Global Automotive Prognostics Market: Key Trends & Drivers Summarized

Why Is Prognostic Technology Redefining the Future of Vehicle Health Management?

Automotive prognostics are rapidly emerging as a pivotal technology in transforming vehicle health management from reactive and scheduled maintenance to predictive and condition-based care. At its core, prognostics involve the ability of a system to detect and evaluate the remaining useful life (RUL) of vehicle components and subsystems before failure occurs. This is achieved through advanced analytics, machine learning, and the continuous monitoring of real-time vehicle data, including sensor feedback, telemetry, and operational histories. Unlike traditional diagnostics that identify issues after they arise, prognostics focuses on identifying early signs of degradation or stress, thereby enabling preventive measures to avoid breakdowns. As vehicles become increasingly connected and software defined, the volume and quality of operational data available to prognostic models have improved substantially. Automakers are integrating dedicated prognostics control units into vehicle electronic architectures to track critical components such as batteries, brakes, engines, transmissions, and tire systems. These units work in tandem with cloud-based AI algorithms that compare in-vehicle conditions against large databases of failure signatures and usage patterns. Innovations in edge computing have also enabled vehicles to process prognostic insights locally, reducing reliance on cloud connectivity and enabling real-time responses. As a result, vehicle downtime can be significantly reduced, warranty claims minimized, and safety enhanced. This evolution is particularly valuable in commercial transportation, where unexpected maintenance can lead to costly operational disruptions. The continued development of automotive prognostics signals a fundamental shift in how vehicles are monitored, maintained, and managed throughout their lifecycle.Are Global Regulations and Industry Standards Keeping Pace with Prognostic Integration?

As automotive prognostics technology becomes more sophisticated and widely adopted, it is raising new regulatory and standardization challenges for governments and industry stakeholders alike. Unlike conventional vehicle systems, prognostics involves dynamic decision-making based on data analysis and algorithmic predictions, which introduces questions around transparency, accountability, and interoperability. Regulatory agencies are increasingly focused on ensuring that the integration of prognostic tools into vehicles does not compromise safety, privacy, or compliance with emissions and roadworthiness standards. In regions such as the European Union, there is growing momentum toward mandating open-access platforms that allow independent service providers and fleet operators to access and interpret prognostic data. Similarly, regulatory bodies in North America and Asia are exploring frameworks for validating the accuracy and consistency of prognostic predictions across different vehicle makes and models. Industry organizations such as ISO and SAE are working to develop common terminologies, performance benchmarks, and data formats to support the interoperability of prognostic systems across global markets. Another key area of focus is cybersecurity, as prognostic modules often require continuous connectivity to cloud services and external databases, increasing the risk of intrusion and data breaches. As a response, manufacturers are incorporating encrypted communication protocols and secure software updates into their prognostic platforms. Moreover, warranty and insurance sectors are beginning to align their policies with prognostic outcomes, demanding clear standards for how and when a vehicle is deemed at risk based on prognostic evaluations. While comprehensive global regulation is still evolving, the alignment between policymakers, OEMs, and standards bodies is strengthening, paving the way for safer and more regulated implementation of prognostic technologies.Which Sectors Are Leading the Real-World Application of Prognostics in Automotive Systems?

The adoption of automotive prognostics is gaining significant traction across a wide range of sectors, with commercial fleets, public transportation networks, and high-end passenger vehicles at the forefront of implementation. Fleet operators, in particular, stand to gain enormous value from prognostic systems by minimizing unplanned downtime, improving asset utilization, and lowering maintenance costs. By continuously monitoring engine performance, brake wear, fluid integrity, and electrical systems, fleet managers can schedule maintenance only when necessary, rather than relying on fixed service intervals. This data-driven approach helps optimize vehicle availability and extend component life, delivering substantial cost savings over time. Public transportation authorities are also leveraging prognostics to monitor the health of buses, rail vehicles, and electric transit systems, using insights to preempt mechanical failures that could disrupt service or endanger passengers. In the premium passenger vehicle segment, prognostic technology is being positioned as a luxury feature that ensures vehicle reliability, enhances the ownership experience, and protects resale value. Manufacturers are embedding prognostics into connected car ecosystems, offering users predictive alerts and maintenance scheduling through smartphone apps and digital dashboards. The technology is also making headway in electric and hybrid vehicles, where battery health and thermal management systems are critical to performance and safety. Even the automotive aftermarket is beginning to capitalize on prognostic capabilities, with repair shops and parts suppliers developing solutions that interface with OEM systems to deliver tailored maintenance plans and preemptive service offerings. Across each of these sectors, the application of automotive prognostics is redefining how vehicles are maintained and managed, marking a shift toward predictive, data-driven transportation ecosystems.What Market Forces Are Fueling the Expansion of Automotive Prognostic Solutions?

The growth in the automotive prognostics market is driven by several factors closely linked to advancements in vehicle connectivity, increasing electrification, and the evolving expectations of fleet operators and consumers. One of the key drivers is the proliferation of sensors and telematics systems in modern vehicles, which generate the continuous streams of data necessary to support robust prognostic models. The transition from internal combustion engines to electric powertrains has further amplified the demand for predictive monitoring, particularly for battery systems, which require constant oversight to ensure safety, efficiency, and longevity. As automotive hardware becomes more integrated with software platforms, manufacturers are increasingly investing in software-defined architectures that support real-time data analysis and remote diagnostics. The rise of mobility-as-a-service models and logistics platforms is accelerating the adoption of prognostic tools as these businesses rely heavily on asset uptime and efficient maintenance scheduling. Fleet operators are particularly receptive to prognostics due to its ability to reduce total cost of ownership and maximize operational efficiency. Additionally, there is growing pressure from regulatory bodies and environmental agencies to maintain vehicle performance and emissions within legal thresholds, a challenge that prognostics is well positioned to address through early fault detection and timely maintenance alerts. The expansion of over-the-air (OTA) update capabilities has made it easier for OEMs to refine prognostic algorithms and extend system functionality throughout the vehicle lifecycle. Furthermore, rising consumer demand for convenience, reliability, and real-time support is pushing automakers to embed predictive maintenance features into connected car offerings. These collective forces are shaping a fast-growing, innovation-driven market for automotive prognostics, one that is becoming increasingly integral to the future of intelligent mobility.Report Scope

The report analyzes the Automotive Prognostics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles); Application (Battery Application, Engine Application, Power Steering System Application, Suspension System Application, On-Board Monitoring & Diagnostics Application); End-Use (OEMs End-Use, Aftermarket End-Use, Fleet Operators End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars segment, which is expected to reach US$13.5 Billion by 2030 with a CAGR of 14.8%. The Light Commercial Vehicles segment is also set to grow at 16.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.2 Billion in 2024, and China, forecasted to grow at an impressive 19.8% CAGR to reach $3.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Prognostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Prognostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Prognostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aptiv PLC, Bosch Mobility (Robert Bosch GmbH), Cloudera Inc., Continental AG, Cummins Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 26 companies featured in this Automotive Prognostics market report include:

- Aptiv PLC

- Bosch Mobility (Robert Bosch GmbH)

- Cloudera Inc.

- Continental AG

- Cummins Inc.

- Denso Corporation

- Garrett Motion Inc.

- General Motors Company

- Harman International

- Hitachi Astemo, Ltd.

- Honeywell International Inc.

- IBM Corporation

- KPIT Technologies Ltd.

- Nauto, Inc.

- NEXYAD

- OnBoard Security (A Qualcomm Company)

- PTC Inc.

- SAS Institute Inc.

- Siemens Digital Industries

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aptiv PLC

- Bosch Mobility (Robert Bosch GmbH)

- Cloudera Inc.

- Continental AG

- Cummins Inc.

- Denso Corporation

- Garrett Motion Inc.

- General Motors Company

- Harman International

- Hitachi Astemo, Ltd.

- Honeywell International Inc.

- IBM Corporation

- KPIT Technologies Ltd.

- Nauto, Inc.

- NEXYAD

- OnBoard Security (A Qualcomm Company)

- PTC Inc.

- SAS Institute Inc.

- Siemens Digital Industries

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 524 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

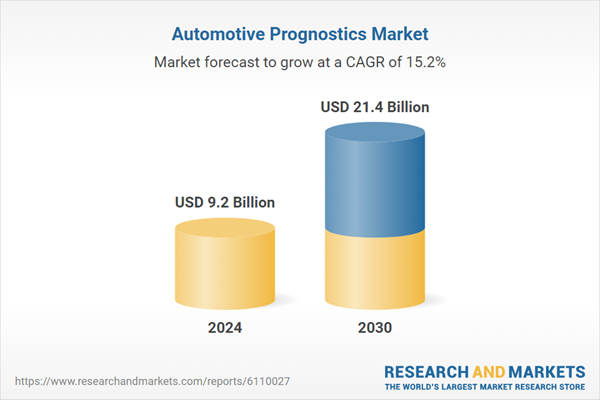

| Estimated Market Value ( USD | $ 9.2 Billion |

| Forecasted Market Value ( USD | $ 21.4 Billion |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | Global |