Global Main Automation Contractor (MAC) in Oil and Gas Industry Market - Key Trends & Drivers Summarized

Why Are Oil and Gas Operators Turning to Main Automation Contractors (MACs)?

In the complex, capital-intensive oil and gas (O&G) industry, Main Automation Contractors (MACs) have emerged as strategic partners for end-to-end automation integration, project risk reduction, and lifecycle support. MACs are responsible for planning, designing, procuring, and implementing automation systems across upstream, midstream, and downstream operations. As greenfield and brownfield projects increase in scale and complexity-particularly in offshore platforms, LNG plants, and petrochemical refineries-the role of MACs becomes central in ensuring interoperability, schedule adherence, and system reliability.The conventional segmented approach to automation procurement-where multiple vendors and integrators deliver siloed solutions-often leads to fragmented systems, delayed timelines, and higher total cost of ownership. MACs mitigate these issues by serving as single-point accountability providers who integrate distributed control systems (DCS), safety instrumented systems (SIS), field instrumentation, cybersecurity frameworks, and communication protocols into a cohesive automation strategy. This turnkey model reduces vendor coordination burden for project owners and aligns automation with plant performance goals from day one.

How Are MACs Supporting Digital Transformation and Energy Transition in the Sector?

MACs are increasingly tasked with driving digitalization in oil and gas projects by incorporating advanced automation, industrial IoT, remote operations, and analytics-ready architectures into new and existing facilities. They are deploying edge computing devices, cloud platforms, and wireless sensor networks to enable predictive maintenance, real-time data visualization, and operational insights across wellheads, pipelines, and processing plants. The convergence of operational technology (OT) with information technology (IT) is being orchestrated by MACs to deliver digital twins, AI-powered diagnostics, and centralized command centers.As oil and gas operators aim to decarbonize and align with ESG goals, MACs are integrating emissions monitoring, energy management systems, and intelligent control platforms that reduce flaring, optimize fuel usage, and detect leaks. In LNG and offshore platforms, MACs are facilitating autonomous operations and unmanned asset management strategies to reduce human exposure and operating costs. Moreover, the rise of green hydrogen and carbon capture projects is creating new opportunities for MACs to define automation standards in nascent energy transition infrastructures.

Standardization is a key benefit MACs bring to long-term asset lifecycle planning. They develop comprehensive automation libraries, function blocks, and modular templates that simplify future upgrades, ensure consistency across assets, and reduce the learning curve for operators. Their ability to interface with legacy systems while preparing for scalable digital upgrades positions them as critical enablers of long-term operational resilience in the evolving energy landscape.

Which Project Types and Regional Markets Are Driving MAC Engagement?

MACs are most commonly engaged in mega projects such as deepwater exploration rigs, refinery expansions, LNG terminals, and integrated petrochemical complexes. In upstream operations, MACs provide automation for well monitoring, enhanced oil recovery (EOR), and artificial lift systems. Midstream pipelines and storage facilities benefit from centralized SCADA integration, cybersecurity architecture, and leak detection systems provided by MACs. Downstream, MACs automate distillation, cracking, blending, and quality control processes to ensure safety, compliance, and output consistency.The Middle East remains the most active region for MAC engagements, led by massive projects in Saudi Arabia, UAE, and Qatar. National oil companies (NOCs) are awarding long-term automation framework contracts to MACs for new build and modernization efforts. North America continues to see MAC involvement in shale oil operations, refining optimization, and LNG export terminals. Asia-Pacific-particularly China, India, and Southeast Asia-is ramping up automation in new refineries and pipelines. Africa and Latin America are emerging markets where MACs are supporting national energy infrastructure projects with end-to-end automation delivery.

Top MAC players include ABB, Honeywell, Emerson, Yokogawa, and Siemens, each offering tailored automation solutions, project execution capabilities, and global support networks. MAC selection is increasingly based on domain expertise, digital solution maturity, cybersecurity credentials, and ability to manage cross-vendor system integration. Clients seek partners who can deliver within stringent timelines, manage supply chain volatility, and provide lifecycle support for decades-long asset operations.

What Is Fueling Growth in the MAC Services Market Within Oil and Gas?

The growth in the global MAC market in the oil and gas industry is driven by several factors, including the rising complexity of automation needs, increasing emphasis on digital transformation, and growing reliance on integrated project delivery models. As energy companies navigate operational efficiency, safety, and sustainability imperatives, MACs offer unified solutions that streamline execution, reduce lifecycle costs, and prepare assets for the digital future.The need for standardization, regulatory compliance, and future-proof automation architectures is encouraging asset owners to opt for centralized automation contracting. MACs offer the technical depth, vendor neutrality, and project discipline necessary to orchestrate disparate systems and drive consistent performance. Their ability to offer cybersecurity, IIoT, analytics, and energy management solutions as part of a single package strengthens their role in value chain transformation.

Emerging energy verticals-including hydrogen, biofuels, and carbon capture-are also seeking MAC expertise to define new automation baselines. As geopolitical and economic volatility influence oil and gas investment strategies, MACs are providing the assurance, transparency, and control needed to navigate complex multi-stakeholder projects. With digital infrastructure becoming as important as physical infrastructure, MACs are set to remain critical partners in the future of energy project development and operations.

Scope of the Report

The report analyzes the Main Automation Contractor (MAC) in Oil and Gas Industry market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Sector (Upstream Sector, Midstream Sector, Downstream Sector); Project Size (Small & Medium Project Size, Large Project Size).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Upstream Sector segment, which is expected to reach US$934.0 Million by 2030 with a CAGR of a 6.4%. The Midstream Sector segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $305.9 Million in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $309.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Main Automation Contractor (MAC) in Oil and Gas Industry Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Main Automation Contractor (MAC) in Oil and Gas Industry Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Main Automation Contractor (MAC) in Oil and Gas Industry Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd, Advansys ESC, Aker Solutions, Applied Control Engineering, Aspen Technology and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Main Automation Contractor (MAC) in Oil and Gas Industry market report include:

- ABB Ltd

- Advansys ESC

- Aker Solutions

- Applied Control Engineering

- Aspen Technology

- ATS Global

- AVEVA Group plc

- Azbil Corporation

- Bechtel Corporation

- Emerson Electric Co.

- Endress+Hauser

- Honeywell International Inc.

- Hyundai Engineering Co., Ltd.

- Intech Process Automation

- Jacobs Solutions Inc.

- Larsen & Toubro (L&T)

- Schneider Electric SE

- Siemens AG

- Technip Energies

- Yokogawa Electric Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd

- Advansys ESC

- Aker Solutions

- Applied Control Engineering

- Aspen Technology

- ATS Global

- AVEVA Group plc

- Azbil Corporation

- Bechtel Corporation

- Emerson Electric Co.

- Endress+Hauser

- Honeywell International Inc.

- Hyundai Engineering Co., Ltd.

- Intech Process Automation

- Jacobs Solutions Inc.

- Larsen & Toubro (L&T)

- Schneider Electric SE

- Siemens AG

- Technip Energies

- Yokogawa Electric Corporation

Table Information

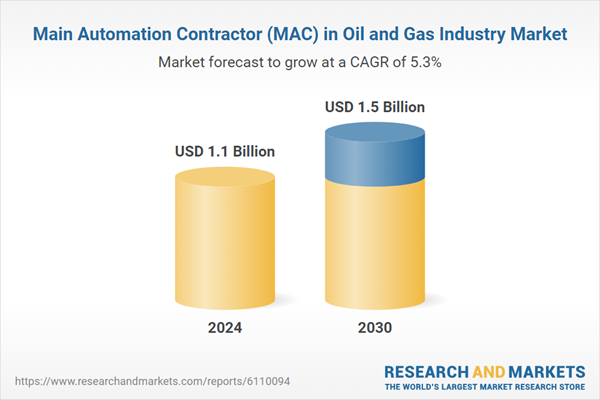

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.5 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |