Material evolution is a key market driver. While copper remains dominant due to its unmatched electrical conductivity, it adds considerable weight - leading manufacturers to explore alternative materials. Lighter options like aluminum are now being integrated to reduce cost and improve energy efficiency. Custom-engineered solutions using advanced composites are gaining popularity for their superior thermal control and mechanical durability, offering a performance boost across various EV applications. Additionally, tailored busbar systems are helping manufacturers minimize material waste and optimize vehicle architecture. The convergence of smart technology integration, next-gen production lines, and evolving OEM specifications is opening new doors for market expansion and innovation across the value chain.

As of 2024, the copper segment in the medium-power electric vehicle busbar market held a 70% share due to its superior conductivity and thermal management. Its ability to minimize energy loss makes it vital for enhancing EV battery performance, ensuring better range, and maintaining system integrity. These characteristics remain critical for automakers striving to balance vehicle efficiency, safety, and power delivery.

United States Medium Power Electric Vehicle Busbar Market USD 25.7 million in 2024. Federal and state-led policies to accelerate EV adoption, coupled with rising demand for advanced grid infrastructure, are pushing manufacturers to scale up. Medium power busbars are essential in optimizing EV power distribution networks, ensuring both charging efficiency and load balancing. As EV production scales, the demand for reliable, compact, and heat-efficient busbar systems is increasing rapidly.

Key companies in the Global Medium Power Electric Vehicle Busbar Market include Amphenol Corporation, Infineon Technologies AG, Brar Elettromeccanica SpA, Littelfuse, Inc., Mersen SA, Siemens, EMS Group, Legrand, Rogers Corporation, Mitsubishi Electric Corporation, TE Connectivity, Schneider Electric, EAE Group, EG Electronics, and Weidmüller Interface GmbH & Co. KG. Leading players in this space are advancing their market footprint through a combination of material innovation, design optimization, and global manufacturing expansion. Many are prioritizing the development of lightweight, high-performance alloys and composites to meet the evolving efficiency standards of next-generation EVs. Strategic joint ventures with automakers and battery manufacturers are helping secure long-term supply agreements. Companies are also boosting investments in automation and precision tooling to enable scalable, cost-effective production of complex, vehicle-specific busbar assemblies. In parallel, they are expanding R&D efforts focused on heat dissipation, smart diagnostics, and system integration to deliver value-added solutions tailored to OEM requirements.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Amphenol Corporation

- Brar Elettromeccanica SpA

- EAE Group

- EG Electronics

- EMS Group

- Infineon Technologies AG

- Legrand

- Littelfuse, Inc.

- Mersen SA

- Mitsubishi Electric Corporation

- Rogers Corporation

- Schneider Electric

- Siemens

- TE Connectivity

- Weidmuller Interface GmbH & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | June 2025 |

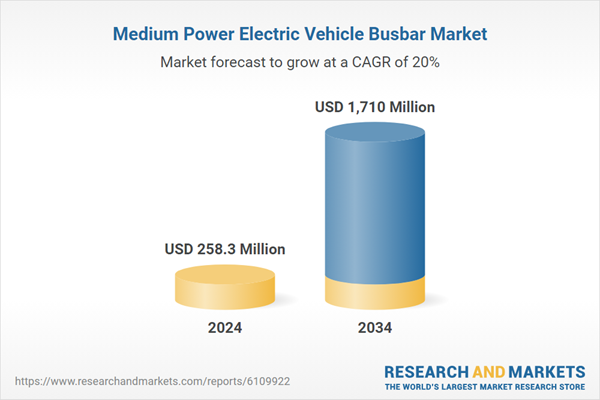

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 258.3 Million |

| Forecasted Market Value ( USD | $ 1710 Million |

| Compound Annual Growth Rate | 20.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |