Another factor contributing to the market’s progress is the development of advanced dermatological drugs aimed at minimizing side effects while enhancing therapeutic outcomes. Pharmaceutical companies are focusing on new formulations, particularly topical and oral options, that improve ease of administration and efficacy. As awareness continues to grow about the impact of skin diseases on animal health, the market is witnessing greater acceptance of dermatology-specific medications. Additionally, the rise in skin infections among livestock and companion animals is pushing the need for early diagnosis and treatment, encouraging the widespread use of dermatology drugs across veterinary practices.

Veterinary dermatology drugs encompass a broad spectrum of treatments used to manage and cure skin disorders in animals, ranging from infections and inflammations to autoimmune skin conditions. These medications are typically categorized into several drug classes, including antibacterial, antifungal, antiparasitic, and anti-inflammatory drugs. These drugs are administered through multiple routes, such as oral, topical, and injectable, depending on the condition and the animal’s response to treatment.

In terms of drug class, antibacterial medications held the largest market share, reaching a value of USD 4.1 billion in 2024. The demand for antibacterial veterinary drugs is largely fueled by the increasing frequency of bacterial skin infections, particularly among companion animals. As these infections become more common, veterinarians are turning to more advanced antibacterial formulations and combination therapies to deliver effective results. The emergence of drug-resistant strains has also accelerated the need for stronger and more targeted antibacterial products. Furthermore, the rising awareness of these conditions and improvements in diagnostic capabilities have enabled early detection, contributing to the consistent dominance of this segment.

By indication, parasitic infections accounted for the largest market share, capturing 33.4% of the total in 2024. Skin conditions caused by parasites are among the most common dermatological issues in animals. Changes in environmental and climatic conditions are playing a role in the increased spread of parasitic diseases, particularly in tropical climates. In response, pharmaceutical companies are introducing long-acting antiparasitic drugs in both topical and oral forms. These new formulations focus on simplifying treatment routines while delivering lasting protection. Ongoing research and innovation in antiparasitic drug development, combined with favorable regulatory conditions, are supporting segment growth. Enhanced access through expanded distribution networks has also contributed to the segment’s strong performance.

Among the various routes of administration, oral drugs accounted for USD 5 billion in 2024 and are forecast to grow at a CAGR of 9% through 2034. Oral administration is widely preferred due to its systemic approach, which allows the drug to circulate through the bloodstream and tackle the root cause of skin issues. It also ensures better compliance, as animals tend to accept oral medications more readily than external applications. This high compliance rate contributes to consistent treatment results, which in turn drives demand in this segment.

Regionally, North America led the global veterinary dermatology drugs market, holding a 38.6% share in 2024. The market in the United States alone was valued at USD 3.8 billion that year, up from USD 3.5 billion in 2023. Growth in this region can be attributed to the presence of robust R&D capabilities and the steady introduction of improved drug formulations. The high volume of companion animals and the cultural emphasis on pet care are central to the region’s dominant market position. As pet owners continue to invest in premium healthcare solutions for their animals, the demand for dermatology drugs has followed suit.

Competition within the market remains strong, with numerous players striving to gain market share through targeted R&D, innovation in drug formulations, geographic expansion, and compliance with evolving regulatory standards. Companies are increasingly focusing on creating specialized products that meet the unique dermatological needs of animals, positioning themselves strategically within this rapidly growing sector.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Bimeda

- Bioiberica

- Boehringer Ingelheim

- Ceva Sante Animale

- Dechra Pharmaceuticals

- Elanco Animal Health

- Indian Immunologicals

- Merck & Co.

- Vee Remedies

- Virbac

- Vetoquinol

- Vivaldis

- Zoetis

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

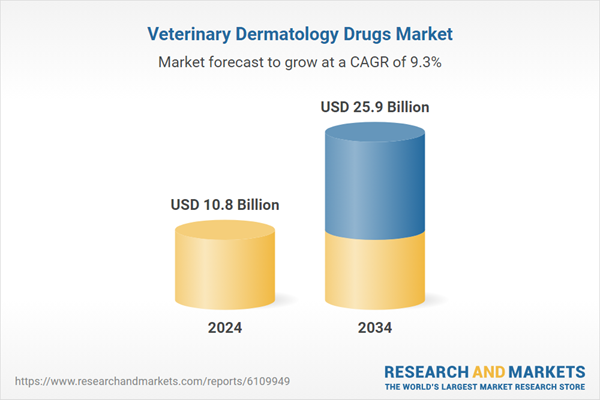

| Estimated Market Value ( USD | $ 10.8 Billion |

| Forecasted Market Value ( USD | $ 25.9 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |