet growing regional demand and reduce costs. To cater to the aftermarket, businesses are diversifying their offerings by introducing customizable, durable, and affordable components.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Aisin Seiki

- Dongfeng Liuzhou

- Dongfeng Motor

- Ficosa International

- Flex-N-Gate

- Gestamp Automoción

- Hyundai Mobis

- Inteva Products

- Kostal

- Lear Corporation

- Magna International

- Martinrea International

- Plastic Omnium

- Sanden

- Siemens

- Schaeffler

- Toyoda Gosei

- Toyota Boshoku

- Valeo

- Yazaki

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

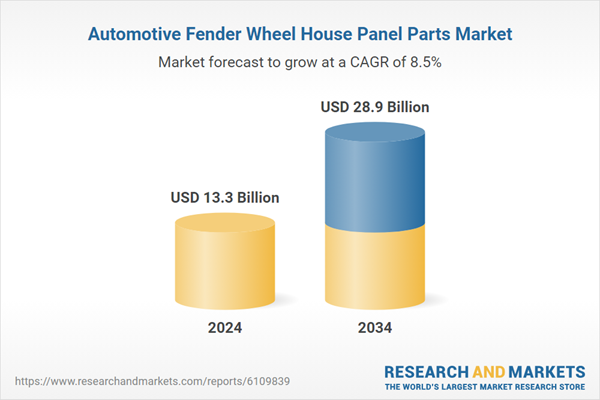

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 13.3 Billion |

| Forecasted Market Value ( USD | $ 28.9 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |