Global Machinery Rental And Leasing Market - Key Trends & Drivers Summarized

Why Are Businesses Turning to Rental and Leasing Over Equipment Ownership?

The global machinery rental and leasing market has gained substantial momentum as businesses seek greater operational flexibility, capital efficiency, and scalability in their asset management strategies. Purchasing heavy machinery such as excavators, cranes, forklifts, or generators requires substantial upfront investment, ongoing maintenance, and storage costs. In contrast, rental and leasing models allow companies to access advanced equipment on a temporary basis, aligning capital expenditure with project timelines and cash flows. This shift is especially prominent in industries with cyclic demand patterns such as construction, mining, oil & gas, agriculture, and logistics.For small and mid-sized contractors or project-based firms, machinery rental mitigates the risks associated with underutilized assets. In emerging economies, where access to financing remains limited, rental options enable entry into competitive tenders without heavy capital commitment. Large enterprises also utilize leasing models for tax optimization and off-balance-sheet financing. As the demand for infrastructure, urban redevelopment, and industrial expansion continues to rise, rental and leasing models are becoming indispensable across regions due to their cost predictability and access to the latest technologies.

How Are Digital Platforms and Telematics Transforming Equipment Rental Services?

Technology integration is a defining force in the evolution of the machinery rental and leasing landscape. Digital rental marketplaces and cloud-based fleet management solutions are enhancing equipment visibility, utilization tracking, and customer service. Online portals and mobile apps now allow users to browse inventory, book equipment, schedule delivery, and manage contracts in real-time-streamlining procurement cycles and enabling dynamic pricing. These platforms also provide transparent comparisons across vendors, improving customer choice and driving competitive pricing in the sector.Telematics and IoT-enabled sensors are driving predictive maintenance, remote diagnostics, and real-time location tracking of rented machinery. This ensures optimal uptime, prevents misuse, and enables rental companies to offer condition-based billing models. Integration with ERP systems, BIM platforms, and construction management tools enables seamless data flow between equipment usage and project performance metrics. Rental companies are also using AI-based forecasting to optimize fleet allocation, manage asset lifecycles, and predict peak demand cycles with greater accuracy.

Moreover, the integration of eco-compliance features and emission monitoring in rented machinery is becoming increasingly important. Governments and corporations are pushing for greener operations, and rental companies are responding with electric or hybrid machinery options, Stage V emission-compliant equipment, and low-noise models to meet urban and environmental standards. This not only improves regulatory compliance for end-users but also strengthens the environmental positioning of rental providers.

Which Sectors and Regions Are Leading the Demand for Machinery Rental and Leasing?

The construction sector remains the largest consumer of rented heavy machinery, driven by large-scale urban development, road infrastructure, real estate, and industrial expansion projects across both developed and developing markets. Earthmoving equipment, material handling systems, concrete machinery, and aerial work platforms are in high demand for both short-term projects and seasonal requirements. In mining and quarrying, drilling rigs, compressors, and haul trucks are rented for exploration phases or auxiliary operations, particularly in regions with fluctuating commodity prices.Energy and utility sectors also rely heavily on leased power generators, lifting equipment, and trenching machines for grid expansion, maintenance, and emergency response. The agricultural sector is embracing rental models for harvesting equipment, seeders, and irrigation systems, especially in countries with fragmented land holdings or variable cropping seasons. In logistics and warehousing, leasing of forklifts, pallet stackers, and conveyor systems is gaining traction due to rising e-commerce volumes and warehouse automation demands.

Regionally, North America leads the global machinery rental and leasing market due to a mature rental culture, advanced digital platforms, and high infrastructure investment. Europe follows closely, with strong demand from residential construction, renewable energy, and industrial refurbishment projects. Asia-Pacific is the fastest-growing region, with China, India, and Southeast Asia driving rental demand amid rapid urbanization and industrialization. The Middle East and Africa are emerging markets, where oil & gas and mega infrastructure projects are fueling demand for both heavy equipment and specialized machinery on rental contracts.

What Is Fueling Growth in the Machinery Rental and Leasing Market Globally?

The growth in the global machinery rental and leasing market is driven by several factors, including the increasing focus on asset-light operations, rising construction and infrastructure activities, and the accelerated adoption of digital rental ecosystems. Businesses are re-evaluating capital investment models in favor of flexible, scalable, and tech-enabled access to equipment. This shift is supported by advancements in telematics, online marketplaces, and real-time analytics, which are redefining how machinery is rented, monitored, and maintained.Environmental regulations and sustainability mandates are pushing rental companies to modernize fleets with energy-efficient and low-emission machinery. Customers are increasingly preferring vendors that offer compliant and well-maintained assets, along with digital integration for performance monitoring. Additionally, rising costs of equipment ownership, unpredictable project cycles, and shrinking profit margins are incentivizing more businesses to opt for rental and leasing solutions.

Rental companies are diversifying service offerings by bundling insurance, operator training, logistics, and maintenance, creating value-added ecosystems. Strategic partnerships between OEMs and rental service providers are emerging to offer embedded leasing solutions, subscription models, and white-labeled rentals. As economies recover from macroeconomic uncertainties, and infrastructure investments accelerate, the rental and leasing model is poised to expand across sectors, delivering capital efficiency and operational agility in an increasingly project-driven world.

Scope of the Report

The report analyzes the Machinery Rental and Leasing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Mining, Oil & Gas, Forestry Machinery & Equipment Rental, Commercial Transportation Equipment Rental, Heavy Construction Machinery Rental, Office Machinery & Equipment Rental, Other Commercial & Industrial Machinery & Equipment Rental Types); Mode (Online Mode, Offline Mode).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mining segment, which is expected to reach US$36.2 Billion by 2030 with a CAGR of a 2.8%. The Oil & Gas segment is also set to grow at 2.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $34.2 Billion in 2024, and China, forecasted to grow at an impressive 6.0% CAGR to reach $29.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Machinery Rental and Leasing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Machinery Rental and Leasing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Machinery Rental and Leasing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aggreko, Aktio Corporation, Ashtead Group plc (Sunbelt), BigRentz, Boels Rental and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Machinery Rental and Leasing market report include:

- Aggreko

- Aktio Corporation

- Ashtead Group plc (Sunbelt)

- BigRentz

- Boels Rental

- Cramo Group

- Fabick Cat

- Finning International

- Herc Rentals

- H&E Equipment Services

- Kanamoto Co., Ltd.

- Komatsu Rental

- Loxam Group

- MacAllister Rentals

- Maxim Crane Works

- Nishio Rent All Co., Ltd.

- Ramirent

- Speedy Hire Plc

- Sunstate Equipment Co.

- United Rentals, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aggreko

- Aktio Corporation

- Ashtead Group plc (Sunbelt)

- BigRentz

- Boels Rental

- Cramo Group

- Fabick Cat

- Finning International

- Herc Rentals

- H&E Equipment Services

- Kanamoto Co., Ltd.

- Komatsu Rental

- Loxam Group

- MacAllister Rentals

- Maxim Crane Works

- Nishio Rent All Co., Ltd.

- Ramirent

- Speedy Hire Plc

- Sunstate Equipment Co.

- United Rentals, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

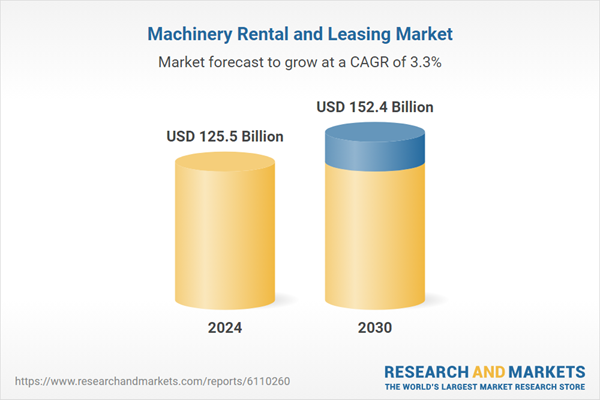

| Estimated Market Value ( USD | $ 125.5 Billion |

| Forecasted Market Value ( USD | $ 152.4 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |