Global Cable Laying Vessels Market - Key Trends & Drivers Summarized

Why Are Cable Laying Vessels Crucial to Global Connectivity and Renewable Energy Infrastructure?

Cable laying vessels are essential assets in the development and maintenance of undersea cable networks, playing a pivotal role in enabling global communications, power transmission, and offshore energy systems. These specialized ships are designed to install, maintain, and repair submarine cables that carry telecommunications data, including internet and voice services, across continents and connect offshore renewable energy projects like wind farms to onshore grids. The increasing demand for high-speed internet, data centers, cloud computing, and smart grid connectivity has intensified the need for robust and expansive undersea cable infrastructure. As global internet traffic grows and new geographies come online, the requirement for transoceanic fiber-optic cables continues to rise, directly influencing the need for capable and technologically advanced cable laying vessels. Similarly, the rapid expansion of offshore wind projects, especially in regions such as the North Sea, East Asia, and the Eastern Seaboard of the United States, has heightened demand for vessels capable of laying high-voltage export and inter-array power cables. Cable laying vessels are equipped with dynamic positioning systems, sophisticated cable handling equipment, remotely operated vehicles (ROVs), and advanced navigation tools to ensure precision during cable deployment in complex seabed environments. These vessels must also be capable of operating in various water depths and under challenging marine weather conditions. Their operational importance is only set to grow as nations invest in energy transition, digital connectivity, and sustainable offshore infrastructure, positioning cable laying vessels as strategic enablers of global technological and environmental advancement.How Are Technological Innovations Enhancing the Capabilities of Cable Laying Vessels?

Technological innovation is fundamentally transforming the capabilities of cable laying vessels, enabling them to operate with greater precision, efficiency, and environmental responsibility. One major advancement is the integration of next-generation dynamic positioning systems, which use satellite-based navigation and real-time seabed mapping to maintain exact vessel location during cable deployment, a critical factor in ensuring accurate cable placement and tension control. Modern vessels also feature automated cable handling systems that reduce the reliance on manual labor and improve safety by minimizing human exposure to high-risk tasks. The adoption of advanced winches, linear cable engines, and tensioners ensures smooth and controlled cable laying even in rough sea conditions. Additionally, ROVs equipped with high-definition cameras and sonar capabilities are now standard on many vessels, assisting in pre-lay surveys, trenching, and post-lay inspections. Digital twin technology is increasingly being used for predictive maintenance and simulation, enabling operators to identify potential system failures before they occur and to model different laying scenarios based on bathymetric data. The push for greener operations is leading to the introduction of hybrid propulsion systems and fuel-efficient engines that reduce carbon emissions and comply with evolving maritime regulations. Automation and digitalization are also improving project planning and real-time operational monitoring, ensuring that cable laying campaigns are completed on schedule and within budget. As cable types become more complex, including hybrid cables carrying both data and power, vessels are being designed with increased deck space, enhanced cable storage capacity, and modular equipment layouts. These technological enhancements are not only improving the reliability and output of cable laying missions but also expanding the operational scope of vessels into deeper waters and more remote environments.What Regional Developments and Industry Dynamics Are Influencing the Demand for Cable Laying Vessels?

The global demand for cable laying vessels is being shaped by a mix of regional infrastructure needs, energy transitions, and geopolitical considerations. In Europe, the rapid expansion of offshore wind energy, especially in the North Sea and Baltic Sea, is generating sustained demand for cable installation vessels that can handle high-voltage submarine cables under tight regulatory and environmental constraints. Countries like the United Kingdom, Germany, and the Netherlands are leading investments in offshore renewable capacity, creating robust project pipelines that require reliable marine installation capabilities. In Asia-Pacific, particularly in China, Japan, South Korea, and Taiwan, both internet connectivity and offshore wind development are driving the deployment of submarine cable systems, fueling the need for regionally based, high-specification vessels. China, in particular, is focusing on building domestic fleets to support its global Belt and Road digital infrastructure ambitions. Meanwhile, North America is seeing growing demand from data center expansions, undersea cable consortiums involving major tech companies, and a budding offshore wind market along the U.S. East Coast. The Americas also face a need to replace aging submarine infrastructure, especially in the Caribbean and Latin America. In emerging markets across Africa and Southeast Asia, investments in undersea communication cables are vital to economic development and digital inclusion, creating opportunities for cable laying companies to support infrastructure growth. Geopolitical tensions are also influencing the sector, with increased scrutiny over who installs and maintains submarine infrastructure due to security and surveillance concerns. These regional drivers are not only accelerating fleet utilization but also encouraging nations to invest in domestic vessel construction and operator capabilities, adding further momentum to the global market for cable laying vessels.What Are the Key Drivers Fueling the Expansion of the Cable Laying Vessels Market Worldwide?

The growth in the cable laying vessels market is driven by a confluence of factors related to the digital revolution, energy transition, global infrastructure expansion, and maritime innovation. A principal driver is the explosive growth in global data consumption, cloud services, and video streaming, which requires new and faster submarine internet cables to support connectivity between continents. This has led major tech companies to directly invest in undersea cable projects, increasing demand for vessels that can deploy fiber-optic cables quickly and securely. Another significant driver is the global shift toward renewable energy, especially offshore wind power, which depends on submarine cables to transmit energy from offshore farms to land-based grids. As nations increase renewable energy targets, the need for cable laying capacity grows accordingly. The aging infrastructure of existing cables, many of which are decades old, also necessitates regular maintenance, repair, and replacement, generating continuous service demand for specialized vessels. The growing complexity and length of new cable systems, which often span thousands of kilometers and cross multiple geopolitical zones, are pushing for more technologically advanced and higher-capacity vessels. Environmental regulations and sustainability goals are encouraging the development of hybrid or fully electric cable laying ships, adding a new layer of innovation and differentiation in the market. Additionally, strategic maritime initiatives to increase sovereignty over critical infrastructure are prompting countries to commission domestic fleets and reduce dependence on foreign service providers. All these drivers converge to create a dynamic, innovation-driven market with long-term growth potential, positioning cable laying vessels as indispensable assets in the architecture of global digital and energy infrastructure.Scope of the Report

The report analyzes the Cable Laying Vessels market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Vessel Type (Power Cable Laying Vessel, Communications Cable Laying Vessel, Umbilical Cable Laying Vessel, Other Vessel Types); Depth (Shallow Water, Deepwater, Ultra-Deepwater); Application (Offshore Wind Power Grid Connection Application, Offshore Oil & Gas Production Facilities Application, Offshore Platforms Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Power Cable Laying Vessel segment, which is expected to reach US$718.3 Million by 2030 with a CAGR of a 6.4%. The Communications Cable Laying Vessel segment is also set to grow at 6.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $371.5 Million in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $434.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cable Laying Vessels Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cable Laying Vessels Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cable Laying Vessels Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

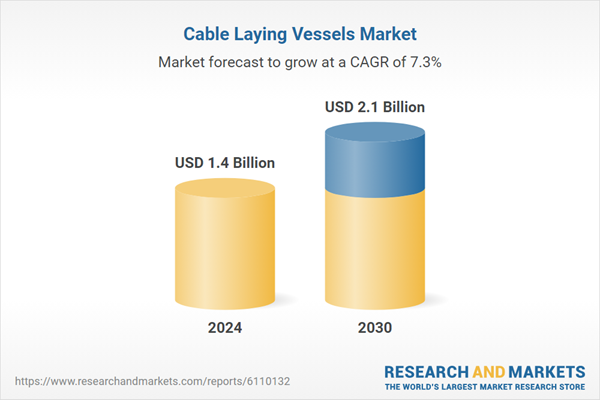

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd, Asso.subsea Ltd, Boskalis Westminster N.V., China Communications Construction Company, Damen Shipyards Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Cable Laying Vessels market report include:

- ABB Ltd

- Asso.subsea Ltd

- Boskalis Westminster N.V.

- China Communications Construction Company

- Damen Shipyards Group

- DEME Group

- Global Marine Group

- Gulf Marine Services

- Jan De Nul Group

- JDR Cable Systems

- Kokusai Cable Ship Co., Ltd.

- LS Cable & System

- Maersk Supply Service

- Nexans S.A.

- NKT A/S

- Prysmian Group

- Seaway 7

- SubCom LLC

- Van Oord

- ZTT Group (Zhongtian Technology)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd

- Asso.subsea Ltd

- Boskalis Westminster N.V.

- China Communications Construction Company

- Damen Shipyards Group

- DEME Group

- Global Marine Group

- Gulf Marine Services

- Jan De Nul Group

- JDR Cable Systems

- Kokusai Cable Ship Co., Ltd.

- LS Cable & System

- Maersk Supply Service

- Nexans S.A.

- NKT A/S

- Prysmian Group

- Seaway 7

- SubCom LLC

- Van Oord

- ZTT Group (Zhongtian Technology)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.1 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |