Global Serious Games Market - Key Trends & Drivers Summarized

How Are Serious Games Redefining User Engagement Across Industry Sectors?

Serious games-digital games designed for purposes beyond entertainment-are transforming user engagement across sectors like healthcare, defense, corporate training, education, and disaster response. Unlike commercial video games, serious games are engineered with a dual-purpose structure: to simulate real-world environments while also training, informing, or changing user behavior through interactive mechanisms. These games leverage gamification principles, behavioral modeling, and immersive simulations to enhance retention, decision-making, and real-time problem-solving. In the defense sector, for instance, serious games are used for mission rehearsal, equipment training, and cognitive agility development in high-stakes environments.Healthcare is also adopting serious games for medical training, mental health therapy, and patient education. Surgical simulators and rehabilitation games use haptic feedback, motion tracking, and biofeedback sensors to allow clinicians to improve fine motor skills or help patients regain mobility. In educational institutions, serious games are being integrated into STEM curricula to foster active learning and encourage conceptual understanding over rote memorization. These solutions are no longer confined to experimental settings-they are now embedded into digital learning platforms and enterprise L&D ecosystems, supported by analytics dashboards that quantify user progress and skill acquisition.

Which Technologies Are Fueling the Shift Toward Immersive and Adaptive Game Environments?

The technology stack behind serious games has evolved dramatically, with the convergence of extended reality (XR), artificial intelligence (AI), and cloud computing playing a pivotal role in reshaping the gameplay architecture. Augmented reality (AR) and virtual reality (VR) enable the creation of highly immersive, multisensory environments that replicate real-world challenges with spatial depth and kinesthetic feedback. For instance, first-responder training modules developed in VR simulate building collapses or fire emergencies to enhance spatial decision-making under pressure. AR overlays are used in educational games to enhance contextual visualization in subjects like biology, history, and geography.AI and machine learning algorithms are now central to delivering adaptive game experiences. These systems dynamically tailor gameplay scenarios based on user responses, cognitive fatigue levels, or knowledge gaps. In military and corporate games, AI-driven simulations adjust difficulty in real time and provide branching narratives to train complex decision trees. Meanwhile, cloud-based deployment and device-agnostic platforms are making serious games more scalable and accessible. Cross-platform development tools like Unity and Unreal Engine allow developers to optimize gameplay across desktops, mobile devices, and head-mounted displays. Game telemetry data stored on the cloud is also used to generate performance analytics and predictive learner modeling.

Where Are Serious Games Being Deployed Most Effectively and Why?

Serious games are gaining maximum traction in sectors where real-world experimentation is costly, dangerous, or impractical. In aviation, aerospace, and defense, gamified simulation environments are used to train pilots, mechanics, and drone operators on high-risk maneuvers without endangering personnel or equipment. These simulation-based games reduce dependency on physical simulators and make learning accessible to geographically dispersed personnel. Similarly, hospitals and medical universities are using serious games to teach anatomy, surgical workflows, and differential diagnosis in a low-risk virtual environment that enhances muscle memory and clinical intuition.In corporate settings, serious games are being used to drive change management, compliance training, and onboarding programs. Large enterprises are replacing slide-based e-learning with scenario-based game modules that simulate ethical dilemmas, sales negotiations, or crisis response. In the education sector, K-12 schools and higher education institutions are embracing serious games to encourage inquiry-based learning. Subjects like physics, programming, and environmental science are increasingly taught through exploratory games that allow experimentation and consequence-based learning. Governments and public health organizations are also leveraging serious games for citizen awareness programs-such as epidemic response, civic responsibility, and climate change adaptation.

What Is Propelling Long-Term Growth in the Serious Games Market?

The growth in the serious games market is driven by several factors, including increasing demand for experiential learning, advances in immersive technology, and the proven effectiveness of gamification in knowledge retention and behavior change. As organizations across sectors shift from content dissemination to skills demonstration and behavioral modeling, serious games offer an evidence-based medium to assess and enhance user capabilities. In educational psychology and training science, multiple studies now validate that interactive game environments outperform traditional learning in engagement and knowledge application.Additionally, the democratization of XR hardware (like Meta Quest, HTC Vive, and smartphone-based AR) and cloud-based deployment models is bringing serious games within reach for SMEs, schools, and NGOs. Funding from government agencies, defense departments, and healthcare foundations is accelerating R&D in specialized use cases like neurocognitive therapy, cybersecurity training, and emergency preparedness. Venture capital is also flowing into startups that offer B2B gamified training platforms with analytics and LMS integration. The rising popularity of AI tutors, voice-based interactions, and multiplayer collaboration modes is adding new layers of realism and relevance.

With growing investments in digital transformation and workforce upskilling, serious games are no longer considered supplementary tools but central components of education and training strategies. As the metaverse matures and generative AI begins powering dynamic content creation within games, the serious games market is poised for exponential expansion-anchored in its ability to deliver personalized, scalable, and data-driven experiential learning.

Scope of the Report

The report analyzes the Serious Games market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Application (Advertising & Marketing Application, Simulation Training Application, Learning & Education Application, Other Applications); End-Use (Healthcare End-Use, Education End-Use, Retail End-Use, Media & Entertainment End-Use, Automotive End-Use, Government End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Advertising & Marketing Application segment, which is expected to reach US$26.4 Billion by 2030 with a CAGR of a 26.0%. The Simulation Training Application segment is also set to grow at 19.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.7 Billion in 2024, and China, forecasted to grow at an impressive 31.8% CAGR to reach $12.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Serious Games Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Serious Games Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Serious Games Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3C Institute, 3D Bear, Bublar Group (Vobling), BreakAway Games, CETE (University of Lyon) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Serious Games market report include:

- 3C Institute

- 3D Bear

- Bublar Group (Vobling)

- BreakAway Games

- CETE (University of Lyon)

- Designing Digitally, Inc.

- DIGINEXT (CS Group)

- Duolingo

- Grendel Games

- Guroo Producer

- McGraw-Hill Education

- MPS Interactive Systems

- PIXELearning

- PlayGen

- Serious Games Interactive

- Simula Learning

- Triseum

- Virtual Heroes (ARA)

- VSTEP Simulation

- WILL Interactive

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3C Institute

- 3D Bear

- Bublar Group (Vobling)

- BreakAway Games

- CETE (University of Lyon)

- Designing Digitally, Inc.

- DIGINEXT (CS Group)

- Duolingo

- Grendel Games

- Guroo Producer

- McGraw-Hill Education

- MPS Interactive Systems

- PIXELearning

- PlayGen

- Serious Games Interactive

- Simula Learning

- Triseum

- Virtual Heroes (ARA)

- VSTEP Simulation

- WILL Interactive

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

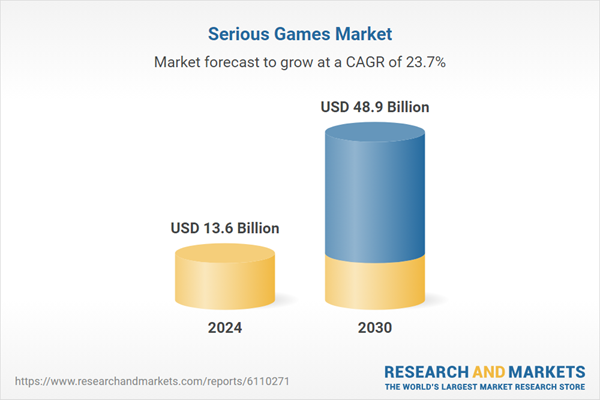

| Estimated Market Value ( USD | $ 13.6 Billion |

| Forecasted Market Value ( USD | $ 48.9 Billion |

| Compound Annual Growth Rate | 23.7% |

| Regions Covered | Global |