The material’s ability to withstand temperature fluctuations and provide reliable insulation positions it as a preferred choice in manufacturing environments that require longevity and resilience. As infrastructure spending rebounds globally, especially across Southeast Asia and parts of the Middle East, more projects are turning to industrial-grade rubber solutions for long-term efficiency. Meanwhile, the ongoing transformation of the automotive sector - particularly the shift toward electric and hybrid mobility - is expected to further strengthen demand for materials that deliver noise insulation, vibration control, and enhanced thermal management. As a result, vulcanized solid rubber is increasingly being adopted in advanced vehicle designs, supporting a surge in innovation and component integration within the industry. These evolving requirements are prompting suppliers to adapt by offering next-generation rubber formulations that are more sustainable, performance-oriented, and application-specific, further driving the market’s momentum.

In terms of product types, styrene-butadiene rubber (SBR) continues to dominate the global market landscape. This segment generated a revenue of USD 2.9 billion in 2024 and is forecasted to grow to USD 5.6 billion by 2034, registering a CAGR of 6.9% over the period. SBR’s popularity is driven by its cost-efficiency and exceptional mechanical performance, especially in high-friction and wear-intensive applications. Its abrasion resistance and aging stability make it highly suitable for use in components such as gaskets, seals, belts, and industrial pads. Additionally, the material blends well with natural rubber, improving its adaptability across different industries like automotive, footwear, and construction. This compatibility not only enhances its physical properties but also broadens its range of use cases, reinforcing its dominance in the market.

When segmented by application, the automotive and transportation sector accounted for the largest share of the global vulcanized solid rubber market in 2024, with a revenue contribution of 43.7%. The sector’s leadership is underpinned by the broad use of vulcanized rubber parts in vehicle components that demand heat resistance, oil tolerance, and stress durability. These characteristics make the material well-suited for use in engine mounts, underbody shields, floor liners, and noise-control systems. With electric vehicles gaining momentum, the industry’s reliance on rubber for non-structural yet critical components such as noise, vibration, and harshness (NVH) reduction systems is becoming more pronounced. The need for quieter cabins and thermal insulation in EVs is fueling innovation in rubber formulations and expanding their relevance across new mobility platforms.

Regionally, China emerged as a leading contributor, generating USD 2.3 billion in revenue in 2024 and is expected to reach USD 4.5 billion by 2034, growing at a CAGR of 6.9%. The country’s strong position is supported by its massive production capacity and ongoing shift towards innovation-led manufacturing. Despite rising raw material costs, local producers are ramping up efforts to develop high-performance rubber compounds that meet the quality expectations of global markets. China's emphasis on self-reliance and technological advancement is fostering greater adoption of value-added rubber products, enhancing its competitiveness on the international stage. Additionally, domestic consumption continues to rise steadily, supporting internal demand and driving long-term growth opportunities.

The global vulcanized solid rubber industry remains highly consolidated, with the top five market players accounting for over 40% of the total share. These companies maintain a competitive edge through vertical integration, comprehensive product offerings, and expansive manufacturing networks. Leading players are investing heavily in research and development to engineer advanced rubber compounds that are bio-based, low in volatile organic compounds (VOCs), and capable of withstanding longer life cycles under demanding conditions. Strategic acquisitions are also playing a significant role in shaping the market, with major companies expanding their footprint through targeted takeovers of niche compounders and joint ventures with regional producers.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Arlanxeo

- Bridgestone Corporation

- Continental AG

- Dow Inc.

- ExxonMobil Corporation

- Freudenberg Group

- Gates Corporation

- Goodyear Tire & Rubber Company

- JSR Corporation

- Kumho Petrochemical

- LANXESS AG

- Michelin

- Momentive Performance Materials Inc.

- NOK Corporation

- Parker Hannifin Corporation

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Trelleborg AB

- Wacker Chemie AG

- Zeon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | June 2025 |

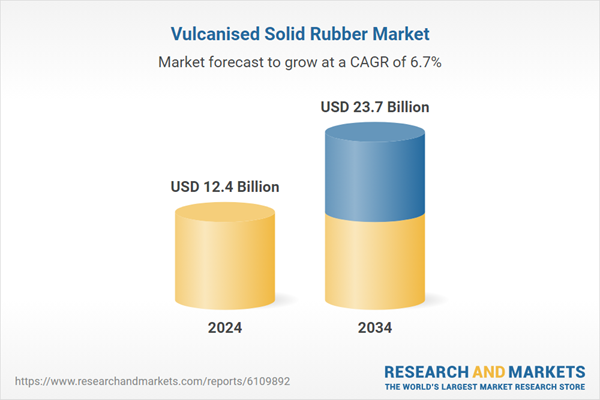

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 12.4 Billion |

| Forecasted Market Value ( USD | $ 23.7 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |