Global Naval Vessels Market - Key Trends & Drivers Summarized

Why Are Naval Vessels Central to Emerging Maritime Geostrategies?

Naval vessels have emerged as strategic assets in an era marked by intensifying geopolitical rivalries, resource-centric maritime claims, and increasing non-conventional threats at sea. From blue-water navies seeking global power projection to littoral forces safeguarding exclusive economic zones (EEZs), nations are significantly investing in multipurpose naval fleets. These vessels are not merely combat platforms but also serve in intelligence gathering, humanitarian missions, and deterrence roles, reinforcing sovereign control in volatile maritime corridors such as the South China Sea, Arctic, and Persian Gulf.The re-emergence of great power competition-particularly between the U.S., China, and Russia-has triggered large-scale naval modernization programs, including both surface combatants and undersea platforms. Simultaneously, smaller nations are acquiring patrol vessels, corvettes, and amphibious ships tailored to regional conflict dynamics, coastal defense, and anti-piracy operations. These trends are reshaping the naval shipbuilding landscape, where modular construction, stealth integration, and digitized combat systems define the new generation of vessels.

How Is Technological Integration Reshaping Naval Vessel Design?

The modernization of naval vessels is deeply influenced by the convergence of advanced technologies, with an emphasis on survivability, agility, and multi-mission adaptability. Contemporary ship designs are embracing stealth features including angular hulls, radar-absorbing materials, and enclosed masts to reduce radar cross-sections and infrared signatures. Naval platforms are increasingly equipped with vertical launch systems (VLS), electronic warfare (EW) suites, and integrated mast solutions that support multi-role combat across anti-air, anti-submarine, and surface warfare domains.Electric propulsion systems, such as integrated electric propulsion (IEP), are being adopted to enhance fuel efficiency, reduce acoustic footprints, and power high-energy weapons including lasers and electromagnetic railguns. The integration of AI-driven combat management systems (CMS), real-time data fusion, and autonomous navigation is transforming decision-making speed and tactical flexibility onboard vessels. Unmanned surface and underwater vehicles (USVs and UUVs) are now being deployed as force multipliers, offering reconnaissance and mine-countermeasure capabilities without exposing human crew to direct threats.

Modularity is another key innovation, allowing navies to reconfigure a vessel’s payload or mission profile through containerized modules. This approach is seen in platforms like the Littoral Combat Ship (LCS) and European modular frigates, enabling navies to respond dynamically to evolving threat scenarios. These technology integrations not only future-proof naval assets but also streamline lifecycle maintenance and reduce total cost of ownership.

Which Naval Segments and Global Regions Are Leading Market Momentum?

The naval vessels market is segmented into destroyers, frigates, corvettes, amphibious ships, aircraft carriers, submarines, support vessels, and patrol boats. Each segment caters to distinct strategic and tactical requirements. Aircraft carriers, for instance, remain the centerpiece of naval supremacy for superpowers, while submarines-both diesel-electric and nuclear-powered-offer strategic deterrence and stealth capabilities. Frigates and corvettes are in demand for regional patrolling, anti-piracy missions, and maritime law enforcement.North America leads the global market, with the U.S. Navy executing multi-billion-dollar procurement programs such as the Columbia-class submarines and Constellation-class frigates. China has emerged as a formidable shipbuilding powerhouse, rapidly expanding its fleet and deploying indigenously developed vessels including Type 055 destroyers and Type 075 amphibious assault ships. European navies are consolidating defense industries to develop interoperable platforms, as seen in the Franco-Italian FREMM frigates and the U.K.’s Type 26 Global Combat Ship.

Asia-Pacific countries such as India, Japan, South Korea, and Australia are ramping up naval capabilities through indigenous manufacturing and joint development initiatives, while the Middle East and Africa are focused on acquiring fast attack crafts, missile boats, and OPVs to address asymmetric threats and safeguard oil shipping lanes. Latin American countries are engaging in selective upgrades, especially in logistics and support vessels, to enhance maritime domain awareness and humanitarian response readiness.

What Is Fueling Growth in the Global Naval Vessels Market?

The growth in the global naval vessels market is driven by several factors, including maritime security threats, great power competition, technological evolution, and the strategic need to protect maritime trade routes and resources. Naval forces are no longer confined to traditional combat roles; they are instrumental in enforcing national policies in contested waters, engaging in joint operations, and responding to climate-induced emergencies.Robust defense budgets, geopolitical assertiveness, and the need to replace aging fleets are encouraging governments to initiate long-term naval acquisition and upgrade programs. The increasing prevalence of gray-zone warfare-marked by non-attributable maritime intrusions, cyber threats, and unmanned incursions-is also pushing navies to adopt flexible and resilient vessel platforms. Moreover, international naval exercises, alliances such as NATO and QUAD, and defense exports are intensifying collaboration and standardization in naval fleet design.

The global naval industrial base is benefiting from modularity, digital twin technologies, and local shipbuilding capabilities, which are accelerating build cycles and enabling distributed production models. As maritime security becomes a central pillar of national defense strategies, naval vessels will continue to attract sustained investment and innovation, establishing their centrality in the 21st-century security architecture.

Scope of the Report

The report analyzes the Naval Vessels market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Vessel Type (Destroyers Vessel, Frigates Vessel, Submarines Vessel, Corvettes Vessel, Aircraft Carriers Vessel, Other Vessel Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Destroyers Vessel segment, which is expected to reach US$44.9 Billion by 2030 with a CAGR of a 6.8%. The Frigates Vessel segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $28.9 Billion in 2024, and China, forecasted to grow at an impressive 9.0% CAGR to reach $29.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Naval Vessels Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Naval Vessels Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Naval Vessels Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BAE Systems, Damen Shipyards Group, Daewoo Shipbuilding & Marine Engineering (DSME), Fincantieri S.p.A., General Dynamics NASSCO and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Naval Vessels market report include:

- BAE Systems

- Damen Shipyards Group

- Daewoo Shipbuilding & Marine Engineering (DSME)

- Fincantieri S.p.A.

- General Dynamics NASSCO

- General Dynamics Bath Iron Works

- Hanjin Heavy Industries & Construction

- Hanwha Ocean Co., Ltd. (formerly Daewoo Shipbuilding)

- Huntington Ingalls Industries

- Hyundai Heavy Industries

- Larsen & Toubro Limited (L&T)

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Naval Group (formerly DCNS)

- Navantia S.A.

- PT PAL Indonesia

- Saab AB

- Thales Group

- Thyssenkrupp Marine Systems

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BAE Systems

- Damen Shipyards Group

- Daewoo Shipbuilding & Marine Engineering (DSME)

- Fincantieri S.p.A.

- General Dynamics NASSCO

- General Dynamics Bath Iron Works

- Hanjin Heavy Industries & Construction

- Hanwha Ocean Co., Ltd. (formerly Daewoo Shipbuilding)

- Huntington Ingalls Industries

- Hyundai Heavy Industries

- Larsen & Toubro Limited (L&T)

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Naval Group (formerly DCNS)

- Navantia S.A.

- PT PAL Indonesia

- Saab AB

- Thales Group

- Thyssenkrupp Marine Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

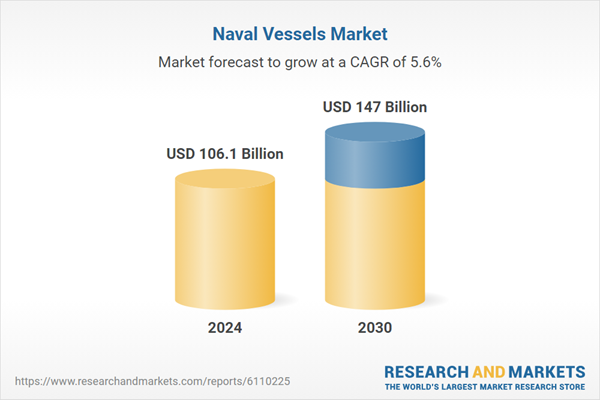

| Estimated Market Value ( USD | $ 106.1 Billion |

| Forecasted Market Value ( USD | $ 147 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |