Preventive healthcare and the growing popularity of personalized treatment plans are further broadening the treatment landscape. With improved awareness, people are opting for early-stage management, which not only reduces complications but also enhances the long-term quality of life for patients. The healthcare ecosystem is rapidly evolving with the availability of detection tools and a growing emphasis on outpatient care. As food allergies continue to impact mental, physical, and social well-being, more schools, workplaces, and travel organizations are adopting supportive policies, strengthening the overall response to allergy-related risks.

Innovation in treatment approaches is another driver of this market, with demand surging for newer formulations such as immunotherapy patches, oral mucosal treatments, and microbiome-focused therapeutics. The industry is experiencing a paradigm shift toward inclusive and gender-neutral healthcare protocols, highlighting the need for broader treatment access beyond children. With rising concerns over the psychological toll of living with food allergies, patients and caregivers are increasingly embracing targeted therapies that offer better safety profiles and improved outcomes.

By allergen type, the market is segmented into dairy products, peanuts, tree nuts, and other allergens. Among these, the peanuts segment emerged as the largest contributor, generating USD 2.8 billion in revenue in 2024. Increasing sensitivity to peanuts, particularly in urban populations, has led to heightened demand for advanced therapies. The severity of reactions and the immediate need for intervention have made peanut allergies a focal point for pharmaceutical R&D. This trend has resulted in increased investments from biotech firms and strong support from regulatory bodies, paving the way for cutting-edge therapies with improved safety and efficacy.

Based on treatment type, the market is categorized into antihistamines, epinephrine, immunotherapy, and others. Antihistamines maintained dominance in 2024 with a market share of 44.4%. These are the go-to medications for managing mild to moderate symptoms like itching, swelling, or congestion. Their ease of use, wide availability, and over-the-counter status make them an accessible choice for many patients. Antihistamines are often the first line of defense in both emergency and preventive care, supporting their strong position in the treatment landscape.

In terms of age group, the market is divided between children and adults. Adults held the leading share in 2024 and are projected to grow at a notable CAGR of 7.8% over the forecast period. With growing adult-onset food allergies and rising awareness about late diagnoses, this segment is rapidly expanding. Factors such as increased consumption of processed foods disrupted gut microbiota, and stronger allergic reactions are contributing to the segment’s growth. Additionally, severe allergic reactions like anaphylaxis are more common among adults, intensifying the demand for comprehensive treatment options.

On the basis of the route of administration, the oral segment led the market in 2024 and is expected to reach USD 8.5 billion by 2034. Oral medications are favored for their convenience and affordability. Compared to injectables, they require less clinical oversight, resulting in higher patient compliance and lower treatment costs. These advantages have contributed to their wide adoption across both home care and clinical settings.

When segmented by end use, the market includes hospitals and clinics, home care settings, and others. Hospitals and clinics accounted for the highest revenue share in 2024 and are estimated to grow at a CAGR of 8% during the forecast timeline. These facilities offer specialized diagnostic tools and emergency response capabilities, making them essential for managing severe allergic reactions. Moreover, clinical programs and follow-up treatments available in hospitals support continuity of care, ensuring better management of long-term allergic conditions. Increased investment in healthcare infrastructure, particularly in emerging economies, is also fueling the growth of hospital-based allergy treatment services.

Regionally, North America dominated the global market with a commanding share of 42.6% in 2024. The region benefits from early diagnosis, strong healthcare infrastructure, and rising healthcare expenditure on allergy management. The market in the United States alone rose from USD 2.3 billion in 2023 to USD 2.5 billion in 2024, reflecting the heightened demand for personalized therapies and robust public health initiatives.

Europe followed with a market value of USD 1.7 billion in 2024 and is expected to show strong growth. Government-backed programs, advancements in treatment technology, and improved accessibility to biologics and precision therapies are enhancing the regional landscape. Strategic collaborations between pharmaceutical companies and public institutions are also playing a key role in driving innovation and ensuring better access to novel treatments.

The competitive landscape remains highly dynamic, led by major players such as Sanofi, Teva Pharmaceutical, Kenvue, Genentech, and Hal Allergy, who together accounted for nearly 60% of the market in 2024. These companies are focused on expanding their portfolios through acquisitions, product launches, and R&D initiatives. Meanwhile, regional and local firms continue to create competitive pressure by offering cost-effective solutions tailored to local demand.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- AdvaCare

- Aimmune Therapeutics

- Alerje

- ARS Pharma

- Camallergy

- Celltrion

- DBV Technologies

- Genentech

- Hal Allergy

- Kenvue

- Sanofi

- Stallergenes Greer

- Teva Pharmaceutical

Table Information

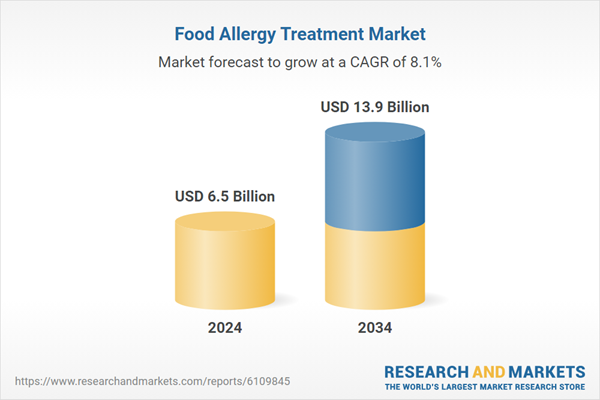

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 13.9 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |