A significant contributor to growth is the expanding autonomous vehicle landscape, including self-driving cars and unmanned aerial vehicles. These platforms require dependable orientation and navigation data in conditions where GPS signals may fail. The vibration resistance, high accuracy, and fail-safe design of FOGs make them indispensable in such use cases. While MEMS gyroscopes often serve low-cost needs, FOGs remain the premium standard for applications requiring reliability and redundancy. Companies are increasingly investing in FOG-assisted navigation to support scalable, all-weather functionality and to reduce risk in safety-critical systems.

In 2024, the 3-axis FOG segment generated USD 616.9 million. These systems offer integrated X, Y, and Z-axis sensing within a compact design that reduces weight and size. This benefits deployment in missiles, UAVs, autonomous vehicles, and next-gen flight systems. As defense organizations prioritize multi-axis navigation in hypersonic and advanced aerospace platforms, 3-axis FOGs are becoming more essential. The rise of electric vertical takeoff and landing aircraft and autonomous drones is also accelerating demand for these solutions, due to their altitude stability and precise control. Despite their upfront cost, the long-term reduction in maintenance costs compared to multiple single-axis gyros continues to drive adoption.

The FOG-based inertial navigation systems segment generated USD 558 million in 2024. These systems are critical in environments where GPS is unreliable or compromised. Military-grade aircraft, underwater vessels, and missile systems rely on FOG-based INS for jam-resistant and long-duration navigation performance. This demand also extends to the commercial sector, where urban autonomous vehicles, logistics drones, and smart air mobility solutions use FOGs for positioning in obstructed environments like tunnels or cityscapes.

Germany Fiber Optics Gyroscope Market was valued at USD 73.4 million in 2024. The nation’s robust automotive manufacturing and industrial automation sectors are key drivers. FOGs are being adopted in ADAS development and autonomous vehicle R&D programs for their high-precision motion sensing. Additionally, Germany's strong presence in aerospace and defense manufacturing, along with domestic companies focused on developing advanced navigation technologies, supports the country’s expanding footprint in this market.

Prominent market players include iMAR Navigation, KVH Industries, SkyMEMS, Optolink, Tamagawa Seiki, Advanced Navigation, Emcore, Exail, Safran, Mostatech, Northrop Grumman Litef, Cielo Inertial Solutions, Honeywell International, and Nedaero Components. Leading companies in the fiber optics gyroscope market focus on a blend of innovation, product differentiation, and long-term defense contracts to build their market presence. Many invest heavily in R&D to develop lighter, more compact multi-axis FOG units with enhanced stability and precision, making them suitable for integration into advanced aerospace, naval, and autonomous platforms. Strategic partnerships with government agencies and private defense contractors help secure repeat business. Some firms are also expanding their manufacturing footprint in regions with rising defense budgets.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Advanced Navigation

- Cielo Inertial Solutions

- Emcore

- Exail

- Honeywell International

- iMAR Navigation

- KVH Industries

- Mostatech

- Nedaero Components

- Northrop Grumman Litef

- Optolink

- Safran

- SkyMEMS

- Tamagawa Seiki

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2025 |

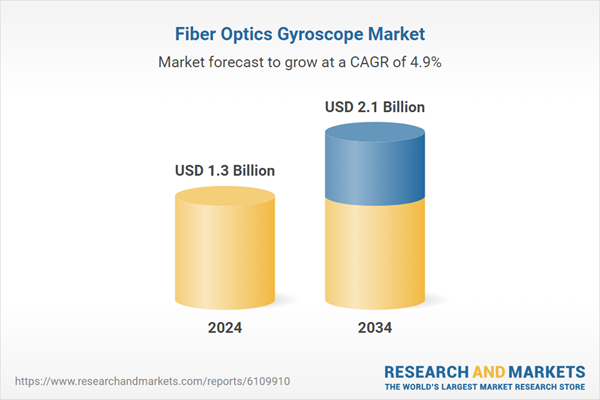

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 2.1 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |