Global Fintech Lending Market - Key Trends & Drivers Summarized

How Is Fintech Redefining Access to Credit for Consumers and Enterprises?

Fintech lending refers to digital-first credit services enabled by financial technology platforms that offer loans directly to consumers, small businesses, and underserved populations. These services bypass traditional banking models by using online applications, algorithmic underwriting, and automated disbursement. The growing availability of real-time financial data, mobile connectivity, and alternative credit scoring methods is making lending more inclusive and efficient. Fintech lenders provide faster approvals, reduced paperwork, and personalized loan products compared to conventional banks, driving adoption across varied borrower segments.Digital lending platforms are being used to support personal loans, merchant financing, peer-to-peer lending, buy-now-pay-later services, and small business working capital solutions. In many regions, fintech lenders are filling credit gaps left by risk-averse banks, particularly among self-employed individuals, micro-entrepreneurs, and gig economy workers. The simplicity of user interfaces and mobile-based loan management is further contributing to high engagement rates. This is reshaping how financial services are accessed, particularly in urban centers and digitally active populations.

What Role Are Data and Automation Playing in Scaling Fintech Lending?

Technology is central to fintech lending operations, from application to risk assessment and repayment tracking. Platforms use data from e-commerce activity, mobile wallets, utility payments, and bank account statements to evaluate creditworthiness. Machine learning algorithms analyze these datasets to make faster, data-driven lending decisions with reduced reliance on traditional credit histories. This allows for broader reach, especially in regions where formal credit bureaus are limited or underdeveloped.Cloud-based infrastructure, digital KYC (Know Your Customer), and API-driven integrations with payment gateways, accounting tools, and customer relationship platforms are enhancing operational scalability. Some lenders also use behavioral analytics and psychometric evaluations to profile borrowers in the absence of conventional financial records. Automation reduces turnaround times, supports volume lending, and minimizes manual intervention, making it feasible for fintechs to operate in high-demand, low-margin segments. This technology-led approach is making fintech lending increasingly agile and accessible.

Where Is Market Adoption Growing and Which Models Are Leading?

Adoption of fintech lending is expanding in both developed and emerging markets. In North America and Europe, consumer-focused digital lenders are gaining traction through unsecured loans and short-term financing models. In Asia-Pacific and parts of Africa, mobile-first platforms are extending credit to rural and low-income users by leveraging mobile money ecosystems and agent networks. Regulatory sandboxes and financial inclusion initiatives are supporting this expansion by encouraging innovation while maintaining oversight.Marketplace lending, embedded finance, and BNPL (buy-now-pay-later) models are seeing rapid growth. E-commerce platforms and digital marketplaces are integrating lending services directly into checkout processes or seller dashboards. Micro and SME lending platforms are forming partnerships with accounting and inventory software providers to access real-time business data. These models reduce customer acquisition costs and enable contextual lending, reinforcing adoption in retail, logistics, and service sectors. Strategic collaborations between fintechs and banks are also creating hybrid models that combine compliance strength with technological flexibility.

What Is Driving Growth in the Fintech Lending Market?

Growth in the fintech lending market is driven by several factors related to digital infrastructure, credit access gaps, and platform innovation. Increasing smartphone penetration and digital transaction volumes are enabling rapid borrower onboarding and credit evaluation. Demand for fast, accessible, and low-documentation credit is fueling adoption across consumer and SME segments. Advancements in machine learning, API ecosystems, and alternative data analytics are improving underwriting accuracy and fraud detection. Growth is also supported by integration of lending services into retail, logistics, and payment platforms through embedded finance models. Regulatory support for digital lending innovation, combined with unmet demand for micro and short-term credit, is reinforcing expansion across both banked and underbanked populations.Scope of the Report

The report analyzes the Fintech Lending market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Loan Type (Personal Loans, Small Business Loans, Mortgage, Auto Loans, Student Loans); Repayment Method (Installment Loans, Line of Credit, Invoice Financing, Merchant Cash Advances); Delivery Channel (Online Lenders, Traditional Banks, Credit Unions, Peer-to-Peer Lenders).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Personal Loans segment, which is expected to reach US$1.6 Trillion by 2030 with a CAGR of a 25.4%. The Small Business Loans segment is also set to grow at 27.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $306.4 Billion in 2024, and China, forecasted to grow at an impressive 33.2% CAGR to reach $1.1 Trillion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fintech Lending Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fintech Lending Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fintech Lending Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Affirm, Avant, Better.com, Bondora, Brex and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Fintech Lending market report include:

- Affirm

- Avant

- Better.com

- Bondora

- Brex

- Creditea

- Credit Karma

- Cross River Bank

- Dealstruck

- Funding Circle

- Kiva

- LendingClub

- LendInvest

- LoanDepot

- Monzo

- Oxygen

- Prosper Marketplace

- SoFi

- Upstart

- Zopa

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Affirm

- Avant

- Better.com

- Bondora

- Brex

- Creditea

- Credit Karma

- Cross River Bank

- Dealstruck

- Funding Circle

- Kiva

- LendingClub

- LendInvest

- LoanDepot

- Monzo

- Oxygen

- Prosper Marketplace

- SoFi

- Upstart

- Zopa

Table Information

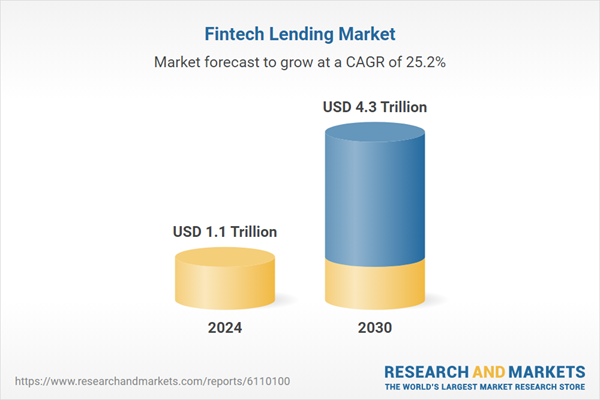

| Report Attribute | Details |

|---|---|

| No. of Pages | 387 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Trillion |

| Forecasted Market Value ( USD | $ 4.3 Trillion |

| Compound Annual Growth Rate | 25.2% |

| Regions Covered | Global |