Foot and ankle devices are specially engineered medical tools aimed at treating, supporting, and managing injuries and conditions affecting the foot and ankle regions. These devices are essential for addressing a wide spectrum of issues, from acute trauma like fractures and ligament tears to chronic disorders such as arthritis, deformities, and tendon dysfunction. They include implants, braces, orthotics, and fixation systems that restore mobility, stability, and structural integrity. Whether used in surgical settings or for conservative treatment, these products help alleviate pain, improve gait, and prevent further damage.

The orthopedic implants segment generated USD 3.4 billion in 2024. These implants are essential for repairing fractures, correcting deformities, and addressing worn joints. The increase in road accidents and falls, especially among elderly individuals, continues to push the demand for orthopedic implants designed specifically for foot and ankle injuries. Additionally, patients suffering from arthritis often require total ankle or subtalar joint replacements. Advanced tools like pre-shaped locking plates, absorbable screws, and modular surgical kits enhance surgical accuracy and reduce the likelihood of revision surgeries. This segment’s growth is further supported by the aging global population, which experiences higher rates of joint degeneration and fractures.

The trauma segment is projected to reach USD 4.2 billion by 2034. This segment’s dominance stems from the rising frequency of trauma incidents caused by road traffic accidents, sports injuries, and other physical activities that result in fractures, dislocations, and ligament damage. Many trauma cases require immediate surgical care, where devices such as screws, plates, and external fixators are critical for stabilizing bones and restoring mobility. Older adults, vulnerable due to osteoporosis and balance issues, face higher risks of fractures from minor falls, while younger, active individuals involved in high-contact sports or physically demanding jobs add to the demand for trauma-related products. The growing adoption of implants made from advanced, durable materials is expected to drive market growth further.

U.S. Foot and Ankle Devices Market was valued at USD 2 billion in 2024. The country’s substantial share is due to high rates of trauma and sports injuries, a well-developed healthcare infrastructure, and comprehensive insurance coverage for orthopedic treatments. The large populations of obese and diabetic individuals, prone to foot deformities and diabetic ulcers, increase the need for corrective surgeries. Moreover, the presence of prominent orthopedic manufacturers focusing on cutting-edge technologies like 3D-printed implants accelerates market development. The shift towards outpatient surgeries in ambulatory centers also boosts demand for both surgical and non-surgical foot and ankle care devices.

Key players in the Foot and Ankle Devices Industry include Acumed, Arthrex, DePuy Synthes (Johnson & Johnson), aap Implants Inc., Enovis, Medartis, Stryker, Smith+Nephew, Fillauer, Zimmer Biomet, Ottobock, CONMED, OSSUR, OrthoFix, VILEX, and ZIMMER BIOMET. Leading companies focus heavily on innovation, continuously developing new products that offer improved surgical outcomes and patient comfort. They invest in R&D to integrate advanced materials and technologies such as 3D printing and modular implant systems to meet diverse clinical needs. Strategic partnerships with healthcare providers and research institutions help facilitate product testing and market acceptance. Expanding geographic reach into emerging markets with growing healthcare infrastructure is also a priority to capture new demand. Companies enhance their competitive edge through acquisitions, enabling access to new technologies and product lines. Additionally, they emphasize education and training programs for surgeons to increase adoption rates.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- aap Implants Inc.

- acumed

- Arthrex

- CONMED

- DePuy Synthes (JnJ)

- enovis

- Fillauer

- medartis

- ORTHOFIX

- OSSUR

- ottobock

- Smith+Nephew

- stryker

- VILEX

- ZIMMER BIOMET

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

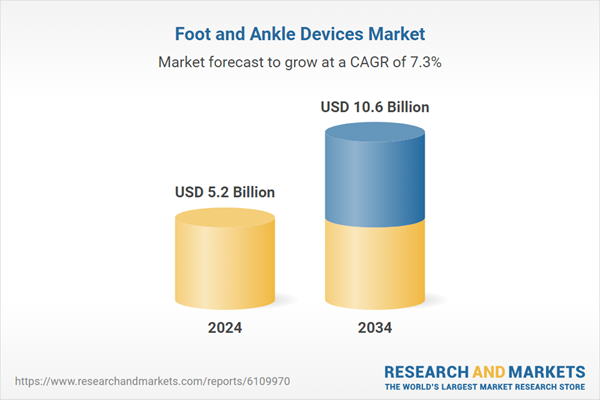

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 10.6 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |