Global Coal Trading Market - Key Trends & Drivers Summarized

Why Does Coal Trading Still Hold Strategic Value in the Global Energy Mix?

Despite the global shift toward renewable energy and decarbonization, coal trading continues to play a critical role in supporting energy security, especially in rapidly developing economies. Coal remains a key fuel for electricity generation, steel production, and industrial heating across numerous countries, including China, India, Indonesia, and South Africa. The international coal trade facilitates the movement of thermal coal for power utilities and metallurgical coal for steel mills, enabling supply-demand balancing between coal-producing and coal-consuming regions. With uneven geographic distribution of coal reserves, trading provides essential market access for energy-deficient nations. Additionally, fluctuations in domestic output due to weather, labor strikes, environmental regulations, or infrastructure constraints often lead nations to rely on imports, boosting global trade volumes. Seaborne coal trade, in particular, has become central to global supply chains, supported by extensive port and shipping infrastructure across Asia-Pacific, Australia, and the Americas. The demand for coal, while facing regulatory pressure in some regions, remains resilient in countries where economic growth and urbanization require affordable and reliable baseload power. Moreover, during periods of geopolitical tension or natural gas shortages, coal is often viewed as a fallback option due to its availability and lower price volatility. This dynamic was evident in recent years when energy crises and disruptions in LNG supply prompted several countries to ramp up coal imports. Thus, coal trading remains a strategically relevant activity in the broader energy landscape, bridging gaps in energy availability and supporting industrial stability.What Factors Influence Global Coal Pricing and Trade Volumes in an Evolving Market?

Coal trading is heavily influenced by a complex interplay of factors including global demand patterns, environmental regulations, transportation logistics, and macroeconomic shifts. Pricing is largely determined by market benchmarks such as the Newcastle Index, API 2 and API 4, which reflect the cost of coal delivered to key regions like Europe, China, and India. Supply dynamics in major producing countries such as Australia, Indonesia, Russia, and the United States have a direct impact on trade flows and prices. Weather events like heavy rains or floods can disrupt mining and transport operations, causing sudden supply shortages and price spikes. At the same time, demand surges driven by cold winters or summer heatwaves can accelerate power generation needs, triggering higher imports. Exchange rates, fuel substitution trends, and policy shifts also shape the economics of coal trade. For instance, rising carbon taxes or stricter emission standards in Europe have curbed thermal coal imports, while domestic policies in China influence import quotas and quality preferences. The type of coal traded, whether thermal or metallurgical, also determines market behavior, as steel-making industries depend heavily on the quality and calorific value of metallurgical coal. Logistics infrastructure, including rail networks and port capacities, plays a crucial role in determining trade efficiency and competitiveness. Freight rates, especially for bulk carriers, can significantly influence landed coal prices and determine sourcing decisions. Additionally, speculative trading, financial derivatives, and long-term contracts all affect short-term price movements and risk exposure for buyers and sellers. These diverse factors make coal trading a dynamic, globally interconnected activity that responds rapidly to both local events and international developments.How Is Technology Transforming the Efficiency and Transparency of Coal Trading Operations?

The adoption of digital platforms and advanced technologies is redefining coal trading by improving transaction efficiency, market transparency, and risk management. Traditional coal trade operations, which relied heavily on manual processes, paper documentation, and broker-mediated deals, are being modernized through the integration of electronic trading platforms and blockchain-based systems. These technologies enable faster deal execution, real-time pricing, and secure data sharing between multiple stakeholders, including miners, traders, shipping companies, and end-users. Blockchain, in particular, is being piloted to track coal shipments, validate certifications, and ensure contract compliance, reducing the risk of disputes and fraud. Additionally, data analytics and artificial intelligence are being used to forecast demand, assess market risks, and optimize supply chain logistics. Predictive models help traders anticipate market movements based on historical trends, weather patterns, regulatory announcements, and macroeconomic indicators. Automation is also streamlining back-office operations such as invoicing, reconciliation, and reporting, reducing operational costs and administrative delays. Furthermore, real-time vessel tracking and satellite data are being utilized to monitor shipping routes, assess delivery timelines, and adjust trading strategies dynamically. Environmental, Social, and Governance (ESG) considerations are also shaping the way coal trades are executed and evaluated. Platforms now provide ESG scoring and traceability tools to ensure that coal sourced aligns with sustainable and ethical guidelines. These technological developments are enabling traders to make faster, more informed decisions while meeting compliance standards and stakeholder expectations. As digitization deepens across the commodities sector, coal trading is undergoing a significant evolution in how deals are structured, executed, and monitored.What Are the Key Drivers Sustaining Global Demand and Investment in Coal Trading?

The growth in the coal trading market is driven by several factors rooted in regional energy strategies, industrial requirements, infrastructure capabilities, and market diversification. While there is a visible global shift toward renewables, many developing nations continue to rely on coal as a dependable and cost-effective energy source to support industrial growth and rural electrification. Coal-fired power plants, especially in South and Southeast Asia, are expanding to meet growing electricity demand, resulting in sustained import activity. Steel and cement industries, which have limited short-term alternatives to metallurgical coal, also contribute significantly to global trade flows. Countries with limited domestic coal production or poor mining infrastructure are turning to imports as a more economical and reliable option. The volatility in natural gas markets, driven by geopolitical factors and fluctuating LNG supplies, has made coal a fallback choice for many nations aiming to stabilize power grids. Port expansions and improvements in bulk transportation are enhancing the efficiency of coal shipments, making trade more accessible and cost-competitive. Meanwhile, traders and investors are diversifying their commodity portfolios by including coal to hedge against market uncertainties and take advantage of arbitrage opportunities. Flexible pricing mechanisms, including spot and long-term contracts, are making coal a more manageable component of energy procurement strategies. Additionally, some governments are relaxing coal import restrictions temporarily to address domestic energy shortages, giving short-term momentum to the trading sector. Financial institutions and commodity exchanges are offering structured products, futures, and hedging instruments that allow traders to manage price volatility more effectively. Despite increasing regulatory pressure, these practical drivers continue to sustain the relevance and resilience of coal trading in the global energy and industrial economy.Scope of the Report

The report analyzes the Coal Trading market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Lignite Coal, Sub-Bituminous Coal, Bituminous Coal, Anthracite Coal); Application (Power Generation Application, Cement Application, Steel Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lignite Coal segment, which is expected to reach US$39.4 Billion by 2030 with a CAGR of a 2.4%. The Sub-Bituminous Coal segment is also set to grow at 2.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $24.3 Billion in 2024, and China, forecasted to grow at an impressive 3.8% CAGR to reach $18.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Coal Trading Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Coal Trading Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Coal Trading Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adani Enterprises Ltd, Anglo American plc, Arch Resources, Inc., Banpu Public Company Limited, BHP Group Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Coal Trading market report include:

- Adani Enterprises Ltd

- Anglo American plc

- Arch Resources, Inc.

- Banpu Public Company Limited

- BHP Group Limited

- China Coal Energy Company

- China Shenhua Energy Co.

- Coal India Limited

- Commodities Trading Corporation

- Glencore plc

- Indika Energy

- Itochu Corporation

- JERA Co., Inc.

- Mercuria Energy Group

- Mitsubishi Corporation

- Noble Group Holdings Limited

- Peabody Energy Corporation

- PT Adaro Energy Indonesia

- SUEK (Siberian Coal Energy Company)

- Vitol Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adani Enterprises Ltd

- Anglo American plc

- Arch Resources, Inc.

- Banpu Public Company Limited

- BHP Group Limited

- China Coal Energy Company

- China Shenhua Energy Co.

- Coal India Limited

- Commodities Trading Corporation

- Glencore plc

- Indika Energy

- Itochu Corporation

- JERA Co., Inc.

- Mercuria Energy Group

- Mitsubishi Corporation

- Noble Group Holdings Limited

- Peabody Energy Corporation

- PT Adaro Energy Indonesia

- SUEK (Siberian Coal Energy Company)

- Vitol Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

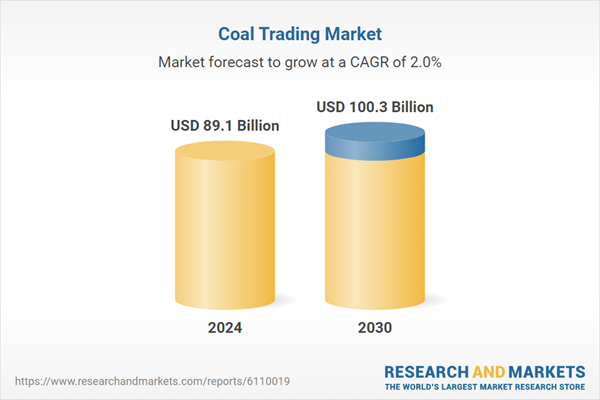

| Estimated Market Value ( USD | $ 89.1 Billion |

| Forecasted Market Value ( USD | $ 100.3 Billion |

| Compound Annual Growth Rate | 2.0% |

| Regions Covered | Global |