Global Infectious Wound Care Management Market - Key Trends & Drivers Summarized

Why Is Effective Management of Infected Wounds a Clinical Priority?

Infectious wound care management focuses on the treatment and prevention of infections in acute, surgical, traumatic, and chronic wounds. These infections can lead to delayed healing, systemic complications, and increased healthcare costs. Rising incidence of surgical site infections, diabetic ulcers, and pressure injuries is increasing the demand for advanced wound care solutions that provide antimicrobial action, maintain moisture balance, and support tissue regeneration.Wound infections are particularly prevalent in elderly populations, patients with diabetes, or those with compromised immunity, making them a key concern in hospitals, long-term care facilities, and home health environments. Delayed or inadequate infection management can result in wound chronicity, hospital readmissions, and, in severe cases, sepsis or amputation. Effective infectious wound care is therefore essential not only for individual patient outcomes but also for public health and cost containment in healthcare systems.

How Are Technologies and Treatment Modalities Evolving?

Infectious wound care is shifting from traditional dressings to advanced therapies that integrate antimicrobial agents, bioactive materials, and controlled-release drug systems. Silver-based dressings remain widely used for their broad-spectrum antimicrobial properties, while honey, iodine, and PHMB are being applied in formulations targeting specific pathogens. Foam, alginate, and hydrofiber dressings that manage exudate while minimizing bacterial proliferation are also gaining adoption in both acute and chronic wound settings.Emerging technologies include antimicrobial hydrogel dressings, nanofiber-based scaffolds, and bioengineered skin substitutes that create favorable healing environments. Negative pressure wound therapy (NPWT) systems with instillation capabilities are being used for complex infected wounds to remove exudate and reduce bacterial load. Diagnostic wound monitoring devices, including biosensors and digital wound imaging tools, are helping clinicians detect infection earlier and tailor interventions accordingly.

Where Is Demand Increasing, and Which Settings Are Driving Usage?

Hospitals remain the primary setting for infectious wound care, particularly in emergency departments, surgical wards, and burn units. Post-acute care settings such as nursing homes and rehabilitation centers are increasingly important due to the high prevalence of chronic wounds and limited access to wound specialists. Home healthcare is another growing area, especially with the expansion of outpatient wound care services and telemedicine platforms.Demand is increasing in regions with aging populations, high rates of diabetes, and expanding healthcare infrastructure. North America and Europe lead in advanced wound care adoption due to greater awareness and reimbursement availability. Asia Pacific is showing rapid growth driven by increasing surgical volumes, expanding elderly care, and rising public-private investment in wound management clinics.

What Is Driving Growth in the Infectious Wound Care Management Market?

Growth in the infectious wound care management market is driven by several factors including rising prevalence of chronic wounds, post-surgical infections, and antibiotic-resistant bacterial strains. Advances in antimicrobial dressings, bioengineered wound coverings, and smart wound monitoring systems are improving treatment outcomes and reducing the need for systemic antibiotics. Greater clinical focus on evidence-based wound care and early infection control is accelerating the shift toward advanced and combination therapy products.End-use expansion across hospitals, home healthcare, and post-acute care facilities is supporting broader deployment of both passive and active wound management tools. Healthcare policies favoring outpatient treatment and shorter hospital stays are increasing demand for high-efficacy wound products that support healing in decentralized settings. Integration of diagnostic technologies and real-time infection monitoring is enabling personalized wound care strategies. These drivers are collectively reinforcing long-term demand for infection-focused wound care solutions across diverse clinical and care delivery environments.

Scope of the Report

The report analyzes the Infectious Wound Care Management market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Therapeutics, Device, Compression Bandage, Negative Pressure Wound Therapy); Wound Type (Diabetes Mellitus Wound, Hypoxia / Poor Tissue Perfusion Wound, Other Wound Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Therapeutics segment, which is expected to reach US$620.0 Million by 2030 with a CAGR of a 1.4%. The Device segment is also set to grow at 1.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $415.2 Million in 2024, and China, forecasted to grow at an impressive 2.9% CAGR to reach $304.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Infectious Wound Care Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Infectious Wound Care Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Infectious Wound Care Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Acelity (now part of 3M), Argentum Medical, B. Braun Melsungen AG, BSN Medical (Essity AB) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Infectious Wound Care Management market report include:

- 3M Company

- Acelity (now part of 3M)

- Argentum Medical

- B. Braun Melsungen AG

- BSN Medical (Essity AB)

- Cardinal Health, Inc.

- Coloplast Group A/S

- ConvaTec Group PLC

- DermaRite Industries, LLC

- Hartmann Group

- Hollister Incorporated

- Integra LifeSciences Holdings Corp.

- Lohmann & Rauscher International

- Medline Industries, Inc.

- Medtronic plc

- Mimedx Group, Inc.

- Molnlycke Health Care AB

- Organogenesis Holdings Inc.

- Smith & Nephew PLC

- Urgo Medical

- Winner Medical Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Acelity (now part of 3M)

- Argentum Medical

- B. Braun Melsungen AG

- BSN Medical (Essity AB)

- Cardinal Health, Inc.

- Coloplast Group A/S

- ConvaTec Group PLC

- DermaRite Industries, LLC

- Hartmann Group

- Hollister Incorporated

- Integra LifeSciences Holdings Corp.

- Lohmann & Rauscher International

- Medline Industries, Inc.

- Medtronic plc

- Mimedx Group, Inc.

- Molnlycke Health Care AB

- Organogenesis Holdings Inc.

- Smith & Nephew PLC

- Urgo Medical

- Winner Medical Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

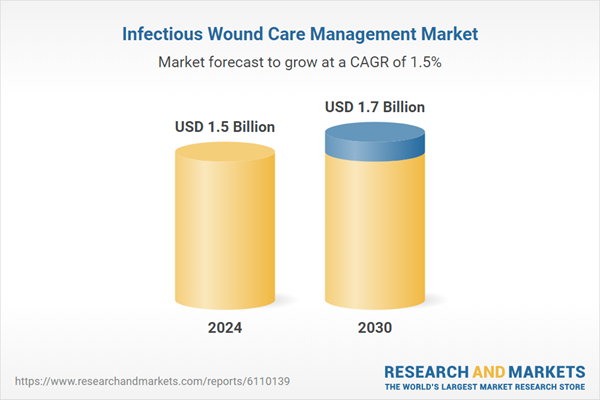

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 1.5% |

| Regions Covered | Global |