Global Desalination Systems Market - Key Trends & Drivers Summarized

What Is Driving the Demand for Desalination Systems Across Coastal and Water-Stressed Regions?

Demand for desalination systems has expanded steadily as water scarcity intensifies across arid and semi-arid regions. Many coastal countries and island nations face serious limitations in accessing renewable freshwater sources. Rapid urbanization in water-stressed cities, increasing industrial consumption, and depletion of groundwater reserves have pushed governments and municipalities to adopt seawater and brackish water desalination as a long-term water security strategy. Countries across the Middle East, North Africa, and parts of Asia have integrated desalination into national water supply plans. Energy-efficient technologies and modular systems have made adoption feasible for decentralized installations in coastal communities and industrial zones.Public-private partnerships and infrastructure modernization initiatives have further influenced system procurement. Countries with limited access to transboundary water resources view desalination as a sovereign measure for water independence. In urban coastal zones, desalination is increasingly integrated with smart water grids and hybrid storage networks to stabilize supply during peak demand. Emerging markets in Africa and South Asia are exploring decentralized solar-powered units to meet rural drinking water needs. In these regions, desalination offers an alternative to contaminated or saline groundwater.

How Are Technology Choices and Operational Preferences Evolving in the Market?

Reverse osmosis continues to dominate system deployment, owing to its higher energy efficiency and modular scalability. While thermal technologies such as multi-stage flash and multi-effect distillation remain in use in large-scale facilities in high-energy regions, membrane-based systems have gained prominence due to lower operational costs and easier integration with renewable energy. Advances in energy recovery devices, low-pressure membranes, and hybrid configurations have reduced energy consumption and operating costs for reverse osmosis systems.Trends indicate growing preference for containerized, mobile, and small-scale units for remote applications. Industrial sectors such as oil and gas, mining, and power generation are deploying customized desalination modules to meet internal process needs. Offshore platforms and military bases also depend on compact desalination systems. Waste brine management, once a limiting concern, is being addressed through crystallization, brine mining, and zero liquid discharge strategies. Integration of real-time monitoring systems for water quality and performance diagnostics is also becoming common in modern facilities. Operators are increasingly prioritizing ease of maintenance, long service life, and water recovery rates in system selection criteria.

Where Are Desalination Systems Gaining Prominence as a Strategic Water Supply Solution?

Interest in desalination is expanding beyond its traditional strongholds. Countries in Southern Europe, Latin America, and Australia are investing in desalination capacity to combat droughts and changing rainfall patterns. In the United States, certain coastal states and island territories have moved ahead with planned desalination projects to address seasonal water stress and overdrawn aquifers. Several municipalities are building dual-source systems, combining conventional surface water with desalinated supply, to diversify risk.In agriculture, desalinated water is being selectively used for greenhouse irrigation and high-value crop production, especially in regions facing salinity intrusion in freshwater supplies. Industrial parks in water-scarce locations are increasingly relying on desalination to maintain operational continuity. Demand is also rising from hospitality and tourism developments along coastal belts, where seasonal water demand spikes cannot be met by existing infrastructure. Adoption in humanitarian and emergency relief scenarios is growing, where portable desalination units help address water shortages following natural disasters or in refugee settings.

What Are the Main Drivers Fueling Growth in Desalination Systems Adoption?

Growth in the desalination systems market is driven by several factors related to infrastructure planning, end-use diversification, and technology optimization. Rising investments in resilient urban water infrastructure have made desalination a priority in water-stressed urban centers. In many regions, desalination forms a core component of climate adaptation and water security planning. Increasing water demands from high-consumption industries such as power, chemicals, and semiconductors have prompted investment in private desalination systems to ensure uninterrupted operations.Policy support and regulatory frameworks in coastal regions have improved project approvals and viability, particularly for decentralized and renewable-powered systems. Technological advancements in membrane materials, energy recovery devices, and brine concentration processes have enhanced system efficiency and reduced environmental impacts. Adoption of solar and wind-powered desalination, especially in off-grid regions, has expanded use cases for small and medium installations. Rising demand for disaster-resilient infrastructure and mobile water treatment units has further broadened system design innovation. Expansion of coastal smart cities and water-sensitive urban planning models also continues to support long-term market adoption.

Scope of the Report

The report analyzes the Desalination Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Separation Technology (Thermal Technology, Membrane Technology); Application (Municipal Application, Industrial Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Thermal Technology segment, which is expected to reach US$1.6 Trillion by 2030 with a CAGR of a 9.3%. The Membrane Technology segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $407.8 Billion in 2024, and China, forecasted to grow at an impressive 12.7% CAGR to reach $516.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Desalination Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Desalination Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Desalination Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acciona Agua, Aqualyng AS, Aquatech International LLC, BASF SE, Biwater Holdings Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Desalination Systems market report include:

- Acciona Agua

- Aqualyng AS

- Aquatech International LLC

- BASF SE

- Biwater Holdings Ltd.

- Doosan Enerbility (Doosan Heavy)

- DuPont Water Solutions

- Energy Recovery, Inc.

- Fisia Italimpianti S.p.A.

- GE Vernova (ex-SUEZ Water Tech)

- Hitachi Zosen Corporation

- IDE Technologies Ltd.

- Kurita Water Industries Ltd.

- Metito Holdings Ltd.

- Mitsubishi Heavy Industries Ltd.

- Poseidon Water LLC

- ProMinent GmbH

- Saline Water Conversion Corp. (SWCC)

- Toray Industries, Inc.

- Veolia Water Technologies

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acciona Agua

- Aqualyng AS

- Aquatech International LLC

- BASF SE

- Biwater Holdings Ltd.

- Doosan Enerbility (Doosan Heavy)

- DuPont Water Solutions

- Energy Recovery, Inc.

- Fisia Italimpianti S.p.A.

- GE Vernova (ex-SUEZ Water Tech)

- Hitachi Zosen Corporation

- IDE Technologies Ltd.

- Kurita Water Industries Ltd.

- Metito Holdings Ltd.

- Mitsubishi Heavy Industries Ltd.

- Poseidon Water LLC

- ProMinent GmbH

- Saline Water Conversion Corp. (SWCC)

- Toray Industries, Inc.

- Veolia Water Technologies

Table Information

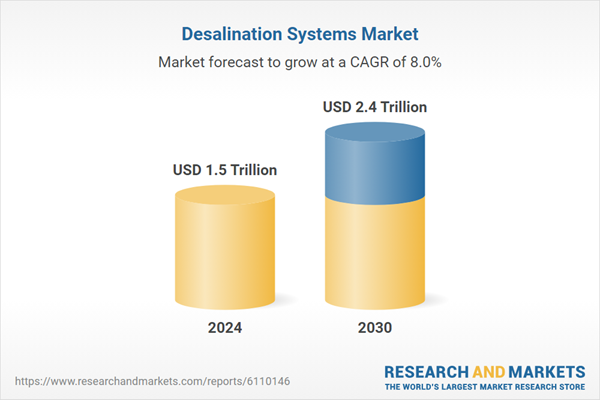

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.5 Trillion |

| Forecasted Market Value ( USD | $ 2.4 Trillion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |