As more industries adopt drones to enhance operational efficiency and reduce costs, the demand for compact, dependable orientation sensors such as e-compasses continues to surge. These sensors play a crucial role in ensuring precise navigation and stable flight, especially in complex or GPS-limited environments. Their lightweight design allows drones to maintain optimal performance without compromising battery life or payload capacity, making them indispensable for a wide range of commercial applications - from aerial surveying and agriculture to infrastructure inspection and delivery services. This growing reliance on e-compasses to provide accurate directional data is fueling rapid market growth, as manufacturers and service providers seek advanced solutions that improve flight control, safety, and reliability.

The magneto-resistive-based segment is expected to grow at an impressive CAGR of 15.9% through 2034. These sensors are gaining traction due to their superior sensitivity and precision, making them ideal for industrial machinery and drone navigation where accurate heading detection is critical. Ongoing advancements in magnetic distortion correction and thermal stability continue to enhance their performance, broadening their adoption in sophisticated navigation systems.

Meanwhile, the 6-axis e-compass segment, combining a 3-axis magnetometer with a 3-axis accelerometer, is anticipated to register a CAGR of 14.9%. These compact systems are widely used in smartphones, wearable technology, and gaming devices, offering an excellent balance between size and functionality for orientation and motion sensing in consumer electronics.

U.S. E-compass Market held an 87.9% share in 2024. Growth in the region is propelled by cutting-edge developments in autonomous vehicles, consumer electronics, and military navigation technologies. Significant investment in research and development, alongside the widespread adoption of wearable and Internet of Things (IoT) devices, is fueling demand for e-compass modules integrated into AI-driven, GPS-independent navigation platforms.

Key players in the market include Allegro Microsystems, Asahi Kasei Microdevices, Bosch Sensortec, Althen, Honeywell, Lars Thrane, and Jewell Instruments, all competing to expand their influence through innovation and strategic partnerships. To solidify their foothold in the e-commerce market, companies are focusing on a blend of innovation, strategic alliances, and diversification.

Leading manufacturers invest heavily in R&D to improve sensor accuracy, reduce power consumption, and enhance thermal and magnetic distortion resistance. Collaborations with automotive, drone, and consumer electronics firms help integrate e-compass modules into emerging technologies like autonomous navigation and wearable devices. Expanding into untapped markets and broadening application segments, especially in industrial and military domains, is also a common approach.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Allegro Microsystems

- Althen

- Asahi Kasei Microdevices

- Bosch Sensortec

- Honeywell

- Jewell Instruments

- Lars Thrane

- Ricoh Imaging

- Rohm Semiconductor

- Shenzhen Rion Technology

- Skymems

- STMicroelectronics

- Truenorth Technologies

- Wuxi Bewis Sensing Technology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

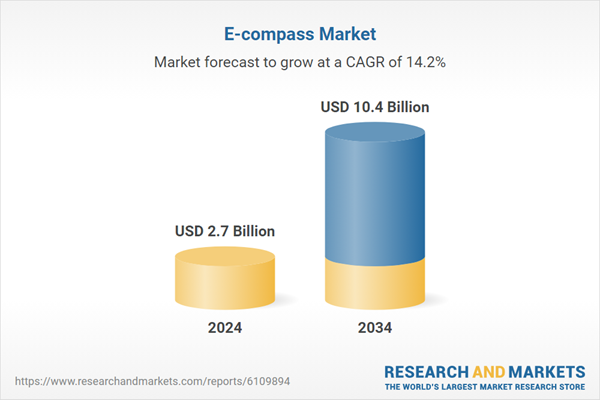

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 10.4 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |