Global Off-Highway Wheels Market - Key Trends & Drivers Summarized

Why Are Off-Highway Wheel Requirements Becoming Increasingly Specialized?

Off-highway vehicles (OHVs), including construction equipment, agricultural tractors, forestry machines, and mining trucks, operate under some of the most demanding conditions, necessitating highly specialized wheel designs. Unlike on-road vehicles, OHVs traverse rugged terrain, soft soil, abrasive surfaces, and steep inclines. Consequently, the wheel systems must accommodate dynamic load distribution, varying soil compaction, and high-impact forces while maintaining structural integrity. The increasing variety of use cases-ranging from narrow vineyard tractors to heavy-duty quarry haulers-has spurred demand for customized wheel assemblies tailored to specific tasks, axle loads, and tire compatibility.Further complicating wheel design is the trend toward higher payload capacities and larger equipment sizes. As global infrastructure projects grow in complexity and scale, heavy machinery is expected to carry greater loads with improved operational uptime. This necessitates reinforced wheel rims made from high-strength steel or specialized alloys, often treated with corrosion-resistant coatings or heat treatments to endure wear, deformation, and exposure to aggressive chemicals. OEMs and aftermarket providers are focusing on optimized rim flange geometries, dual tire setups, and precision-engineered mounting patterns to enhance wheel-tire synchronization and vehicle stability under variable load cycles. Safety standards, such as ISO 4250 and TRA guidelines, also enforce strict dimensional tolerances and load ratings, further driving innovations in design precision and quality assurance.

How Are Technological Advances Reshaping Wheel Performance and Durability?

Material science and manufacturing technologies are redefining the performance attributes of off-highway wheels. One of the most prominent advancements is the integration of high-tensile micro-alloyed steel and forged aluminum into rim production. While steel dominates high-load applications due to its strength-to-weight ratio, aluminum wheels are gaining traction in agricultural and forestry segments where lower vehicle weight contributes to reduced soil compaction and fuel consumption. Moreover, computer-aided design (CAD), finite element analysis (FEA), and simulation-based validation processes are being widely adopted by manufacturers to predict stress distribution, fatigue failure points, and heat dissipation characteristics, allowing for optimal structural configurations.In addition to material upgrades, the introduction of dual-bead seat and beadlock wheel systems enhances the tire retention under fluctuating pressure conditions. These are particularly critical in mining and construction where tire bead slippage or blowout could pose significant operational and safety hazards. Anti-corrosive coatings such as e-coating and powder finishing are being adopted not just to protect against oxidation but to improve lifecycle performance in wet or saline environments. Moreover, wheel telemetry systems are slowly entering the off-highway sector, enabling real-time diagnostics of wheel alignment, temperature, and stress loads. These technologies help operators proactively manage wheel maintenance, reduce unplanned downtimes, and lower total cost of ownership over the equipment lifecycle.

Why Is OEM and Aftermarket Demand Segmentation Becoming More Complex?

The market for off-highway wheels is increasingly segmented by equipment type, terrain condition, and end-user preferences. Original Equipment Manufacturers (OEMs) typically focus on fully integrated wheel systems designed for specific vehicle configurations and performance benchmarks. These wheels are factory-fitted and adhere to strict standards for compatibility, lifecycle durability, and OEM branding. However, the aftermarket segment is witnessing rapid expansion due to rising refurbishment rates, frequent tire replacements, and the growing use of remanufactured equipment in developing regions. Farmers, contractors, and fleet operators often prefer cost-effective aftermarket wheels that offer sufficient durability without the premium pricing of OEMs.In agricultural machinery, end-users frequently demand wheels that can be adjusted for row spacing or soil-specific traction needs. Modular wheel systems and adjustable wheel centers are therefore becoming commonplace. Meanwhile, mining and construction sectors prioritize wheels with reinforced lock rings and flange protectors due to the high risk of impact damage and debris entrapment. Furthermore, regional variation in terrain-muddy fields in Southeast Asia, desert plains in the Middle East, rocky quarries in Africa-necessitates different wheel designs and surface treatments, driving demand for localized customization and logistics support. OEMs and wheel suppliers are responding by decentralizing inventory hubs and establishing partnerships with regional distributors to ensure availability and faster turnaround for repairs or replacements.

What Key Forces Are Fueling Market Growth Across Regions and End-Uses?

The growth in the global off-highway wheels market is driven by several factors that reflect the convergence of equipment evolution, infrastructure demand, and aftermarket expansion. At the macro level, massive investments in public infrastructure, commercial real estate, and agricultural modernization-particularly in Asia-Pacific, Latin America, and Africa-are catalyzing the demand for earthmoving, harvesting, and construction machinery. This translates into rising procurement and replacement of wheels that meet both functional and regulatory requirements. Likewise, climate variability and the push for sustainable farming practices are spurring demand for low-compaction, precision-engineered wheels that minimize soil degradation and improve yield per hectare.Governmental support through subsidies for mechanized farming and rural road-building projects is also playing a role, especially in emerging economies. Simultaneously, industrialized markets like North America and Europe are experiencing a surge in demand for high-tech, sensor-enabled wheels compatible with autonomous machinery, precision navigation systems, and telemetry-based fleet analytics. Equipment rental firms and contractors-key players in the aftermarket-are investing in rugged, low-maintenance wheel systems that ensure operational uptime and safety compliance. Wheel standardization across multi-brand equipment fleets is another growth catalyst, encouraging development of interchangeable and modular designs.

Manufacturers are strategically diversifying product portfolios to cater to both premium and economy segments. Companies like Titan International, Maxion Wheels, Trelleborg, and GKN Wheels are expanding regional manufacturing bases and forming technology alliances to introduce lighter, stronger, and smarter wheels. Sustainability is becoming another decisive factor, with increasing adoption of recyclable materials, environmentally friendly coating processes, and lifecycle analysis tools. With safety regulations tightening and operating conditions becoming more extreme, the off-highway wheels market is poised for a robust growth trajectory driven by performance innovation, terrain-specific design, and aftermarket customization.

Scope of the Report

The report analyzes the Off-Highway Wheels market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Alloy Wheels, Steel Wheels); Application (Agriculture Construction Application, Material Handling Application, Mining Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Alloy Wheels segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 3.2%. The Steel Wheels segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $473.8 Million in 2024, and China, forecasted to grow at an impressive 7.0% CAGR to reach $438.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Off-Highway Wheels Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Off-Highway Wheels Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Off-Highway Wheels Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accuride Corporation, Alcoa Wheels, Apexway Products Corp., Astrum Ltd, BKT (Balkrishna Industries Ltd.) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Off-Highway Wheels market report include:

- Accuride Corporation

- Alcoa Wheels

- Apexway Products Corp.

- Astrum Ltd

- BKT (Balkrishna Industries Ltd.)

- CAMSO (A Michelin Group Brand)

- Carlstar Group

- CEAT Specialty Tyres Ltd.

- GKN Wheels & Structures

- Hexpol Compounding

- Jantsa Jant Sanayi ve Ticaret A.S.

- Maxion Wheels

- OTR Wheel Engineering, Inc.

- Räder Vogel

- RIMEX Supply Ltd.

- SD International

- Titan International, Inc.

- Trelleborg AB (TWS Division)

- TOPY Industries Ltd.

- Wheels India Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accuride Corporation

- Alcoa Wheels

- Apexway Products Corp.

- Astrum Ltd

- BKT (Balkrishna Industries Ltd.)

- CAMSO (A Michelin Group Brand)

- Carlstar Group

- CEAT Specialty Tyres Ltd.

- GKN Wheels & Structures

- Hexpol Compounding

- Jantsa Jant Sanayi ve Ticaret A.S.

- Maxion Wheels

- OTR Wheel Engineering, Inc.

- Räder Vogel

- RIMEX Supply Ltd.

- SD International

- Titan International, Inc.

- Trelleborg AB (TWS Division)

- TOPY Industries Ltd.

- Wheels India Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 266 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

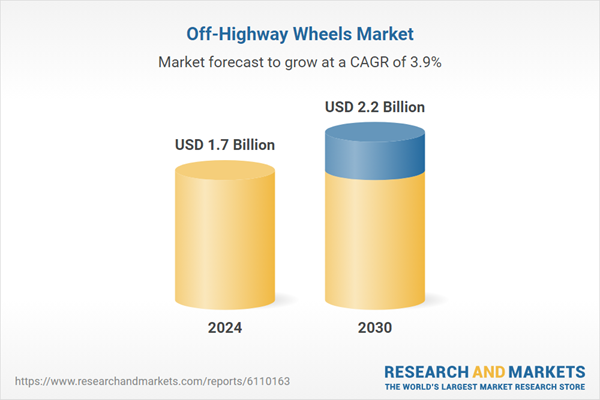

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |