Global RF And Microwave Diodes Market - Key Trends & Drivers Summarized

What Makes RF and Microwave Diodes Foundational to High-Frequency Applications?

Radio frequency (RF) and microwave diodes are indispensable components in high-frequency electronic systems. From satellite communications and radar systems to 5G infrastructure and aerospace applications, these diodes play key roles in signal detection, switching, mixing, and power regulation. Their ability to function across a broad spectrum-from a few MHz up to hundreds of GHz-makes them essential in both commercial and defense systems where reliable high-speed signal transmission is paramount. Schottky, PIN, tunnel, and Gunn diodes are among the most widely used subtypes, each tailored for specific frequency handling, power requirements, and switching speed characteristics.The surge in global wireless connectivity demand is intensifying the need for diodes that exhibit high linearity, minimal signal distortion, and efficient heat dissipation. For instance, in 5G base stations and millimeter-wave networks, microwave diodes are essential for managing signal amplification, antenna beamforming, and frequency conversion. In avionics and defense radar applications, high-power microwave diodes enable the handling of pulsed high-frequency signals without thermal degradation. Moreover, as devices shrink in size yet expand in bandwidth, the market is steadily moving toward diodes that integrate with miniaturized circuit boards while offering elevated thermal stability and electromagnetic compatibility.

How Are Performance Requirements and Design Paradigms Evolving?

The performance thresholds for RF and microwave diodes are being redefined by emerging technologies such as 6G, automotive radar (76-81 GHz), advanced satellite constellations, and ultra-wideband (UWB) applications. These technologies demand diodes with extremely low junction capacitance, high cut-off frequencies, and superior signal-to-noise ratios. Manufacturers are innovating through material science-leveraging GaAs, GaN, InP, and SiC substrates-to deliver higher breakdown voltages, faster switching times, and better thermal conductance than traditional silicon-based diodes.Surface-mount technology (SMT) packaging is also undergoing optimization to improve impedance matching and reduce insertion loss at microwave frequencies. For example, low-profile ceramic packages with gold metallization are now favored for applications where signal integrity is mission-critical. On the integration front, chip-scale packaging (CSP) and monolithic microwave integrated circuits (MMICs) are enabling the embedding of diode functionalities directly into RF front ends, reducing footprint and parasitic losses. Additionally, tunable diodes using varactor technology are supporting agile frequency control in reconfigurable antennas and software-defined radios, further expanding application frontiers.

Which Application Sectors Are Driving Volume Growth and Innovation Cycles?

The telecommunications sector is a dominant driver of RF and microwave diode adoption, particularly with the global rollout of 5G and preparatory investments in 6G infrastructure. Small cell deployments, beam steering antennas, and massive MIMO systems all require diodes for switching, mixing, and amplification. Consumer electronics-especially smartphones, smart TVs, and wearables-rely on miniature RF diodes to enable fast wireless data transfer across Wi-Fi, Bluetooth, NFC, and mmWave channels. Automotive applications are seeing rapid uptake of microwave diodes in driver-assistance systems (ADAS), collision avoidance radar, and autonomous vehicle communications.Defense and aerospace represent a high-margin segment with stringent reliability standards. Here, diodes are used in electronic warfare systems, satellite payloads, and navigation equipment. Medical imaging, particularly MRI and RF ablation, is another niche but high-value segment where microwave diodes support signal rectification and power regulation. Industrial automation and IoT applications further expand market breadth, using diodes in RF sensors, predictive maintenance modules, and smart metering infrastructure. As these application spheres diversify, they are collectively driving demand for broader frequency compatibility, higher power handling, and tighter tolerance levels in diode design.

What Is Sustaining Long-Term Demand and Competitive Growth in the Market?

The growth in the RF and microwave diodes market is driven by several factors, including accelerating 5G and satellite deployment, increasing radar and sensing adoption in mobility, and rising R&D in quantum and high-frequency communications. The convergence of miniaturization, energy efficiency, and high-frequency performance in emerging technologies is pushing manufacturers to innovate across substrate selection, packaging, and fabrication techniques. Strategic partnerships between semiconductor manufacturers and RF component integrators are fostering co-designed, application-specific diodes for performance-intensive environments.Global defense modernization, especially in radar and communication systems, is securing long-term procurement contracts for microwave diode suppliers. Simultaneously, the rise of cloud-based remote healthcare, telemedicine, and medical electronics is fueling demand for diodes in portable RF medical devices. Policy pushes for domestic semiconductor manufacturing, such as the U.S. CHIPS Act and Europe’s semiconductor resilience programs, are also expected to de-risk supply chains and stimulate innovation in high-frequency component production. Together, these dynamics ensure that RF and microwave diodes remain integral to next-generation connectivity, sensing, and communications platforms worldwide.

Scope of the Report

The report analyzes the RF and Microwave Diodes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Schottky Diodes, PIN Diodes, Zener Diodes, Tuning Varactor Diodes, Gunn Diodes, Tunnel Diodes, Other Types); End-Use (Automotive End-Use, Consumer Electronics End-Use, Communications End-Use, Manufacturing End-Use, Medical End-Use, Aerospace & Defense End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Schottky Diodes segment, which is expected to reach US$535.8 Million by 2030 with a CAGR of a 3.1%. The PIN Diodes segment is also set to grow at 1.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $518.5 Million in 2024, and China, forecasted to grow at an impressive 4.3% CAGR to reach $410.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global RF and Microwave Diodes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global RF and Microwave Diodes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global RF and Microwave Diodes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akon Inc., AMCOM Communications Inc., Analog Devices, Inc., API Technologies, Avago Technologies (Broadcom) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this RF and Microwave Diodes market report include:

- Akon Inc.

- AMCOM Communications Inc.

- Analog Devices, Inc.

- API Technologies

- Avago Technologies (Broadcom)

- Diodes Incorporated

- Dynawave Inc.

- Infineon Technologies AG

- Keysight Technologies

- Kyocera AVX Corporation

- MACOM Technology Solutions

- Microchip Technology Inc.

- Microsemi (Microchip)

- Nexperia

- NXP Semiconductors

- ON Semiconductor

- Skyworks Solutions Inc.

- STMicroelectronics

- Toshiba Electronic Devices

- Vishay Intertechnology Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akon Inc.

- AMCOM Communications Inc.

- Analog Devices, Inc.

- API Technologies

- Avago Technologies (Broadcom)

- Diodes Incorporated

- Dynawave Inc.

- Infineon Technologies AG

- Keysight Technologies

- Kyocera AVX Corporation

- MACOM Technology Solutions

- Microchip Technology Inc.

- Microsemi (Microchip)

- Nexperia

- NXP Semiconductors

- ON Semiconductor

- Skyworks Solutions Inc.

- STMicroelectronics

- Toshiba Electronic Devices

- Vishay Intertechnology Inc.

Table Information

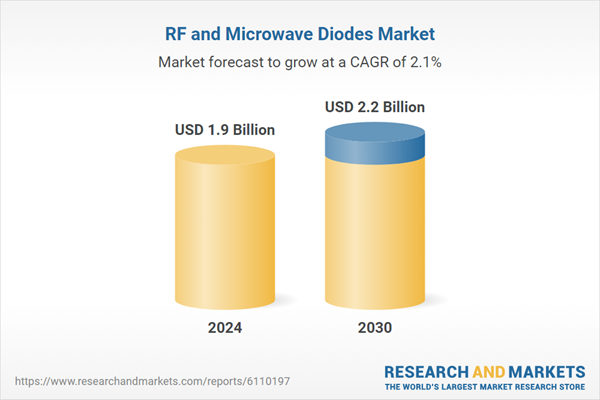

| Report Attribute | Details |

|---|---|

| No. of Pages | 295 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |