Additionally, improvements in on-site waste treatment and a shift toward water-based drilling fluids, which produce less hazardous waste compared to traditional oil-based or synthetic muds, are influencing market dynamics. However, some oil-based drilling waste remains classified as hazardous by environmental authorities, leading to more complex and costly disposal requirements. This increasing environmental scrutiny is fueling a surge in innovation and attracting significant investment across industry.

Companies are motivated to develop advanced technologies and smarter solutions that not only meet but exceed regulatory demands. This push is encouraging the adoption of cutting-edge tools such as AI-driven analytics, real-time monitoring, and automated reporting systems. Investors recognize the long-term value in sustainable practices, directing capital toward firms that prioritize environmental compliance and operational efficiency. As a result, the industry is witnessing accelerated research and development efforts, strategic partnerships, and expanded product portfolios designed to address evolving environmental challenges while supporting business growth.

In 2024, the onshore operations segment captured a 62.3% share, driven by the expanding footprint of hydraulic fracturing across various emerging economies. These high-volume drilling activities result in significant amounts of drill cuttings, flowback fluids, and produced water - all of which require secure on-site containment solutions before any downstream processing or disposal. As drilling intensifies in resource-rich territories, the demand for scalable and compliant waste-handling systems is rising sharply. Operators are prioritizing investments in containment equipment and site-specific infrastructure to align with both environmental compliance and operational efficiency standards.

United States Containment & Handling Drilling Waste Management Market was valued at USD 93.5 million in 2024. The U.S. and Canada continue to face mounting pressure from rigorous federal and regional environmental regulations, particularly around emissions, water safety, and land use. Combined with heightened drilling activity in shale-rich formations, this regulatory environment has accelerated the shift toward advanced containment technologies and sustainable waste-handling frameworks. The region's focus on reducing ecological risks while maintaining production output further solidifies North America’s role in shaping global standards for drilling waste management practices.

Companies actively operating in this market include Baker Hughes, Schlumberger, Clean Harbors, Halliburton, GN Solids Control, Newpark Resources, TWMA, Derrick Equipment Company, Secure Energy Services, Imdex, Ridgeline Canada, Soli-Bond, Select Water Solutions, Weatherford, Augean, and NOV. To solidify their market position, leading players focus on expanding technological capabilities, including advanced on-site waste treatment and containment systems tailored to regulatory demands.

They prioritize compliance with evolving environmental standards by developing safer, more efficient handling solutions that reduce ecological impact. Strategic partnerships and acquisitions are common to broaden service offerings and geographic reach. Many companies invest in R&D to enhance product innovation, particularly around handling challenging waste streams like viscous or hazardous materials.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Augean

- Baker Hughes

- Clean Harbors

- Derrick Equipment Company

- Geminor

- GN Solids Control

- Halliburton

- Imdex

- Newpark Resources

- NOV

- Ridgeline Canada

- Schlumberger

- Secure Energy Services

- Select Water Solutions

- Soli-Bond

- TWMA

- Weatherford

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | June 2025 |

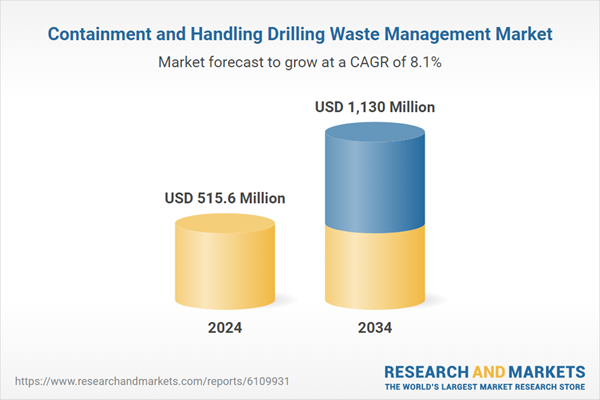

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 515.6 Million |

| Forecasted Market Value ( USD | $ 1130 Million |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |