The rapid adoption of AI-powered intra-oral sensors is transforming dental clinics worldwide by elevating diagnostic precision and improving overall patient care. These advanced systems leverage artificial intelligence to automatically detect anomalies, streamline image analysis, and reduce human error, allowing practitioners to deliver faster and more accurate diagnoses. As AI continues to evolve, sensors equipped with machine learning algorithms can now identify early signs of cavities, gum disease, and bone loss with minimal manual input.

The flat panel sensors segment in the intra-oral sensor market generated USD 355.7 million in 2024. Their rise in popularity is largely driven by high-definition image output, which allows for enhanced visualization of fine dental structures. These sensors integrate seamlessly into digital workflows, making them indispensable in modern dental environments where precision, speed, and interoperability with practice management systems are essential. Dental professionals increasingly favor these sensors due to their ability to improve diagnostic accuracy and patient communication, especially during treatment planning and consultations. Additionally, their ergonomic design and real-time image delivery make them both patient- and operator-friendly.

The wired sensors segment secured a valuation of USD 328.02 million in 2024 and continues to hold a strong market position. Known for their durability, dependable image consistency, and ease of integration into existing dental software ecosystems, wired sensors remain a top choice among practitioners who prioritize reliability over wireless flexibility. These systems operate with continuous power and real-time data transfer, minimizing disruptions during procedures. Their cost-effectiveness, minimal maintenance needs, and proven track record further reinforce their preference, especially in clinics that require budget-friendly, scalable imaging solutions.

Germany Intra-Oral Sensor Market was valued at USD 30.27 million in 2024, propelled by the nation’s advanced healthcare system and robust dental equipment production base. Backed by strong insurance frameworks and national digitization strategies, the adoption of cutting-edge dental technologies continues to rise. Government policies encouraging digital health solutions have led to a steady increase in the replacement of traditional imaging tools with digital sensors. Additionally, stringent clinical guidelines and rigorous training standards in dentistry push clinics to frequently upgrade their imaging capabilities, ensuring both diagnostic excellence and compliance with evolving health regulations.

Prominent players in the market include FONA srl, Carestream Dental LLC., Acteon Group, Dexis LLC., Genoray Co., Ltd., Dentsply Sirona Inc. Manufacturers are focusing on integrating AI and CBCT technologies to offer enhanced diagnostic accuracy and faster imaging. Partnerships with dental software providers and imaging OEMs are creating comprehensive, easy-to-integrate imaging solutions. To meet growing demand, companies are expanding their product portfolios to include compact, wireless intra-oral sensors that prioritize patient comfort and clinic efficiency. They are also investing in R&D to improve sensor resolution and reduce radiation exposure. Educational initiatives and training programs for dental professionals help improve adoption rates and ensure effective utilization.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Acteon Group

- Carestream Dental LLC.

- Dentsply Sirona Inc.

- Dexis LLC.

- FONA srl

- Genoray Co., Ltd.

- Hamamatsu Photonics K.K.

- ImageWorks Corporation

- Midmark Corporation

- MyRay

- Owandy Radiology

- Planmeca Oy

- Trident S.r.l.

- Vatech Co., Ltd.

- XDR Radiology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

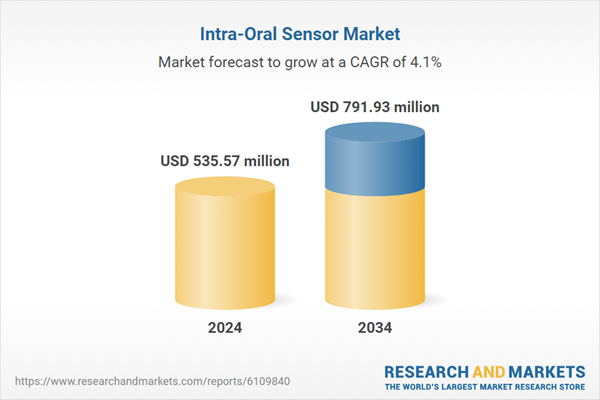

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 535.57 million |

| Forecasted Market Value ( USD | $ 791.93 million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |