The expansion of digital commerce platforms is also simplifying the supply chain, indirectly pushing the demand for automated, scalable poultry farming tools. Modern technologies designed to improve operational efficiency and animal welfare are gaining traction. Innovative solutions are being implemented to balance space efficiency and automation, supporting healthier bird-rearing conditions and optimized feeding systems. The trend toward precision farming and the push for higher productivity is reinforcing the shift toward more advanced equipment solutions. Enhanced comfort, sanitation, and automation within farming facilities are now becoming essential components of successful poultry operations, supporting a more sustainable and efficient poultry farming ecosystem.

In 2024, the feeding system segment generated USD 1.2 billion in 2024 and is anticipated to grow at a 4.7% CAGR throughout 2034. Automatic feeding solutions are rapidly being adopted by poultry producers looking to streamline operations and reduce manual labor. The use of timed distribution systems and precision-engineered hoppers is helping farmers control feed portions and optimize growth outcomes. Developments in precision feeding technologies are fostering further demand in this category. Increasing consumer concern for ethically raised poultry and growing regulatory standards around animal welfare are pushing the adoption of modern cage systems. These systems, combined with the increasing demand for high-quality environmental management within poultry houses, are driving the growth of advanced climate control technologies.

The commercial farming sector held a 79% share in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The global appetite for poultry products in large volumes pushes commercial operators to invest heavily in automated farming equipment. These advanced machines help reduce labor expenses and allow producers to meet demand more efficiently. As poultry becomes a key protein source across regions, commercial farms are prioritizing productivity, consistency, and hygiene, driving the continued reliance on smart and scalable solutions.

Europe Poultry Farming Equipment Market generated USD 0.8 billion in 2024 and is projected to grow at a CAGR of 4.2% through 2034. The expansion of commercial farms across the region is accelerating demand for durable and high-capacity equipment management operations at scale. Government support programs and policy initiatives promoting the adoption of innovative agricultural technology are also contributing to market expansion. These incentives are encouraging producers to embrace cutting-edge machinery to improve yield and efficiency, enabling them to cater to the evolving demands of the poultry sector.

Leading companies shaping the industry include SKA, Qingdao Huabo, Hellmann Poultry, Potters Poultry, Valco Industries, Zucami Poultry Equipment, Texha, Officine Facco, PEP Poultry Equipment Plus, AGICO, Roxell, Big Dutchman, Hightop, Tecno Poultry Equipment, and Tavsan. These key players are playing an instrumental role in pushing the market forward through product innovation and strategic growth. To enhance their position in the poultry farming equipment industry, top manufacturers are actively expanding product lines by integrating automation, energy efficiency, and animal welfare features into their equipment. Partnerships and collaborations with commercial poultry farms allow companies to tailor solutions to specific operational needs. Investment in R&D enables the development of user-friendly and precision-based technologies to improve farm management.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- AGICO

- Big Dutchman

- Hellmann Poultry

- Hightop

- Officine Facco

- PEP Poultry Equipment Plus

- Potters Poultry

- Qingdao Huabo

- Roxell

- SKA

- Tavsan

- Tecno Poultry Equipment

- Texha

- Valco Industries

- Zucami Poultry Equipment

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

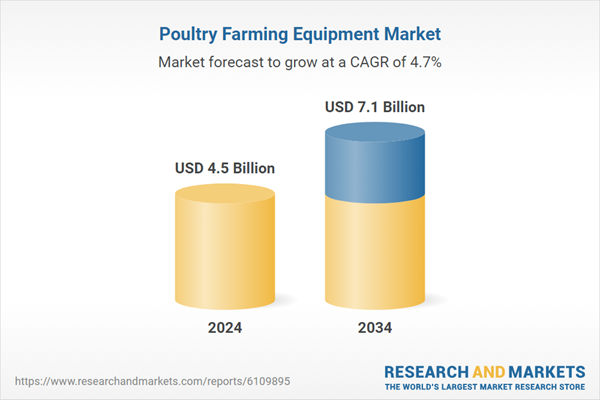

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |