These panels support better decision-making by processing data locally, reducing latency, and improving responsiveness compared to traditional cloud-dependent systems. Compact, modular architecture that allows seamless integration with smart home devices or scalable industrial frameworks is gaining momentum. The rising adoption of protocols like Zigbee, Bluetooth Low Energy (BLE), Z-Wave, and Wi-Fi boosts device interoperability, making smart panels a central hub for connected environments.

Cybersecurity concerns are also influencing product development, with manufacturers incorporating secure firmware updates, user authentication, and encrypted gateways to meet industry standards and protect grid infrastructure. The market’s steady expansion is being powered by a blend of technological advancements, user demand, and strategic investments.

A growing number of consumers are choosing smart panels to manage thermostats, lighting systems, and connected home appliances to improve energy efficiency and lower electricity bills. Households are prioritizing time-of-use management features and real-time consumption analytics to control usage patterns. In residential sectors, smart panels are evolving into all-in-one energy solutions, now offering compatibility with Level 2 electric vehicle charging infrastructure.

In commercial environments, integration with building energy management systems and HVAC setups is further propelling adoption. Businesses are increasingly reliant on smart panels for power monitoring and load balancing, particularly in high-demand settings. Construction firms and telecom operators operating across dispersed sites are also turning to remote monitoring capabilities enabled by these smart panels. This helps reduce downtime and enhance visibility across distributed assets, ultimately contributing to more streamlined operations and reduced costs.

The software component segment of the smart electric panel market was valued at USD 4.1 billion in 2024, driven by enhancing user experience. Cloud connectivity allows remote access, real-time analytics, and customized energy usage reports from virtually anywhere. The growing implementation of AI and machine learning software is transforming how energy is managed, enabling panels to learn user behavior and adjust circuit functions accordingly. Autonomous circuit optimization improves overall efficiency while reducing manual oversight, helping both residential and industrial users enhance reliability and reduce operational costs. Software advancements enable smarter energy forecasting and automated response to fluctuating grid demands.

The three-phase smart electric panels segment commanded a 56.1% share in 2024 due to their application in high-load facilities such as industrial plants, healthcare centers, and IT data hubs. These systems are favored for their ability to manage higher power requirements and deliver enhanced operational stability. Modern three-phase panels offer greater circuit flexibility and higher amperage ratings, which are essential in managing complex and heavy-duty electrical loads. As energy-intensive sectors increasingly adopt automated machinery and connected infrastructure, the need for robust, scalable electrical distribution systems continues to rise. Advanced diagnostic capabilities and fail-safe mechanisms embedded within these systems add another layer of value for facilities that cannot afford interruptions.

United States Smart Electric Panel Market was valued at USD 2.4 billion in 2024. The market is expected to expand further as more American households shift toward electrification. The increasing presence of electric vehicles, heat pump installations, and induction cooktops in homes is directly fueling the demand for intelligent panel upgrades. Utility companies are also promoting the adoption of smart panels through incentive programs aimed at achieving greater grid responsiveness and energy efficiency. These upgrades allow for two-way communication with the grid, facilitating load shifting and peak demand management, which are crucial to the energy transition.

Key manufacturers in the Smart Electric Panel Market include Siemens, Schneider Electric, Eaton, Rockwell Automation, Honeywell International, ABB, Emerson Electric, EcoFlow Technology, Accu Panels, General Electric, Leviton Manufacturing, Lumin, Hager Group, Qmerit Electrification, Legrand, Havells India, and Chint Group. Companies active in the smart electric panel industry are strengthening their presence through strategic R&D investments and technological integration.

Many are embedding AI, edge computing, and IoT compatibility into their panel designs to support real-time monitoring and energy automation. Product portfolios are expanding to include modular, scalable units that align with smart building trends and green energy goals. Firms are also focusing on cybersecurity features such as encrypted communications, secure firmware, and advanced access controls. To accelerate market penetration, key players are forming alliances with residential developers, utility providers, and automation system integrators.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- ABB

- Accu Panels

- Chint Group

- Eaton

- EcoFlow Technology

- Emerson Electric

- General Electric

- Hager Group

- Havells India

- Honeywell International

- Legrand

- Leviton Manufacturing

- Lumin

- Qmerit Electrification

- Rockwell Automation

- Schneider Electric

- Siemens

- SPAN

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | June 2025 |

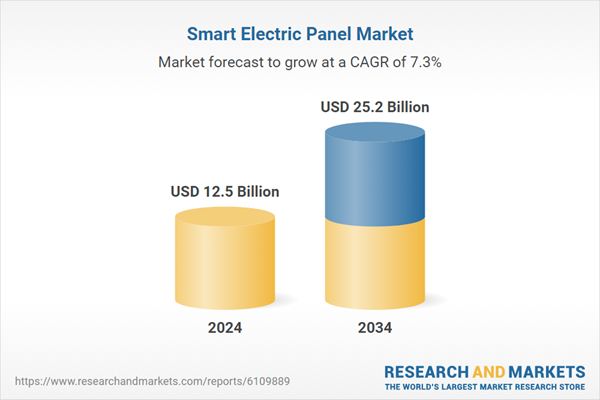

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 12.5 Billion |

| Forecasted Market Value ( USD | $ 25.2 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |