Health-conscious consumers are prioritizing clean air, and air purifiers are becoming essential household appliances in both developed and developing regions. As awareness grows around the health risks associated with poor indoor air quality, such as respiratory infections, allergies, asthma, and long-term exposure to airborne pollutants, consumers are actively investing in solutions that ensure safer living environments. Urban dwellers are turning to air purifiers to combat the rising levels of pollutants caused by traffic emissions, industrial activity, and construction dust. In emerging economies, a growing middle class with increasing disposable income is driving demand for affordable yet efficient air purification systems.

The HEPA filters segment led the market at USD 6 billion in 2024 and is forecasted to grow at a 9% CAGR through 2034. These filters are renowned for their ability to capture ultra-fine particles like allergens, dust, and microscopic pollutants with 99.97% efficiency. Their superior filtration capability, including the ability to trap PM2.5 and other harmful pathogens, has made them the most sought-after component in residential and commercial air purifiers. HEPA-based systems are used widely in sectors where air quality control is vital, such as healthcare, hospitality, and education, further boosting demand. The random fiber arrangement in these filters makes them highly effective for removing airborne contaminants, making them an ideal choice for consumers seeking long-term indoor air solutions.

The indirect distribution segment held a 69.1% share in 2024 and is expected to grow at a CAGR of 8.3% throughout 2034. Consumers continue to prefer purchasing air purifiers through offline retail stores due to the ability to physically evaluate product features and performance before deciding. In-store demonstrations, face-to-face consultation with sales staff, and access to after-sales service are key drivers that reinforce trust and ease in the buying process. These channels also allow buyers to compare various models based on size, filter types, energy efficiency, and maintenance requirements. The tactile experience offered by retail environments fosters higher consumer confidence and encourages greater engagement with product features.

U.S. Air Purifier Market held an 88.8% share in 2024 and is projected to grow a strong 8.9% CAGR through 2034. Poor outdoor air quality caused by factors like urban smog and seasonal wildfires continues to influence consumer preferences. Households are increasingly turning to air purifiers to combat allergens, airborne viruses, and pollutant exposure indoors. Worsening conditions, such as frequent smoke-related air alerts and pollen surges, have heightened awareness and driven air purifier adoption across the country. In addition, an increasing number of Americans are willing to invest in smart appliances that support a healthier lifestyle, further supporting market expansion.

Key players involved in the market include 3M Co., AVVIR, Ahlstrom-Munksjo Oyj, Daikin Industries Ltd., Samsung Electronics, Freudenberg Group, Parker Hannifin Corp., Donaldson Co. Inc., IQAir, Camfil AB, Whirlpool Corporation, MAHLE GmbH, MANN+HUMMEL Group, DENSO Corp., and Cummins Inc. To strengthen their market footprint, leading air purifier manufacturers are investing in advanced filtration technologies and integrating smart features like real-time air quality monitoring, remote control, and app compatibility. Many are expanding their product lines to cater to both premium and budget-conscious consumers, while also focusing on sustainable filter materials and energy-efficient systems. Strategic partnerships with home appliance retailers and e-commerce platforms enhance distribution reach.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- 3M Co.

- Ahlstrom-Munksjo Oyj

- AVVIR

- Camfil AB

- Cummins Inc.

- Daikin Industries Ltd.

- DENSO Corp.

- Donaldson Co. Inc.

- Freudenberg Group

- IQAir

- MAHLE GmbH

- MANN+HUMMEL Group

- Parker Hannifin Corp.

- Samsung Electronics

- Whirlpool Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

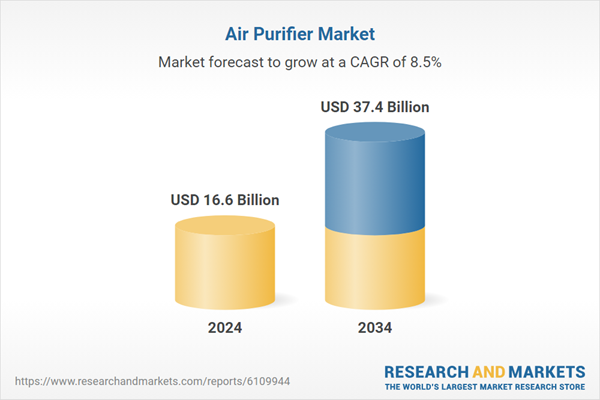

| Estimated Market Value ( USD | $ 16.6 Billion |

| Forecasted Market Value ( USD | $ 37.4 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |