Global Sound Sensors Market - Key Trends & Drivers Summarized

Sound Sensors: Can Machines Truly Learn to Hear Like Humans?

Sound sensors, also known as acoustic sensors, are transforming the way machines interact with the environment by enabling audio detection, voice processing, and intelligent feedback systems. At the core of this technology are microelectromechanical systems (MEMS) microphones, piezoelectric elements, or electret condensers, which convert sound waves into electrical signals. The market is currently witnessing rapid diversification across industries - from automotive and industrial automation to healthcare, smart homes, and consumer electronics. A defining trend in this space is the shift from simple analog microphones to advanced digital sound sensors integrated with signal conditioning, amplification, and analog-to-digital conversion on a single chip. This integration is allowing developers to create compact, low-power, and highly sensitive acoustic sensing systems suitable for a wide range of applications.The rise of voice-enabled interfaces is another powerful trend driving sound sensor development. From virtual assistants and smart TVs to wearable devices, voice activation is becoming the preferred mode of human-machine interaction. This has led to innovations such as far-field voice detection, noise cancellation, and beamforming arrays that enable accurate sound capture even in noisy environments. In automotive applications, sound sensors are being deployed for advanced driver-assistance systems (ADAS), enabling features such as emergency vehicle detection, voice-controlled infotainment, and cabin noise monitoring. Meanwhile, industrial settings are using acoustic sensors for predictive maintenance, where sound patterns are analyzed to detect machinery faults before they become critical. These diverse uses are elevating sound sensors from basic components to intelligent sensing solutions that play a crucial role in automation and digitization.

What Innovations Are Giving Sound Sensors a New Voice in Emerging Markets?

Emerging applications are pushing the boundaries of what sound sensors can do, and much of this innovation stems from the integration of artificial intelligence (AI) and edge computing. Smart sound sensors now incorporate machine learning algorithms capable of distinguishing between various acoustic events - such as glass breaking, footsteps, or specific spoken words - without needing a continuous internet connection. These smart acoustic sensors are ideal for IoT-enabled environments like smart cities, where they enhance security, traffic management, and public safety through sound classification and event-triggered alerts.In healthcare, sound sensors are revolutionizing diagnostics. Electronic stethoscopes equipped with high-fidelity sensors can detect subtle physiological sounds, aiding in the early diagnosis of heart and lung conditions. Some wearable devices are even exploring continuous cough monitoring or sleep apnea detection through embedded acoustic modules. Additionally, environmental monitoring is being elevated with underwater sound sensors for marine biology research, and urban soundscapes are being analyzed for pollution control. These developments are supported by miniaturization and the use of energy-harvesting technologies, which allow sensors to operate autonomously over long durations. As the need for real-time, context-aware sound data grows, the focus is increasingly on multi-modal sensors that combine acoustic input with motion, light, or temperature for a richer understanding of environmental dynamics.

What’s Fueling the Rapid Expansion of the Sound Sensor Market?

The growth in the sound sensors market is driven by several factors related to end-use proliferation, embedded intelligence, and cross-vertical adoption. One of the strongest growth drivers is the booming consumer electronics sector, especially the demand for smart speakers, earbuds, gaming peripherals, and AR/VR systems that rely heavily on voice and ambient sound recognition. This is complemented by the rising popularity of hearables and audio wearables, which are embedding advanced sound sensors to deliver adaptive audio experiences and health monitoring features.The industrial sector is another major contributor, as manufacturers adopt acoustic sensing to reduce downtime, improve safety, and enhance machine efficiency. With increasing emphasis on predictive maintenance, sound sensors are being embedded in industrial robots, HVAC systems, and turbines to provide early warnings for performance anomalies. Moreover, the ongoing rollout of 5G and edge AI platforms is providing the bandwidth and processing power needed to support distributed acoustic sensing across vast networks, such as in pipeline monitoring or smart infrastructure. In the automotive sector, the push for autonomous vehicles is generating demand for in-cabin and external audio sensing systems that enhance driver awareness and system responsiveness. Lastly, the growing availability of energy-efficient MEMS components is lowering the cost barrier, enabling widespread deployment in budget-sensitive markets like smart homes and public safety. Together, these trends are establishing sound sensors as foundational building blocks in the global sensor ecosystem.

Scope of the Report

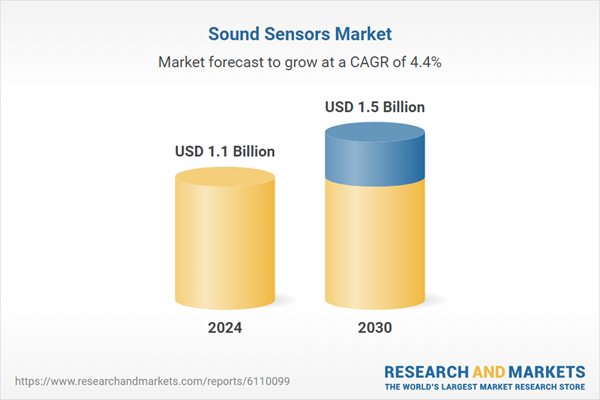

The report analyzes the Sound Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: End-Use (Consumer Electronics End-Use, Telecommunications End-Use, Industrial End-Use, Defense End-Use, Healthcare End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Consumer Electronics End-Use segment, which is expected to reach US$472.7 Million by 2030 with a CAGR of a 6.1%. The Telecommunications End-Use segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $306.4 Million in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $305.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sound Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sound Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sound Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Analog Devices, Inc., Bruel & Kjaer, Honeywell International Inc., Honeywell Sensing Solutions, InvenSense (TDK) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Sound Sensors market report include:

- Analog Devices, Inc.

- Bruel & Kjaer

- Honeywell International Inc.

- Honeywell Sensing Solutions

- InvenSense (TDK)

- Kistler Group

- Knowles Corporation

- Murata Manufacturing Co., Ltd

- Omron Corporation

- Panasonic Corporation

- PCB Piezotronics

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Sensirion AG

- Siemens AG

- Sony Group Corporation

- STMicroelectronics NV

- TDK Corporation

- Teledyne Technologies Inc.

- Texas Instruments Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Analog Devices, Inc.

- Bruel & Kjaer

- Honeywell International Inc.

- Honeywell Sensing Solutions

- InvenSense (TDK)

- Kistler Group

- Knowles Corporation

- Murata Manufacturing Co., Ltd

- Omron Corporation

- Panasonic Corporation

- PCB Piezotronics

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Sensirion AG

- Siemens AG

- Sony Group Corporation

- STMicroelectronics NV

- TDK Corporation

- Teledyne Technologies Inc.

- Texas Instruments Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.5 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |