Global Multilayer Printed Circuit Boards Market - Key Trends & Drivers Summarized

Why Are Multilayer Printed Circuit Boards Becoming Indispensable in Advanced Electronics?

Multilayer printed circuit boards (PCBs), composed of three or more conductive copper layers embedded between insulating material, are emerging as critical enablers in the miniaturization and complexity of today’s electronic devices. These boards offer superior routing density, improved signal integrity, and greater reliability compared to single or double-layer alternatives, making them integral to sectors like aerospace, defense, telecommunications, medical electronics, automotive, and industrial automation. The surge in demand for compact, high-functionality electronics is propelling the deployment of multilayer PCBs in everything from smartphones and servers to electric vehicles and satellites.The ongoing evolution toward 5G networks, Internet of Things (IoT) ecosystems, artificial intelligence (AI) integration, and edge computing is creating a need for circuit boards that support higher interconnectivity, signal fidelity, and power management. Multilayer PCBs are ideally suited for these roles due to their ability to support differential signal routing, controlled impedance, and heat dissipation across densely packed components. Their multilayer architecture allows for optimized placement of ground and power planes, essential for reducing electromagnetic interference (EMI) and signal loss in high-frequency circuits.

What Are the Key Innovations Transforming PCB Design and Fabrication?

The multilayer PCB market is undergoing significant technological transformation fueled by advancements in materials, manufacturing techniques, and computer-aided design. High-performance base materials such as polyimide, PTFE (Teflon), and ceramic-filled laminates are being increasingly used to support high-speed digital and RF applications. These substrates provide high glass transition temperatures (Tg), low dielectric loss, and excellent thermal stability-key for applications in aerospace, defense, and high-end computing.Laser drilling and sequential lamination techniques have enabled the creation of high-density interconnect (HDI) multilayer PCBs, where microvias and via-in-pad designs drastically improve component density and electrical performance. The use of embedded components, buried vias, and stacked via structures is enhancing the compactness and functionality of modern multilayer boards. Moreover, hybrid multilayer PCBs that combine rigid and flexible substrates (rigid-flex PCBs) are gaining momentum in wearables, medical devices, and military-grade electronics, where space-saving and reliability are paramount.

Design software with integrated simulation capabilities, signal integrity analysis, and 3D modeling is improving layout efficiency and reducing prototyping errors. Concurrently, manufacturers are adopting digital twins and Industry 4.0 concepts in PCB fabrication facilities-utilizing automation, robotics, and AI-powered visual inspection to enhance throughput and defect detection. Sustainability is also becoming a core focus, with initiatives targeting halogen-free laminates, lead-free soldering, and waste minimization during etching and plating processes.

Which End-Use Industries and Regions Are Shaping Global Demand?

Consumer electronics remain the largest market for multilayer PCBs, primarily driven by the ever-evolving demand for thinner, faster, and more feature-rich devices like smartphones, tablets, laptops, smartwatches, and gaming consoles. Multilayer PCBs are critical in enabling compact system-on-chip (SoC) integration, high-speed memory interfaces, and complex signal routing within limited board real estate. The automotive sector is another significant adopter, where the proliferation of ADAS (Advanced Driver Assistance Systems), infotainment units, digital instrument clusters, and EV battery management systems is pushing demand for high-reliability multilayer designs.The medical electronics market is experiencing rising adoption of multilayer PCBs in diagnostic imaging systems, implantable devices, portable monitors, and robotic surgery platforms. These applications demand ultra-reliable, biocompatible, and high-density PCBs with stringent compliance requirements. Meanwhile, industrial applications such as machine vision systems, process automation controllers, and smart meters are leveraging multilayer PCBs to handle complex sensor arrays and communication protocols.

Asia-Pacific dominates the global supply and demand scenario, led by China, Taiwan, South Korea, and Japan-housing the world’s most advanced PCB manufacturing clusters and electronics assembly lines. North America and Europe remain key innovation hubs, especially in aerospace, defense, and high-performance computing. Emerging nations like India and Vietnam are attracting investments in PCB fabrication due to favorable manufacturing policies, low labor costs, and growing domestic electronics consumption.

What Is Fueling Growth in the Global Multilayer PCB Market?

The growth in the global multilayer printed circuit boards market is driven by several factors, including the proliferation of advanced electronics, the miniaturization of devices, and increasing system complexity across end-use sectors. As consumers and industries demand faster processing, better connectivity, and smarter interfaces, multilayer PCBs are becoming foundational to hardware architecture. Their ability to support high-speed signal transmission, power integrity, and EMI shielding positions them as indispensable in next-generation electronics.The rise of 5G infrastructure, automotive electrification, aerospace modernization, and medical device innovation is accelerating investments in high-layer count and HDI PCBs. Additionally, trends such as digital twins, autonomous systems, and smart factories are expanding the scope of PCB applications into new domains requiring robust, multilayer interconnects. Supply chain integration, collaborative design ecosystems, and advancements in material science are reducing design-to-deployment timelines and improving board functionality.

Global policy shifts around local semiconductor manufacturing, particularly in the U.S., EU, and India, are incentivizing domestic PCB production and boosting regional demand. Simultaneously, sustainability initiatives are pushing the development of recyclable boards and lead-free processes, expanding the appeal of multilayer PCBs in green electronics. As technology cycles shorten and innovation accelerates, the multilayer PCB market is expected to experience sustained and transformative growth.

Scope of the Report

The report analyzes the Multilayer Printed Circuit Boards market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Rigid PCBs, Standard Multilayer PCBs, HDI / Build-Up / Microvia PCBs, Flexible Circuits, IC Substrates, Other Products); Substance (Rigid Substance, Flexible Substance, Rigid-Flex Substance).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rigid PCBs segment, which is expected to reach US$31.6 Billion by 2030 with a CAGR of a 5.6%. The Standard Multilayer PCBs segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $24.3 Billion in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $23.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Multilayer Printed Circuit Boards Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Multilayer Printed Circuit Boards Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Multilayer Printed Circuit Boards Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AT&S Austria Technologie & Systemtechnik, Chin Poon Industrial Co., Ltd., CMK Corporation, Daeduck Electronics Co., Ltd., DLPCB Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Multilayer Printed Circuit Boards market report include:

- AT&S Austria Technologie & Systemtechnik

- Chin Poon Industrial Co., Ltd.

- CMK Corporation

- Daeduck Electronics Co., Ltd.

- DLPCB Co., Ltd.

- Eltek Ltd.

- HannStar Board Corporation

- Ibiden Co., Ltd.

- Jiangsu Suhan Circuit Co., Ltd.

- Kingboard Holdings Limited

- Meiko Electronics Co., Ltd.

- Nippon Mektron, Ltd.

- Olympic Circuit Technology Co., Ltd.

- Shennan Circuits Co., Ltd.

- Shinko Electric Industries Co., Ltd.

- Simmtech Co., Ltd.

- Tripod Technology Corporation

- TTM Technologies, Inc.

- Unimicron Technology Corporation

- Zhen Ding Technology Holding Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AT&S Austria Technologie & Systemtechnik

- Chin Poon Industrial Co., Ltd.

- CMK Corporation

- Daeduck Electronics Co., Ltd.

- DLPCB Co., Ltd.

- Eltek Ltd.

- HannStar Board Corporation

- Ibiden Co., Ltd.

- Jiangsu Suhan Circuit Co., Ltd.

- Kingboard Holdings Limited

- Meiko Electronics Co., Ltd.

- Nippon Mektron, Ltd.

- Olympic Circuit Technology Co., Ltd.

- Shennan Circuits Co., Ltd.

- Shinko Electric Industries Co., Ltd.

- Simmtech Co., Ltd.

- Tripod Technology Corporation

- TTM Technologies, Inc.

- Unimicron Technology Corporation

- Zhen Ding Technology Holding Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

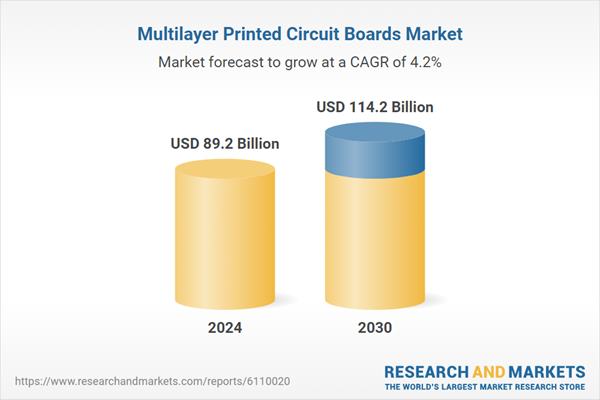

| Estimated Market Value ( USD | $ 89.2 Billion |

| Forecasted Market Value ( USD | $ 114.2 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |