Global Reusable Corrugated Plastic Boxes Market - Key Trends & Drivers Summarized

Why Are Businesses and Retailers Replacing Traditional Packaging with Reusable Plastic Boxes?

The shift from single-use cardboard packaging to reusable corrugated plastic boxes is gaining momentum as sustainability pressures, cost-efficiency targets, and supply chain durability concerns converge. In sectors such as agriculture, automotive, e-commerce, pharmaceuticals, and consumer goods, businesses are increasingly adopting reusable corrugated plastic packaging to minimize waste, extend packaging life cycles, and reduce operational disruptions. These boxes, typically made from polypropylene or polyethylene copolymers, offer durability, weather resistance, and structural integrity, allowing repeated usage across multiple logistics cycles.This transition is especially visible in closed-loop supply chains, where goods shuttle between distribution centers, production facilities, and retail outlets. In contrast to single-use corrugated fiberboard, reusable plastic boxes are impervious to moisture, chemicals, and mechanical wear-making them ideal for cold chain, bulk handling, and returnable transport packaging (RTP) systems. Enterprises aiming for ESG compliance and circular economy adoption are viewing plastic corrugated boxes not just as containers, but as long-term assets that contribute to measurable waste reduction and lifecycle savings.

How Are Design Innovation and Material Science Improving Functionality and Appeal?

Modern reusable corrugated plastic boxes are benefitting from innovations in structural design, material engineering, and recyclability. The use of twin-wall extruded polypropylene sheets has enhanced load-bearing capacity without significantly increasing weight. Features like interlocking mechanisms, ventilation holes, customized inserts, folding capabilities, and RFID tagging are becoming standard across reusable packaging SKUs, improving product protection, space optimization, and traceability throughout the supply chain.Advanced formulations now offer anti-UV, anti-static, and flame-retardant properties, expanding use cases in electronics, pharmaceuticals, and high-value goods. Moreover, design software tools allow manufacturers to create customer-specific configurations tailored to pallet dimensions, product fragility, and shipping routes. On the sustainability front, many suppliers are offering take-back schemes to recycle end-of-life boxes into new products. This closed-loop approach is being supported by investments in wash-and-sanitize infrastructure to extend product life while meeting hygiene requirements-especially in food and pharmaceutical logistics.

Which End-Use Markets and Regional Dynamics Are Accelerating Adoption?

The retail and grocery sectors are emerging as major adopters of reusable corrugated plastic boxes, driven by the need to minimize packaging waste and improve shelf-ready packaging efficiency. E-commerce fulfillment centers are also utilizing these boxes for internal order picking and returns handling, thanks to their ease of handling, stackability, and return logistics compatibility. In agriculture, reusable crates are increasingly used for transporting fruits, vegetables, and seafood, as they preserve freshness and prevent contamination during transit and storage.Geographically, Europe has taken a lead in adoption due to stringent packaging waste directives, high recycling targets, and established reverse logistics infrastructure. North America follows closely, with strong uptake in automotive and retail chains aiming to cut back on corrugated waste. Meanwhile, Asia-Pacific is witnessing rapid growth, particularly in China and India, as industrial and export packaging requirements evolve. Manufacturers and 3PL providers are also offering leasing models, making reusable boxes accessible to SMEs and seasonal operators in cost-sensitive markets.

What Market Forces Are Driving Long-Term Growth and Competitive Differentiation?

The growth in the reusable corrugated plastic boxes market is driven by several factors, including regulatory push for waste reduction, rising demand for durable packaging in multi-trip logistics, and brand emphasis on sustainability metrics. Extended Producer Responsibility (EPR) programs in various countries are mandating reduction in single-use packaging, prompting retailers and suppliers to invest in returnable packaging alternatives. The total cost of ownership (TCO) advantage-despite higher upfront cost-makes reusable boxes more viable over the long term, especially when integrated with digital tracking and pooling systems.Global brands are increasingly incorporating reusable packaging into their supply chain KPIs, often in collaboration with third-party logistics and pooling firms. Additionally, the shift toward automation in warehouses and fulfillment centers favors the use of standardized, rigid packaging like reusable plastic boxes that work seamlessly with conveyors and robotic pickers. As ESG disclosures gain investor attention, the ability to quantify packaging reuse, carbon footprint savings, and landfill diversion is strengthening the business case for reusable corrugated plastic boxes across industries.

Scope of the Report

The report analyzes the Reusable Corrugated Plastic Boxes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Foldable Boxes, Non-Foldable Boxes); Material (Polypropylene Material, Polyethylene Material, Polyvinyl Chloride Material, Other Materials); End-Use (Food & Beverages End-Use, Automotive End-Use, Consumer Durables End-Use, Healthcare End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Foldable Boxes segment, which is expected to reach US$7.6 Billion by 2030 with a CAGR of a 3.6%. The Non-Foldable Boxes segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.5 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Reusable Corrugated Plastic Boxes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Reusable Corrugated Plastic Boxes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Reusable Corrugated Plastic Boxes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alpha Packaging, Amatech Inc., CoolSeal USA, Coroplast LLC, DS Smith Plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Reusable Corrugated Plastic Boxes market report include:

- Alpha Packaging

- Amatech Inc.

- CoolSeal USA

- Coroplast LLC

- DS Smith Plc

- Flexcon Container, Inc.

- GWP Group Ltd.

- Inteplast Group Corporation

- Karton Spa

- Mondi Group

- Northern Plastics Ltd.

- ORBIS Corporation

- PalletOne Inc.

- Plasgad Ltd.

- Rehrig Pacific Company

- Returnable Packaging Services

- RTP Company

- Schoeller Allibert

- Shuert Technologies

- TranPak Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpha Packaging

- Amatech Inc.

- CoolSeal USA

- Coroplast LLC

- DS Smith Plc

- Flexcon Container, Inc.

- GWP Group Ltd.

- Inteplast Group Corporation

- Karton Spa

- Mondi Group

- Northern Plastics Ltd.

- ORBIS Corporation

- PalletOne Inc.

- Plasgad Ltd.

- Rehrig Pacific Company

- Returnable Packaging Services

- RTP Company

- Schoeller Allibert

- Shuert Technologies

- TranPak Inc.

Table Information

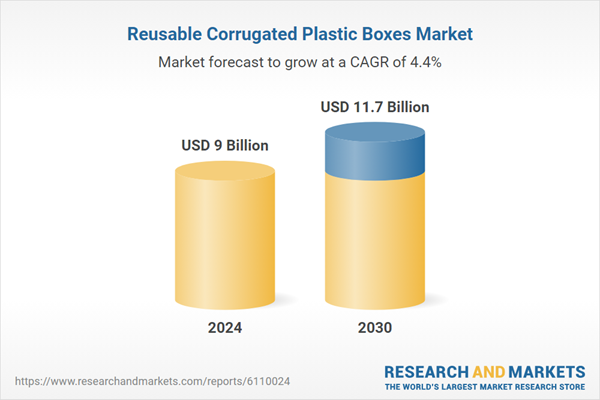

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9 Billion |

| Forecasted Market Value ( USD | $ 11.7 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |