Global Peanuts Market - Key Trends & Drivers Summarized

Why Are Peanuts Gaining Momentum Across Diverse Global Food Chains?

Peanuts, long regarded as a staple in several regional diets, are undergoing a resurgence as both a mainstream commodity and a value-added ingredient in processed food markets. Also known as groundnuts, peanuts are botanically legumes but nutritionally and economically considered oilseeds due to their high fat content. They are consumed in various forms-from raw and roasted kernels to peanut butter, confectionery pastes, and peanut oil. Global peanut production is expanding rapidly due to shifting dietary preferences, food security concerns, and strong demand from both emerging and developed markets.Major consuming regions like Asia and Africa continue to use peanuts as an affordable protein source, particularly in lower-income segments. However, in Western markets, peanuts are being rebranded as a clean-label, plant-based, protein-rich ingredient aligned with health and wellness trends. They are increasingly featured in high-protein snack bars, sports nutrition products, non-dairy spreads, and gluten-free formulations. The popularity of peanut butter in North America and Europe continues to grow, driven by demand from children, fitness-conscious consumers, and bakery manufacturers.

In parallel, the global supply chain for peanuts is becoming more integrated and export-oriented. Countries such as the United States, India, China, Argentina, and Sudan dominate production, while import demand is rising in Europe, Japan, and Southeast Asia. Peanuts are also becoming vital to emergency food programs due to their nutrient density and long shelf life. Ready-to-use therapeutic foods (RUTFs) made with peanut paste are key components in UNICEF and WHO malnutrition treatment kits-further embedding peanuts into global food security strategies.

What Technological and Agronomic Advances Are Shaping Peanut Production?

The modernization of peanut cultivation is being accelerated by a combination of advanced breeding programs, precision agriculture, and post-harvest technologies. High-yielding, drought-resistant, and pest-resistant cultivars are being developed by research institutions and seed companies to improve productivity and reduce crop losses. Varieties with higher oleic acid content are also gaining traction, as they offer better flavor stability and longer shelf life, which are critical for exports and processed applications.Mechanization of sowing, irrigation, and harvesting is improving operational efficiency in large-scale farms, particularly in the U.S., Argentina, and China. GPS-guided tractors, drip irrigation systems, and real-time soil monitoring tools are being adopted to improve resource utilization and reduce environmental impact. In smallholder-dominated regions such as India and sub-Saharan Africa, mechanization remains limited but is supported by government schemes and non-profit initiatives aimed at boosting yields and minimizing labor dependency.

Post-harvest handling and storage are seeing innovation as well. Technologies to minimize aflatoxin contamination-a serious concern in tropical climates-are being implemented, including low-moisture storage units, UV sorting, and mycotoxin testing kits. Furthermore, shelling, blanching, roasting, and flavor-coating lines are increasingly automated in processing facilities, allowing for consistent quality in snack food and export-oriented peanut kernels. These technological shifts are positioning peanuts as a traceable, processable, and scalable agricultural commodity.

Which End-Use Applications and Regional Markets Are Fueling Demand Growth?

The end-use diversity of peanuts spans food, edible oil, animal feed, confectionery, and therapeutic nutrition. Food-grade peanuts are used in snacks (roasted, salted, spiced), peanut butter, granola bars, trail mixes, cookies, and protein-rich breakfast cereals. The surging demand for plant-based foods and clean-label protein is driving innovation in peanut-based dairy alternatives, meat analogs, and ready-to-drink nutrition beverages. Peanut flour and protein isolates are also gaining momentum in sports nutrition and specialty food markets.Peanut oil, extracted from lower-grade or oilseed-type peanuts, is widely used for deep frying and salad dressing, especially in Asian cuisine. With a high smoke point and neutral taste, it remains popular in China, Southeast Asia, and parts of West Africa. Meanwhile, peanut cake and meal, the residual byproduct after oil extraction, is a valued protein supplement in livestock feed, contributing to the circularity of peanut value chains.

Regionally, China remains the world’s largest producer and consumer, with substantial volumes used domestically for both direct consumption and oil extraction. India, while a major producer, also exhibits strong domestic demand and is focusing on boosting exports of premium-quality peanuts. The United States dominates in shelled peanut and peanut butter exports, particularly to Canada, Europe, and Japan. African nations such as Nigeria, Senegal, and Sudan are focusing on value-added exports and improved traceability to access premium markets. Meanwhile, EU countries are showing rising demand for non-GMO, sustainably sourced peanuts in health food and snack applications.

What Factors Are Driving Growth in the Global Peanuts Market?

The growth in the global peanuts market is driven by rising consumer demand for affordable plant-based protein, expansion of peanut-based processed foods, advancements in farming and processing technologies, and increasing global trade and food aid flows. As populations grow and dietary preferences evolve toward nutrient-dense, protein-rich, and allergen-managed ingredients, peanuts are emerging as a versatile and economically viable solution.The health and wellness movement continues to drive innovation in peanut-based products. With consumer preference shifting toward protein bars, natural nut butters, and fortified snacks, food manufacturers are introducing novel peanut formulations-low-sugar, high-protein, organic, and even functional variants with added probiotics or collagen. The price advantage of peanuts over almonds or cashews makes them a preferred base for affordable nutritious products in middle-income and developing economies.

On the supply side, improvements in seed technology, irrigation efficiency, and aflatoxin mitigation are enhancing both yield and quality. Government policies supporting oilseed crop diversification, farmer incentives, and export facilitation are also contributing to increased cultivation acreage and trade flow. Furthermore, the expansion of peanut processing capacity in countries like China, India, and the U.S. is creating integrated supply chains that span from farm to fork. With rising global food security challenges, the high caloric value and storability of peanuts ensure that their relevance in both commercial and humanitarian markets will remain strong.

Scope of the Report

The report analyzes the Peanuts market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Single Segment.

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $23.9 Billion in 2024, and China, forecasted to grow at an impressive 3.5% CAGR to reach $18.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Peanuts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Peanuts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

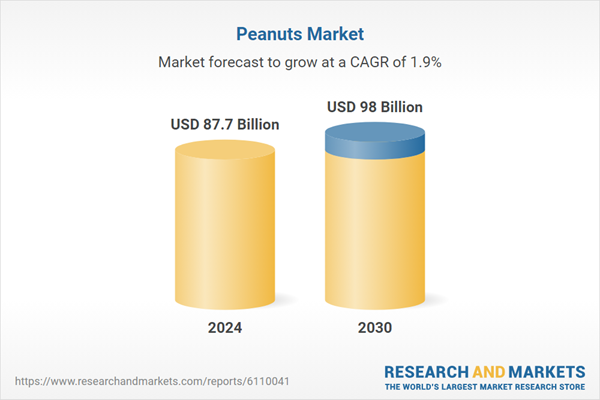

- How is the Global Peanuts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A. L. Bazzini Co. (Bazzini), Agrocrops, Associated British Foods, B.G.I. Genomics, Conagra Brands and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Peanuts market report include:

- A. L. Bazzini Co. (Bazzini)

- Agrocrops

- Associated British Foods

- B.G.I. Genomics

- Conagra Brands

- Duyvis (PepsiCo-owned)

- Eurofins Scientific

- Hormel Foods (Planters)

- J.M. Smucker Co.

- Kellogg Company

- KP Snacks (KP Nuts)

- Kraft Heinz

- Leavitt Corporation (Teddie)

- Mondelez International

- PepsiCo (Duyvis)

- Planters (Hormel Foods)

- Smucker

- The Leavitt Corporation (Teddie)

- Tiger Brands (Black Cat)

- Unilever

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A. L. Bazzini Co. (Bazzini)

- Agrocrops

- Associated British Foods

- B.G.I. Genomics

- Conagra Brands

- Duyvis (PepsiCo-owned)

- Eurofins Scientific

- Hormel Foods (Planters)

- J.M. Smucker Co.

- Kellogg Company

- KP Snacks (KP Nuts)

- Kraft Heinz

- Leavitt Corporation (Teddie)

- Mondelez International

- PepsiCo (Duyvis)

- Planters (Hormel Foods)

- Smucker

- The Leavitt Corporation (Teddie)

- Tiger Brands (Black Cat)

- Unilever

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 87.7 Billion |

| Forecasted Market Value ( USD | $ 98 Billion |

| Compound Annual Growth Rate | 1.9% |

| Regions Covered | Global |