The adoption of automated systems is rising as producers recognize the benefits of consistency in feeding routines, time savings in labor-intensive tasks, and enhanced animal welfare. Farmers are focusing on optimizing their resources, especially as livestock feed accounts for a large portion of operational expenses. Technological integration in equipment is not only helping reduce feed waste and labor costs but also supports better health management of animals through early disease detection and behavioral tracking. These innovations are reshaping how livestock operations are managed, pushing the market toward consistent growth over the next decade.

In terms of equipment type, feeding equipment held a dominant position, with the segment valued at USD 800 million in 2024. This category is projected to grow steadily and reach USD 1.3 billion by 2034. Equipment designed for feed management continues to see strong demand as it helps producers reduce feed loss and improve distribution efficiency. Automatic dispensers, precision feeders, and other feeding tools are being preferred due to their ability to support healthier animal growth and minimize feed waste, which remains one of the highest operational costs in livestock farming.

The market based on operation mode shows that semi-automated equipment accounted for approximately 44.5% of the global revenue share in 2024. This segment is expected to expand at a CAGR of 4.4% during the forecast period. These systems are becoming increasingly attractive to mid-scale and large-scale farmers who seek to strike a balance between automation and manual control. Their ability to offer improved operational speed, consistent performance, and reduced dependence on manual labor makes them an efficient alternative, especially in regions facing agricultural workforce shortages.

Distribution channels play a key role in determining product accessibility and service quality. In 2024, the direct distribution segment dominated the market with a share of around 64.9%. This model allows manufacturers to engage directly with end users, enabling better customization of equipment and providing the opportunity to address specific farming needs. It also supports real-time feedback collection, allowing manufacturers to adapt their offerings based on changing market dynamics. The direct channel also benefits logistics, ensuring quicker deliveries and smoother inventory flow, particularly during seasonal demand spikes.

Regionally, the United States held a strong presence in the global landscape, with the market valued at USD 360° million in 2024. The country is expected to see growth at a CAGR of 5.1% between 2025 and 2034. The U.S. livestock sector continues to expand, bolstered by modern farming infrastructure and rising demand for meat, milk, and wool. The availability of high-performance equipment tailored to U.S. farming practices contributes significantly to the industry’s upward trajectory.

North America as a whole is also witnessing steady progress, supported by policies that encourage sustainable agriculture and innovations in livestock management. The emphasis on responsible resource use and digital integration in farm equipment is strengthening the region’s position in the global market.

In this evolving market, manufacturers are concentrating on offering energy-efficient systems, enhanced durability, and tailored features that cater to the diverse requirements of sheep and goat farmers. There is also an increasing emphasis on after-sales services and regional support infrastructure. In emerging markets, demand is growing for cost-effective yet reliable equipment such as feeders, fencing units, electronic identification (EID) scales, and mobile handling systems. These priorities continue to shape the strategic direction of key industry participants as they expand their portfolios and cater to the needs of the global livestock community.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Allflex Livestock Intelligence

- Arrowquip

- Gallagher

- Heiniger

- IAE

- Kerbl

- Lister Shearing

- Premier 1 Supplies

- Priefert

- Ritchie Agricultural

- Stockpro

- Sydell Inc.

- Te Pari Products

- Tru-Test (Datamars)

- WOPA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 260 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

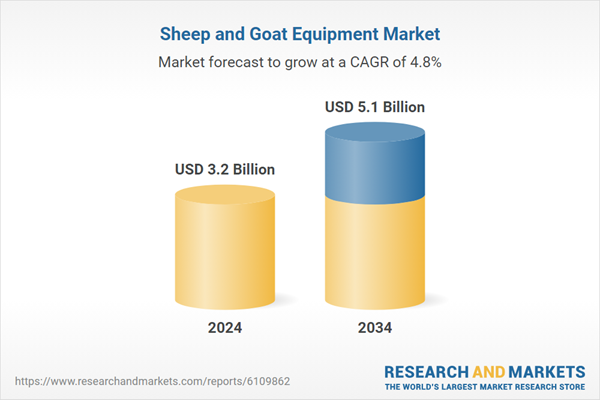

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |