Global Utility Scale Green Power Transformers Market - Key Trends & Drivers Summarized

Why Are Grid Operators Increasingly Relying on Transformers Tailored for Green Energy?

The rapid integration of renewable energy into utility-scale transmission and distribution systems is transforming the role and design of power transformers. Green power transformers-engineered for high-efficiency, low-loss, and environmentally benign operation-are becoming essential components in solar farms, wind parks, and grid-scale energy storage installations. Unlike traditional oil-immersed transformers, many green transformers utilize biodegradable ester fluids, reduced core losses, and optimized thermal designs to enhance grid stability while aligning with climate resilience goals.Renewable power plants, often located in remote and harsh environments, require high-performance transformers that can manage fluctuating power flows and intermittent voltage profiles without degradation. Transformers deployed in offshore wind farms, for instance, are designed for saltwater corrosion resistance and high mechanical durability. In solar installations, dry-type transformers are preferred in arid or wildfire-prone areas due to their fire safety profiles. Additionally, the increased adoption of high-voltage direct current (HVDC) and medium-voltage AC technologies is prompting innovation in transformer designs for long-distance green power evacuation and grid interconnection.

What Are the Innovations Enhancing Performance and Sustainability of Green Transformers?

Manufacturers are increasingly focusing on eco-efficient materials, modular designs, and digitalization to align with the decarbonization agenda. Ester-based dielectric fluids not only improve fire safety but also extend insulation life and allow for compact transformer enclosures. Amorphous metal cores are being adopted to minimize no-load losses, while advanced winding designs and high-grade insulation materials are enhancing short-circuit withstand capability and thermal stability. These design elements ensure that transformers perform optimally even under dynamic renewable generation profiles.Digitalization is another transformative trend. Smart sensors embedded in green transformers monitor temperature, load, oil quality, and partial discharges in real time. These devices are connected to utility SCADA systems or cloud analytics platforms for predictive maintenance and operational optimization. AI-enabled algorithms now forecast transformer failure risks based on load profiles, ambient conditions, and historical data. Additionally, modular and skid-mounted transformers are gaining popularity for their ease of transport, fast deployment, and suitability in temporary grid expansions or mobile substations supporting renewable project phasing.

Which Deployment Scenarios Are Driving Green Transformer Demand Across Regions?

Global investment in utility-scale renewable energy projects is surging, with green power transformers playing a critical role in transmission build-outs and substation modernization. In the U.S., large solar PV and wind projects in Texas, California, and the Midwest are creating demand for high-voltage, low-loss transformers that integrate renewable generation into legacy grids. Europe, led by Germany, the UK, and Nordic countries, is aggressively replacing aging transformer fleets with eco-friendly alternatives as part of energy transition goals and grid digitization mandates.Asia-Pacific is also a growth hotspot, driven by China and India’s aggressive renewable energy targets and grid modernization programs. In India, for instance, green transformers are being adopted in transmission corridors connecting solar parks and wind zones under the Green Energy Corridor initiative. In Southeast Asia and Latin America, hybrid projects combining renewables with battery storage are spurring demand for multi-input transformers capable of handling bidirectional energy flows. The adoption of microgrids and mini-grids in Africa and island nations further expands the use case for compact, modular green transformers in off-grid and weak-grid contexts.

What Factors Are Accelerating Market Growth for Utility Scale Green Transformers?

The growth in the utility scale green power transformers market is driven by several factors, including the exponential rise in renewable energy deployment, grid decarbonization mandates, and aging transformer infrastructure. As utilities seek to reduce transmission losses and improve energy efficiency, green transformers offer a tangible solution with measurable environmental and operational benefits. The global shift to sustainable energy is also backed by regulatory mandates-such as the EU’s EcoDesign directive and India’s IS 1180 standards-that require energy-efficient transformer adoption.Moreover, the growing incidence of extreme weather events is compelling utilities to invest in more resilient, fire-safe, and environmentally robust transformer technologies. The availability of green financing and carbon credits for grid decarbonization projects is further incentivizing adoption. At the same time, cost competitiveness of ester fluids and amorphous cores is improving, making green transformers viable for both retrofits and new installations. As digital substations, smart grids, and renewable-heavy energy mixes become the norm, green transformers will remain at the heart of utility-scale electrification strategies, enabling a cleaner, more reliable, and future-ready grid.

Scope of the Report

The report analyzes the Utility Scale Green Power Transformers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Cooling System (Oil-Cooled Cooling System, Dry-Cooled Cooling System, Hybrid-Cooled Cooling System); Transformer Capacity (Below 500 MVA Capacity, 500 - 1000 MVA Capacity, Above 1000 MVA Capacity); Voltage Rating (36 - 150 kV Rating, 150 - 525 kV Rating, 525 - 1200 kV Rating); Installation (Pole-Mounted Installation, Pad-Mounted Installation, Substation Installation).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oil-Cooled Cooling System segment, which is expected to reach US$8.8 Billion by 2030 with a CAGR of a 4.2%. The Dry-Cooled Cooling System segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.0 Billion in 2024, and China, forecasted to grow at an impressive 8.0% CAGR to reach $2.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Utility Scale Green Power Transformers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Utility Scale Green Power Transformers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Utility Scale Green Power Transformers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Alstom Grid (GE Renewable Energy division), Arteche Group, CG Power and Industrial Solutions, China XD Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Utility Scale Green Power Transformers market report include:

- ABB Ltd.

- Alstom Grid (GE Renewable Energy division)

- Arteche Group

- CG Power and Industrial Solutions

- China XD Group

- Delta Star, Inc.

- Eaton Corporation

- GE Grid Solutions (GE Vernova)

- HD Hyundai Electric Co., Ltd.

- Hitachi Energy Ltd.

- Hyosung Heavy Industries

- Mitsubishi Electric Corporation

- Ormazabal Grupo

- Prolec GE

- Saint-Gobain Tape Solutions (Green support)

- Schneider Electric SE

- Shanghai Electric Group

- Siemens Energy AG

- SPX Technologies (SPX Transformer Solutions)

- TBEA Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Alstom Grid (GE Renewable Energy division)

- Arteche Group

- CG Power and Industrial Solutions

- China XD Group

- Delta Star, Inc.

- Eaton Corporation

- GE Grid Solutions (GE Vernova)

- HD Hyundai Electric Co., Ltd.

- Hitachi Energy Ltd.

- Hyosung Heavy Industries

- Mitsubishi Electric Corporation

- Ormazabal Grupo

- Prolec GE

- Saint-Gobain Tape Solutions (Green support)

- Schneider Electric SE

- Shanghai Electric Group

- Siemens Energy AG

- SPX Technologies (SPX Transformer Solutions)

- TBEA Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 473 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

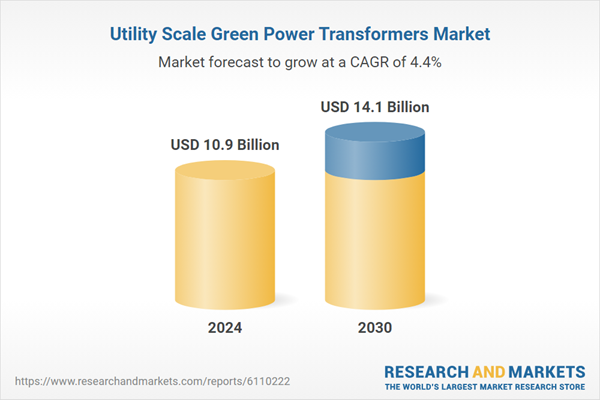

| Estimated Market Value ( USD | $ 10.9 Billion |

| Forecasted Market Value ( USD | $ 14.1 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |