Industries around the world are now increasingly aware of the advantages these modern instruments bring to complex land development and planning initiatives. These advanced surveying tools, such as GNSS receivers, robotic total stations, and 3D laser scanners, offer unmatched precision, faster data collection, and real-time analytics, helping reduce project timelines and eliminate costly errors. From infrastructure development and transportation planning to large-scale agricultural and mining operations, the ability to capture high-resolution spatial data in a fraction of the time has revolutionized how projects are initiated, managed, and executed. Sectors like construction, utilities, and energy are also turning to these innovations to streamline workflow, enhance accuracy in mapping and modeling, and comply with increasingly stringent regulations around safety and environmental impact.

In 2024, the total stations segment held a 34.04% share and is anticipated to hit USD 4.8 billion by 2034. Their integrated ability to measure angles and distances makes them highly valuable for high-precision work. Their versatility and cost-effectiveness make them a preferred tool across a range of sectors, particularly for transportation and urban infrastructure developments. Recent innovations such as GNSS compatibility, wireless connectivity, and robotic automation are streamlining workflow and expanding their capabilities.

Ground-based survey systems segment held a 62% share in 2024 and is expected to grow at a CAGR of 5% from 2025 to 2034. This category covers both traditional and contemporary land survey equipment like GNSS systems, levels, and total stations. Their adaptability, reliability, and accessibility make them suitable for a broad array of project scopes, particularly in sectors like construction and city planning. Ground-based surveys remain essential across high-growth markets in Asia and Europe, where large-scale urban infrastructure continues to drive demand.

U.S. Land Survey Equipment Market accounted for a 77.1% share in 2024, generating USD 2.61 billion. North America leads globally in adopting advanced land surveying systems, including AI-integrated analytics, 3D scanning technologies, and UAV-based survey tools. The U.S. market stands out for its fast embrace of digitalization, especially through initiatives in smart infrastructure and construction digitization. Companies like Hexagon and Trimble play a major role in shaping the region’s technological landscape by continually investing in product upgrades, research, and digital transformation to meet the growing need for real-time, high-accuracy data.

Key players shaping the Land Survey Equipment Industry include GeoTech, Hexagon, Topcon, Trimble, Stonex, DeepWell, FARO, Bosch Tools, Emlid Tech, and Shanghai Huace Navigation Technology. Companies in the land survey equipment market are investing significantly in R&D to create innovative, multi-functional, and high-accuracy solutions that cater to evolving industry demands. Many are integrating AI, IoT, and wireless technologies into survey equipment to enhance automation, real-time data processing, and cloud compatibility. Partnerships and strategic collaborations with construction and infrastructure firms are also key to expanding client bases. Players are emphasizing the development of compact, rugged, and mobile-friendly devices to address remote and urban survey challenges. Additionally, companies are localizing production and support services to better cater to regional markets while focusing on sustainability and long-term serviceability of equipment.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Aptella

- Baseline Equipment Company

- Bosch Tools

- DeepWell

- Emlid Tech

- FARO

- GeoTech

- Guangdong KOLIDA Instrument

- Hexagon

- Hi-Target

- Juniper Systems

- Seiler Instrument Company

- Shanghai Huace Navigation Technology

- South Surveying & Mapping Technology Company

- Spectra Geospatial

- Stonex

- Suparule Systems

- Teledyne

- Topcon

- Trimble

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

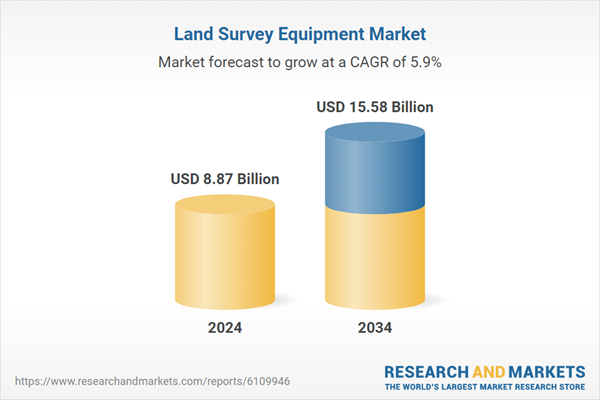

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 8.87 Billion |

| Forecasted Market Value ( USD | $ 15.58 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |