Global Gas Compressors in Oil and Gas Industry - Key Trends & Drivers Summarized

Why Are Gas Compressors Integral to Modern Oil and Gas Operations?

Gas compressors are essential in upstream, midstream, and downstream oil and gas activities, enabling transportation, reinjection, storage, and processing of natural gas and associated hydrocarbons. These machines increase the pressure of gases to allow efficient movement through pipelines, support gas lift operations in wells, or drive separation and liquefaction processes. As exploration shifts to deeper, unconventional, and remote fields, the demand for high-performance compressors capable of operating under extreme pressure and variable flow conditions is rising.In upstream operations, compressors are used for enhanced oil recovery (EOR), gas injection, and vapor recovery units. Midstream use includes pipeline pressurization, gas transmission, and LNG plant feed systems. Downstream facilities deploy compressors for refining processes, hydrogen compression, and flare gas recovery. The increasing role of natural gas in energy transition strategies-particularly as a cleaner-burning bridge fuel-amplifies the importance of gas compression in ensuring supply continuity and infrastructure flexibility.

What Technology and System Design Trends Are Advancing Compressor Efficiency?

Modern gas compressors are being developed with emphasis on energy efficiency, digital monitoring, and operational flexibility. Design improvements include multi-stage configurations, dry gas seals, advanced rotor dynamics, and aerodynamic enhancements to boost performance across pressure and flow ranges. Variable-speed drives (VSDs) and automatic load control systems are integrated to reduce energy consumption and match compressor output to fluctuating process demands.Digitalization plays a key role in predictive maintenance and system optimization. IoT-based sensors, real-time diagnostics, and cloud-based analytics enable operators to track vibration, temperature, and flow metrics, reducing downtime and unplanned failures. Skid-mounted and modular compressor packages are being adopted to accelerate installation and allow redeployment across multiple sites. Compressors that can handle wet gas, sour gas, and high-CO2 content are also in development, addressing emerging operational challenges in shale gas and offshore fields.

How Are Market Needs Shifting with Energy Transition and Regulatory Pressures?

The oil and gas industry’s move toward lower emissions and improved energy efficiency has created demand for compressors with smaller environmental footprints. This includes systems optimized for low-leakage, reduced flare gas loss, and compatibility with carbon capture and storage (CCS) infrastructure. Compressors used in hydrogen handling, biogas upgrading, and blue hydrogen production are receiving increased attention as gas processing technologies evolve.Regional growth patterns also influence market dynamics. North America leads in compressor deployment for shale gas operations, while the Middle East continues to invest in large-scale gas reinjection and LNG export facilities. Asia-Pacific markets are expanding gas infrastructure for urban and industrial use, driving adoption of pipeline and storage compressors. Government mandates related to flare gas recovery, methane leakage control, and process efficiency are further encouraging modernization of compressor fleets across oil and gas operations.

Growth in the Gas Compressors Market in Oil and Gas Is Driven by Several Factors…

Growth in the gas compressors market in the oil and gas industry is driven by several factors including increasing gas-based energy production, enhanced recovery operations, and regulatory compliance for emissions and energy efficiency. Rising use of gas lift, vapor recovery, and gas injection techniques in upstream operations sustains equipment demand. Expansion of LNG terminals, pipeline networks, and underground storage across global regions supports midstream compressor adoption. Advancements in compressor design-such as variable-speed technology, dry seals, and real-time monitoring-boost performance and reduce operating costs. Increasing integration of compressors in CCS, hydrogen, and biogas systems reflects alignment with decarbonization goals. As oil and gas operators modernize infrastructure to meet environmental and operational requirements, compressors remain indispensable assets throughout the value chain.Scope of the Report

The report analyzes the Gas Compressors in Oil and Gas Industry market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Reciprocating Compressor, Screw Compressor); Application (Upstream Application, Downstream Application, Midstream Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Reciprocating Compressor segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of a 1.3%. The Screw Compressor segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $492.2 Million in 2024, and China, forecasted to grow at an impressive 3.5% CAGR to reach $373.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gas Compressors in Oil and Gas Industry Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gas Compressors in Oil and Gas Industry Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gas Compressors in Oil and Gas Industry Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Atlas Copco AB, Baker Hughes Company, Caterpillar Inc., Climax Portable, Dresser-Rand (Siemens Energy) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Gas Compressors in Oil and Gas Industry market report include:

- Atlas Copco AB

- Baker Hughes Company

- Caterpillar Inc.

- Climax Portable

- Dresser-Rand (Siemens Energy)

- Elliott Group

- Fusheng Group

- GE Oil & Gas (Baker Hughes)

- Gardner Denver (Ingersoll Rand)

- Howden Group

- Ingersoll Rand

- John Crane (Smiths Group)

- Kirloskar Pneumatic Company Ltd.

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Parker Hannifin Corporation

- Solar Turbines Inc. (Caterpillar)

- Sulzer Ltd.

- TechnipFMC

- Wuxi Huayang Compressor Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Atlas Copco AB

- Baker Hughes Company

- Caterpillar Inc.

- Climax Portable

- Dresser-Rand (Siemens Energy)

- Elliott Group

- Fusheng Group

- GE Oil & Gas (Baker Hughes)

- Gardner Denver (Ingersoll Rand)

- Howden Group

- Ingersoll Rand

- John Crane (Smiths Group)

- Kirloskar Pneumatic Company Ltd.

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Parker Hannifin Corporation

- Solar Turbines Inc. (Caterpillar)

- Sulzer Ltd.

- TechnipFMC

- Wuxi Huayang Compressor Co., Ltd.

Table Information

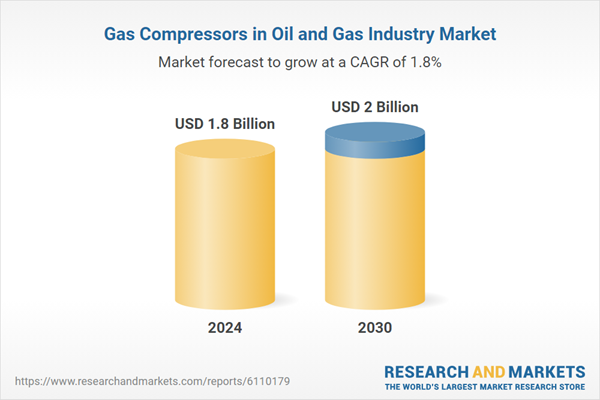

| Report Attribute | Details |

|---|---|

| No. of Pages | 268 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |