This heightened demand is prompting manufacturers to enhance production capacity and efficiency through the deployment of advanced cotton processing equipment. Companies are channeling resources into R&D initiatives to bring to market solutions that reduce material waste, improve productivity, and ensure the consistent quality of processed cotton. Additionally, the rising shift toward automation and sustainable manufacturing is shaping the landscape of cotton processing operations, driving investments in smart technologies that align with environmental goals.

Among the various equipment types, the spinning equipment segment stood out with a market value exceeding USD 5.1 billion in 2024. It is anticipated to grow at a CAGR of 4.1% through the forecast period. This segment is experiencing strong momentum due to the rising focus on automated, efficient, and high-speed spinning systems. Manufacturers are increasingly integrating features like high-speed rotors, advanced ring spindles, and digital tools to optimize production.

These technologies are enabling real-time monitoring, predictive maintenance, and enhanced yarn output, leading to fewer breakdowns and better operational efficiency. The emphasis on digital transformation, coupled with the need for sustainability, is driving the evolution of spinning systems across large-scale production facilities. This transformation is also reshaping labor patterns, reducing the dependency on manual labor while simultaneously creating new roles in technical support and equipment maintenance.

In terms of operation mode, fully automatic machinery accounted for approximately 61% of the market share in 2024 and is forecast to grow at a CAGR of 3.7% between 2025 and 2034. The appeal of fully automatic cotton processing systems lies in their ability to deliver high-precision output while significantly lowering operational errors. These machines are proving essential for large-scale manufacturers aiming to enhance productivity while reducing labor costs.

The incorporation of intelligent technologies such as IoT, machine learning, and real-time data analytics is enhancing the functionality and output quality of these systems. As businesses seek to implement smart manufacturing strategies, the preference for fully automated systems is expected to intensify across key manufacturing hubs. In contrast, manual machinery continues to hold relevance in smaller, localized markets, particularly in regions where cost constraints or limited access to advanced infrastructure prevail.

On the basis of application, the textile industry remains the dominant consumer of cotton processing equipment and is expected to expand at a CAGR of over 3.7% during the forecast period. The continued growth of the global apparel and home furnishing sectors is generating strong demand for cotton-based products. A noticeable rise in consumer preference for eco-friendly and natural fibers is also propelling the consumption of cotton across both fashion and interior décor markets.

Beyond apparel, the medical sector is emerging as a consistent consumer of high-quality cotton products, including gauze, bandages, and surgical items. Increasing emphasis on hygiene and infection control in healthcare facilities has reinforced the need for advanced cotton processing systems that support the production of sterile and durable materials. This trend is encouraging manufacturers to adopt precision-based processing machinery tailored to the needs of the medical segment.

Regionally, the United States continues to dominate the North American market, holding 83% of the regional share and expected to reach USD 3.04 billion in 2024. The country benefits from being a major hub for both the import and export of cotton and cotton-related products. With growing demand for modern textile solutions and rising adoption of technologically upgraded machinery, the market for cotton processing equipment in the U.S. is experiencing consistent growth. Businesses in the country are focusing on investing in advanced systems that increase efficiency and align with shifting industry standards. Efforts to modernize infrastructure and boost output with minimal environmental impact are pushing demand for intelligent machinery.

Key players operating in this space are consistently investing in technological upgrades and collaborative partnerships to introduce more effective and adaptive solutions for customers. These strategies are not only improving product offerings but also enhancing the competitiveness of manufacturers across the global value chain. With evolving customer expectations and the steady push for smart, eco-conscious solutions, the cotton processing equipment market is poised to maintain a strong growth trajectory in the coming years.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Abel

- Continental Eagle

- Giannitsa Ginning Mills

- Kimbell Gin Machinery

- Lummus

- Mitsun

- Multipro Machines

- Muratec

- Rieter

- Sando Tech

- Saurer

- Savio

- Suntech Textile Machinery

- Tongda Group

- Trutzschler

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

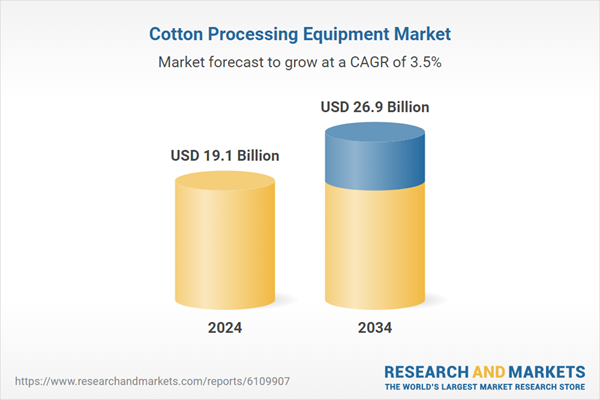

| Estimated Market Value ( USD | $ 19.1 Billion |

| Forecasted Market Value ( USD | $ 26.9 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |