Supportive regulatory initiatives and greater industry funding are further driving the adoption of virtual care services across pet and livestock health management. Governments and veterinary boards are increasingly establishing telehealth guidelines and policy frameworks that validate and support remote consultations. This has created a more stable legal and operational environment for veterinary telemedicine providers to grow. Additionally, the influx of investments from both the public and private sectors is accelerating the development of advanced digital platforms, AI-powered diagnostic tools, and integrated communication systems. These investments are not only enabling wider access to care for animal owners in remote or underserved regions but also encouraging veterinary practices to expand their service models.

The online consultation segment generated USD 425 million in 2024. Virtual platforms have become vital for pet owners seeking expert advice without geographic limitations. The ability to consult with veterinarians from any location is especially valuable in rural areas with limited in-person care options. Online appointments eliminate travel time and streamline veterinary access, helping owners respond more quickly to their animals' needs. This convenience, combined with rising digital literacy, continues to drive growth in this segment.

The software solutions segment held a 41.3% share in 2024. Cloud-based platforms offer numerous advantages, including real-time consultations, remote diagnostics, and continuous care tracking. These systems enable veterinarians to analyze data using integrated AI and machine learning tools, resulting in more accurate diagnoses and personalized treatment. Remote video calls, image sharing, and data integration into health records are transforming how pet healthcare is delivered. Both rural clinics and urban pet hospitals increasingly rely on software tools to bridge care gaps and enhance service efficiency.

U.S. Veterinary Telemedicine Market was valued at USD 233 million in 2024, driven by widespread access to high-speed internet and mobile technology. The country’s significant population of domestic animals and cultural attachment to pets contribute to the high demand for virtual veterinary care. A strong insurance and reimbursement ecosystem further supports the use of telehealth services. U.S. pet owners have both the financial means and the digital access required to engage with advanced mobility platforms, boosting the adoption of online veterinary tools such as video consultations, mobile apps, and virtual triage systems.

Prominent players in the Global Veterinary Telemedicine Industry include Airvet, Activ4Pets, Babelbark, FirstVet, GuardianVets, PawSquad, TeleTails, vetchat, VetTriage, Vetster, VitusVet, and Whiskers Worldwide. Leading veterinary telemedicine providers are investing in integrated digital ecosystems to strengthen their position in the market. By partnering with veterinary clinics and hospitals, they are embedding their platforms into day-to-day pet care operations.

Many companies are also developing AI-driven diagnostic features and expanding multilingual support to cater to global users. Subscription-based models are being introduced to ensure consistent user engagement, while mobile app enhancements continue to improve service accessibility. Firms are targeting underpenetrated rural markets by offering affordable plans and streamlined platforms. Cloud-based analytics and real-time data sharing are improving the accuracy of care, helping companies differentiate their offerings. Ongoing investment in R&D and customer-centric service models is helping players scale faster in a competitive landscape.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Airvet

- Activ4Pets

- Babelbark

- FirstVet

- GuardianVets

- PawSquad

- TeleTails

- vetchat

- VetTriage

- Vetster

- VitusVet

- Whiskers Worldwide

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | June 2025 |

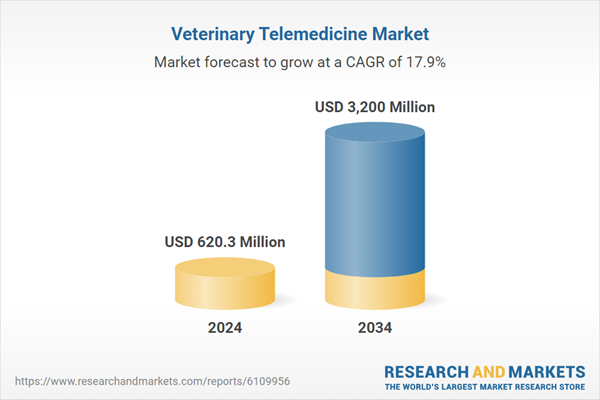

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 620.3 Million |

| Forecasted Market Value ( USD | $ 3200 Million |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |