Global GaN Industrial Devices Market - Key Trends & Drivers Summarized

Why Are GaN Devices Transforming Industrial Power Systems?

Gallium nitride (GaN) devices are gaining momentum across industrial applications due to their superior switching speed, thermal efficiency, and compact design compared to traditional silicon-based power electronics. GaN transistors and diodes are widely used in industrial converters, motor drives, power inverters, and wireless power transfer systems. Their ability to operate at higher voltages and frequencies with lower power loss makes them ideal for energy-intensive and space-constrained environments.Industrial systems increasingly demand higher efficiency and power density, especially in segments such as robotics, factory automation, heavy machinery, and industrial lighting. GaN-based components are being adopted to support high-speed switching, reduce passive component size, and enable simplified thermal management. As electrification advances across industrial sectors, GaN devices are becoming critical to achieving reduced footprint, improved energy savings, and increased system reliability.

What Technological Innovations Are Advancing Device Capabilities?

GaN-on-silicon substrates are the dominant platform, offering a cost-effective path to scale GaN technology using established silicon manufacturing processes. Enhancements in epitaxial growth and packaging technologies are improving device consistency, thermal conductivity, and integration with standard control circuits. Surface passivation and robust gate protection structures are also being refined to meet industrial durability standards.Design integration is another focus area. GaN devices are increasingly available in half-bridge or full-bridge configurations with embedded gate drivers and protection circuitry. These integrated power modules simplify board design and reduce electromagnetic interference. Compact surface-mount packaging formats such as PQFN are enabling higher power density in confined industrial enclosures. GaN components are also being tailored for harsh operating conditions, including temperature and vibration resilience in automotive and energy systems.

How Are Industrial Use Cases and Power System Designs Evolving?

GaN devices are being deployed across a broad spectrum of industrial applications, including motor control units, power factor correction (PFC) circuits, and DC-DC converters for automation and robotics systems. High-frequency operation allows for reduced magnetics and compact cooling systems, which is especially beneficial in mobile or modular industrial equipment. In renewable energy, GaN inverters are enabling more compact and efficient solar power optimizers and energy storage interfaces.Electric vehicle (EV) charging infrastructure also benefits from GaN’s fast switching and compact size. Charging stations, onboard chargers, and bidirectional converters are being redesigned to meet efficiency targets using GaN switches. Industrial uninterruptible power supply (UPS) systems and telecommunications power modules are adopting GaN to achieve higher load response rates and better thermal performance. These applications require scalable, high-efficiency power conversion that GaN materials are well-suited to deliver.

Growth in the GaN Industrial Devices Market Is Driven by Several Factors…

Growth in the GaN industrial devices market is driven by several factors including demand for higher energy efficiency, miniaturization of industrial power systems, and adoption of high-frequency switching architectures. Increasing electrification in industrial automation, robotics, and energy management systems supports integration of GaN-based power devices. Improvements in GaN-on-silicon production, packaging, and integrated module design reduce costs and facilitate adoption. Expanding use in EV charging, solar inverters, and factory power supply units further boosts demand. As industrial design requirements evolve toward greater power density, thermal control, and digital integration, GaN devices offer performance advantages that continue to drive market growth across multiple application domains.Scope of the Report

The report analyzes the GaN Industrial Devices market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Optoelectronics GaN Devices, Power GaN Devices, RF GaN Devices); Application (RF Power Amplifier Application, Microwave & Millimeter Wave Circuits Application, Radar Sensing Equipment Application, Tactical Radios Application, Communications Satellite Equipment Application, Other Applications); End-Use, Aerospace & Defense End-Use, Automotive End-Use, IT & Telecommunications End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Optoelectronics GaN Devices segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 9.5%. The Power GaN Devices segment is also set to grow at 14.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $478.4 Million in 2024, and China, forecasted to grow at an impressive 15.1% CAGR to reach $686.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global GaN Industrial Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global GaN Industrial Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global GaN Industrial Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aixtron SE, Analog Devices, Inc., Efficient Power Conversion (EPC), Enkris Semiconductor, EPCOS (TDK Corporation) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this GaN Industrial Devices market report include:

- Aixtron SE

- Analog Devices, Inc.

- Efficient Power Conversion (EPC)

- Enkris Semiconductor

- EPCOS (TDK Corporation)

- GaN Systems

- Infineon Technologies AG

- IQE plc

- MACOM Technology Solutions

- Mitsubishi Electric

- NXP Semiconductors

- Navitas Semiconductor

- Qorvo, Inc.

- ROHM Semiconductor

- STMicroelectronics

- Sumitomo Electric

- Transphorm, Inc.

- Texas Instruments

- Toyota Tsusho Corporation

- Wolfspeed, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aixtron SE

- Analog Devices, Inc.

- Efficient Power Conversion (EPC)

- Enkris Semiconductor

- EPCOS (TDK Corporation)

- GaN Systems

- Infineon Technologies AG

- IQE plc

- MACOM Technology Solutions

- Mitsubishi Electric

- NXP Semiconductors

- Navitas Semiconductor

- Qorvo, Inc.

- ROHM Semiconductor

- STMicroelectronics

- Sumitomo Electric

- Transphorm, Inc.

- Texas Instruments

- Toyota Tsusho Corporation

- Wolfspeed, Inc.

Table Information

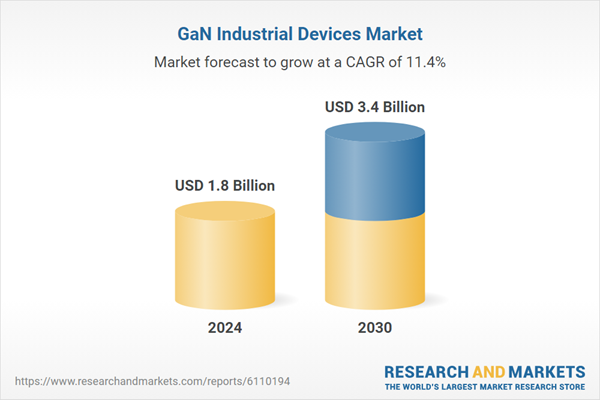

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |